Statement on Monetary Policy – November 2019 2. Domestic Economic Conditions

Over the past year, growth in the Australian economy has been slow because of soft consumption growth and declines in housing activity and business investment. Economic growth was, however, stronger over the first half of 2019 than it was over the second half of last year. Although partial data suggest that weakness in household spending has persisted, conditions in the established housing market have improved and employment growth has remained strong. Recent monetary policy easing and the tax offset will support growth in household disposable income in the second half of 2019.

Growth in the domestic economy has increased but remains modest

Real GDP growth was stronger in the first half of 2019 than it was over the second half of 2018, mostly because of stronger growth in resource exports. Growth remains modest overall though: GDP growth of 1.4 per cent over the year to the June quarter was the slowest rate of growth in the past decade (Table 2.1) (Graph 2.1). Private domestic demand contracted by 0.3 per cent over the year (Graph 2.2). This was driven by declines in housing activity and mining investment, as well as slower growth in consumption.

| June quarter 2019 | March quarter 2019 | Year to June quarter 2019 | Share of GDP 2018/19 | |

|---|---|---|---|---|

| GDP | 0.5 | 0.5 | 1.4 | 100 |

| Domestic demand | 0.3 | 0.1 | 1.0 | 98 |

| – Consumption | 0.4 | 0.3 | 1.4 | 56 |

| – Dwelling investment | −4.4 | −2.2 | −9.1 | 6 |

| – Mining investment | 2.4 | −1.2 | −11.6 | 3 |

| – Non-mining investment | −1.1 | 0.3 | 1.5 | 9 |

| – Public consumption | 2.7 | 0.9 | 6.2 | 19 |

| – Public investment | −3.2 | 0.1 | 1.4 | 5 |

| Change in inventories(a) | −0.5 | −0.1 | −0.7 | n/a |

| Exports | 1.4 | 1.9 | 2.9 | 24 |

| Imports | −1.3 | −0.2 | −2.8 | 22 |

| Mining activity(b) | 1.6 | 2.3 | −1.0 | 15 |

| Non-mining activity(b) | 0.3 | 0.3 | 1.8 | 85 |

| Farm GDP | −2.4 | 0.5 | −8.3 | 2 |

| Non-farm GDP | 0.5 | 0.5 | 1.7 | 98 |

| Nominal GDP | 1.2 | 1.6 | 5.4 | n/a |

| Terms of trade | 1.5 | 3.1 | 8.9 | n/a |

|

(a) Contribution to GDP growth

Sources: ABS; RBA |

||||

Household consumption growth has been weak

Household consumption grew by 0.4 per cent in the June quarter and by 1.4 per cent over the year. Growth for all consumption categories except health slowed relative to the previous year, although the slowdown was more noticeable for discretionary components like furnishing & equipment, motor vehicles, and recreation & culture (Graph 2.3). The broad-based slowdown in consumption is consistent with several years of low growth in household income and the sharp decline in the housing market since 2017. Bank estimates suggest that these developments are likely to have each accounted for roughly half of the recent decline in consumption growth.

Timely indicators suggest that household consumption growth remained weak in the September quarter. Year-ended growth in retail sales values has been relatively steady over recent quarters, however, this has been almost entirely driven by retail price inflation resulting from exchange rate pass-through and drought-related increases in food prices (Graph 2.4). Retail sales volumes decreased by 0.1 per cent in the September quarter and by 0.2 per cent over the year, the lowest rate of growth since 1991. Sales volumes declined in most states in the September quarter.

Sales volumes of durable items, such as clothing, furniture, hardware, garden supplies and electronics strengthened a little in the September quarter, which may reflect reductions in the cash rate and the low and middle income tax offset (LMITO) supporting consumption at the margin. Car sales, which are an indicator of household discretionary spending, decreased by 1.5 per cent in the September quarter. Contacts in the Bank's business liaison program suggest that year-ended growth in retail sales values was broadly unchanged in October.

Household disposable income growth remained subdued

Household disposable income grew by 0.3 per cent in the June quarter and year-ended growth remained modest at 2.4 per cent (Graph 2.5). Growth in the number of employees has recently supported growth in labour income, which grew by 1.2 per cent in the quarter to be 5 per cent over the year, around the fastest pace since 2012. However, non-labour income declined by 0.3 per cent in the quarter and year-ended growth slowed further, to 0.9 per cent.

The decline in non-labour income partly reflected further declines in income from unincorporated businesses resulting from the persistence of the drought and the ongoing decline in residential construction activity (Graph 2.6). The absence of temporary insurance payments related to weather events that were received by households in the previous two quarters also weighed. Growth in social assistance payments, and rental and financial income remained low. Non-labour income is not expected to pick up over the coming year.

By contrast, growth in household disposable income is expected to be boosted in the period ahead by the recent monetary policy easing lowering household interest payments, and lower tax payments. Tax paid is expected to have declined in the September quarter as households have received the LMITO; this compares with strong growth in tax paid which weighed on household disposable income growth in the June quarter. Over recent years, consumption growth has remained stronger than disposable income growth so the household saving ratio has declined.

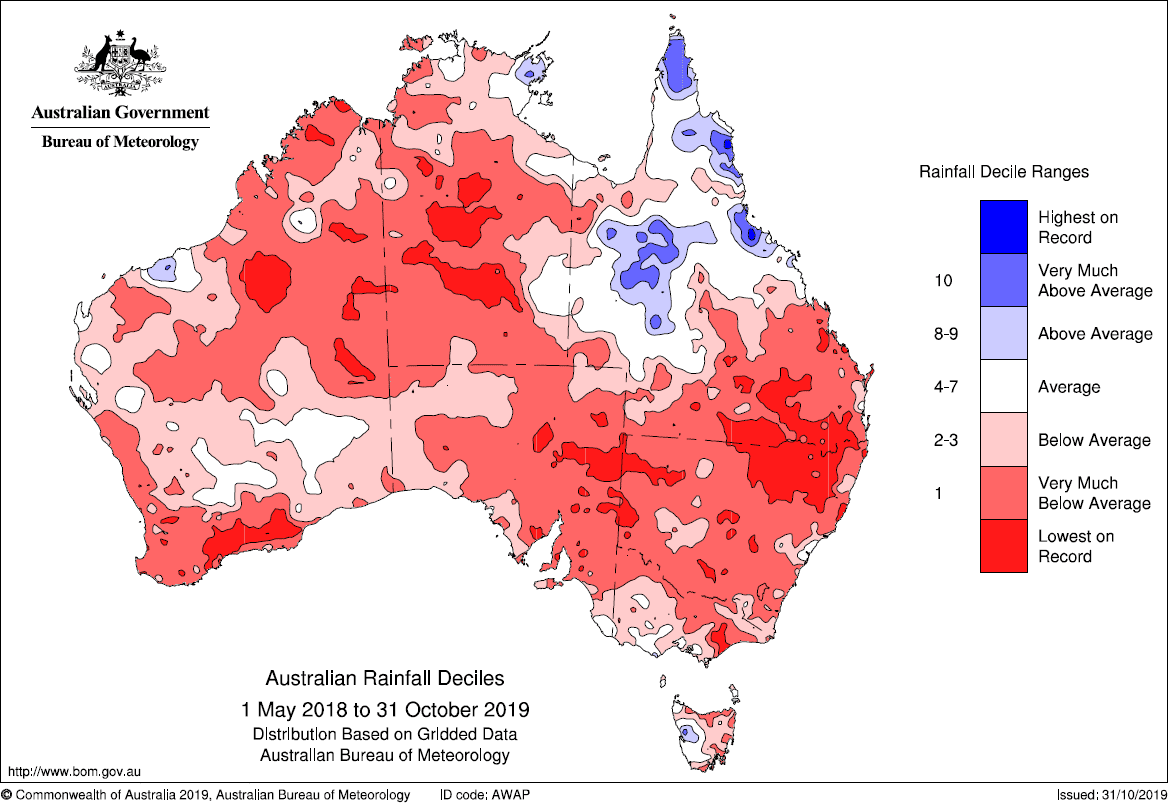

Drought conditions continue to weigh heavily on the farm sector

Drought conditions have persisted across much of Australia, particularly in the Murray–Darling Basin (Figure 2.1). The dry conditions have led to very low levels of stored water and soil moisture, which has reduced farm output and increased input costs. Consistent with this, farm GDP has declined by around 8 per cent since the middle of 2018, while nominal farm profits have fallen by over 20 per cent (Graph 2.7). Rural exports also decreased in the June quarter, with the decline broadly based across all components, and partial data suggest the weakness continued into the September quarter.

The outlook for the farm sector remains challenging. Forecasts by the Australian Bureau of Agricultural and Resource Economics and Sciences suggest that farm production will decline further in 2019/20, reflecting reduced production of livestock, wool and summer crops. The smaller national herd and flock size is likely to weigh on rural exports for some time until producers are able to rebuild livestock numbers. The most recent climate outlook published by the Bureau of Meteorology indicates that drier-than-average conditions are expected across most of Australia until at least the end of the year.

Dwelling investment declined further

Private dwelling investment declined by more than 4 per cent in the June quarter, to be 9 per cent lower over the year. Although the decline was broad based across states and dwelling types, the large decline in investment in higher-density dwellings in New South Wales in the quarter was notable (Graph 2.8).

Residential building approvals declined further in the September quarter, to be around 35 per cent below their peak in 2017. To date, the decline in dwelling investment has been much smaller than the decline in building approvals because a large volume of dwellings is still under construction. There was a small pick-up in building approvals in the month of September, mainly due to higher-density projects in the Australian Capital Territory and Queensland. Greenfield land sales have improved a little over recent months in most states but remain well below previous peaks. Completions of existing projects are expected to outpace approvals of new dwellings for some time (Graph 2.9). The turnaround in the established housing market in some regions has not yet translated into a pick-up in pre-sales of new houses and apartments for most developers, according to information from the Bank's business liaison program.

The turnaround in the established housing market in Sydney and Melbourne has continued

The fall in housing prices over 2017 and 2018 was an important reason behind weakness in consumption and dwelling investment. After stabilising midyear, housing price growth has picked up in Sydney and Melbourne, although conditions vary considerably across the country (Graph 2.10). Conditions in established markets appear to be firming in Brisbane and to have troughed in Adelaide. The pace of housing price growth has picked up in regional Australia in recent months. However, housing prices in Perth and Darwin declined further over the September quarter to be around their 2006 levels.

| October | September | August | July | Year-ended | Growth over previous five years | |

|---|---|---|---|---|---|---|

| Sydney | 1.2 | 1.1 | 1.0 | 0.0 | −2.6 | 20 |

| Melbourne | 2.0 | 1.6 | 1.3 | 0.3 | −1.0 | 28 |

| Brisbane | 0.6 | 0.2 | 0.2 | 0.3 | −1.3 | 8 |

| Adelaide | 0.3 | 0.1 | −0.1 | −0.2 | −0.9 | 10 |

| Perth | −0.3 | −0.5 | −0.4 | −0.6 | −8.8 | −21 |

| Darwin | 0.3 | −0.2 | −1.2 | 0.4 | −9.2 | −30 |

| Canberra | 0.5 | 0.7 | 0.8 | 0.0 | 2.0 | 23 |

| Hobart | 0.5 | 0.0 | 0.4 | 0.3 | 2.5 | 39 |

| Capital cities | 1.2 | 1.0 | 0.7 | 0.2 | −2.4 | 15 |

| Regions | 0.4 | 0.3 | 0.1 | 0.0 | −1.9 | 12 |

| Australia | 1.0 | 0.8 | 0.6 | 0.2 | −2.3 | 14 |

|

Sources: CoreLogic; RBA |

||||||

Other indicators of housing market conditions have strengthened in recent months, primarily in Sydney and Melbourne, where auction clearance rates have picked up further and vendor discounts and days on market have declined from recent highs (Graph 2.11). Nationally, the share of households expecting housing prices to rise over the coming year has increased in recent consumer surveys.

Available evidence suggests that the national housing turnover rate has increased over recent months. Auction volumes have started to turn around in both Sydney and Melbourne, as has the number of properties sold at auction, and new listings have picked up. Rental vacancy rates increased in several cities over the June quarter, but generally remain below their long-term average. The vacancy rate in Sydney rose sharply to reach its highest level in 16 years, but it has begun to moderate more recently.

Mining activity has picked up since the start of the year

Mining investment picked up by 2.4 per cent in the June quarter, following several quarters of declines associated with the extended wind-down in LNG project construction. According to the most recent Australian Bureau of Statistics (ABS) Capital Expenditure (Capex) survey, mining firms expect to increase investment in 2019/20 for both buildings & structures and machinery & equipment (Graph 2.12). Information from the Bank's liaison program and company announcements also suggest that resource firms are likely to increase investment over the next couple of years to sustain and, in some cases, expand, production. Mining profits have also increased strongly over the past year, which could add further support to investment.

Resource export volumes increased by 2.4 per cent in the June quarter, to be 2 per cent higher over the year. Growth in the quarter was driven by an increase in exports of LNG, as recently completed LNG projects continued to ramp-up production (Graph 2.13). Coal exports also increased in the quarter, underpinned by strong demand for coking coal from India and an increase in thermal coal exports to China. Iron ore exports recovered from supply disruptions including Tropical Cyclone Veronica in late March.

Service and manufactured exports have been supported by a depreciation of the Australian dollar

Australia's service and manufactured exports have continued to grow steadily, supported by a depreciation of the Australian dollar over the past year or so, reasonable growth in Australia's major trading partners and, in the case of service exports, an increase in student and visitor arrivals. Manufactured exports increased by around 12 per cent over the year to the June quarter 2019, underpinned by strong growth in exports of scientific instruments and medicinal & pharmaceutical products (Graph 2.14).

An increase in export volumes and higher export prices (led by iron ore), combined with a decline in import values, resulted in a further increase in the trade surplus in the June quarter to 4 per cent of GDP – its highest since 1959 when quarterly data begin (Graph 2.15). Partial data suggest the trade surplus will remain elevated in the September quarter. The increase in the trade surplus in the June quarter, alongside a narrowing in the net income deficit, also resulted in Australia's first current account surplus since 1975.

Imports have declined alongside slower growth in domestic demand

Import volumes decreased by 1.3 per cent in the June quarter, to be 2.8 per cent lower over the year. The recent decline in imports has been broad based and is consistent with slower growth in domestic final demand, particularly private sector demand, which is relatively more import-intensive (Graph 2.16). The depreciation of the Australian dollar over the past year has increased the relative price of imports, which has also weighed on import demand. Partial data suggest that import volumes declined a little in the September quarter.

Non-mining investment has expanded at a modest pace over the past year

Private non-mining business investment declined by 1 per cent in the June quarter, to be 1.5 per cent higher over the year (Graph 2.17). A large part of the easing in growth over the past year has been driven by a moderation in non-residential construction activity, following a period of strong growth over 2017 and the first half of 2018. However, the level of construction activity remains elevated, both for infrastructure investment (particularly roads and renewable electricity generation projects) and buildings (particularly short-term accommodation, offices and industrial buildings). Investment in machinery & equipment has grown moderately over the past year; an increase in investment by service industries, including professional & technical services, has offset declines across goods-related industries, particularly transport, postal & warehousing.

Forward-looking indicators have been mixed but generally suggest that non-mining investment will expand at a moderate pace. Private non-residential building approvals have trended higher over recent months, led by approvals for office and other commercial buildings (Graph 2.18). The pipelines of both buildings and private infrastructure work yet to be done remain elevated. These indicators suggest ongoing support for non-residential construction activity over the next year or so.

Investment intentions for 2019/20 reported by non-mining firms in the Capex survey suggest non-mining business investment may ease; however, the Capex survey does not cover all industries or all types of investment (Graph 2.19). The decline in reported business investment intentions was particularly concentrated in the construction industry, consistent with the recent slowing in non-residential construction activity (Graph 2.20). Investment intentions in other non-mining industries remain broadly positive, particularly in the utilities, transport, postal & warehousing and rental, hiring & real estate industries. Survey measures of business conditions and expected capital expenditure remain around long-run average levels, but well below their high levels in early 2018.

Public consumption strengthened

Public demand increased by 1.5 per cent in the June quarter and by 5.2 per cent over the year. Growth was driven by public consumption, which increased by 6.2 per cent over the year (Graph 2.21). This reflected growth in consumption at both the federal and state levels, underpinned by the ongoing rollout of the National Disability Insurance Scheme (NDIS) and spending on aged care. Public consumption was boosted in the quarter by some temporary factors, such as expenditure associated with the federal election and remediation work following floods in central Queensland.

In contrast, public investment slowed further, declining by 3.2 per cent in the quarter; year-ended growth eased to 1.4 per cent. Investment by state and local governments declined in the quarter, because a number of infrastructure projects were completed and there was lower investment in energy projects in South Australia and Victoria. Other forms of government spending such as social assistance have been broadly unchanged for several years.

Taxation revenue from the household sector has grown strongly over the past few years, and taxation revenue from other sources has also grown (Graph 2.22). As a result, there has been a trend reduction in the underlying cash deficit in the consolidated set of government budgets over recent years and government saving has increased.

Employment growth remains strong …

Employment grew by around 90,000 in the September quarter (Graph 2.23). Employment has increased at an annualised rate of around 2½ per cent over the past three years, and the employment-to-population ratio is at its highest level since 2008. Both full-time and part-time employment have contributed in roughly equal parts to employment growth over the past six months, although full-time employment has accounted for most of the growth over the past few years. Despite the relative strength in full-time employment growth, average hours worked have declined because full-time workers on long hours are working less, especially those that are self-employed.

Strong employment outcomes have occurred despite weaker growth in economic activity from mid 2018 as well as softer signals from leading indicators of labour demand (see Box B: Industry Insights into Productivity Growth). Leading indicators of labour demand point to around average employment growth in the near term (Graph 2.24). Indicators of job advertisements are lower than one year ago. Employment intentions in the NAB survey and the Bank's liaison program have also declined over the past year, but remain above long-run averages. Job vacancies have declined slightly since earlier in the year, but remain at a relatively high level as a share of the labour force.

Employment growth continued to be concentrated in the household services sector (Graph 2.25). Health care & social assistance and education & training have been the main contributors to employment growth. The increase in health-related employment appears to have been fairly broad based but, in recent years, growth has been particularly pronounced for aged & disabled carers and nurses. Alongside the structural rise in health-related employment as a result of the ageing in the population, part of the increase is likely to be related to the rollout of the NDIS. By contrast, the construction industry's share of total employment has fallen recently following strong growth over the previous few years. Construction employment vacancies declined a little over the three months to August and information from the Bank's liaison program shows that employment intentions for firms exposed to residential construction are weak.

… and continues to be met by a rise in labour supply

Much of the strength in employment growth over the past three years has been matched by higher labour force participation and the participation rate is around record highs. The increase in the participation rate over the past six months has been larger than the average ‘encouraged worker’ response to employment growth would suggest, but is within the bounds of historical experience over recent decades. The rise has been broadly based across most states – although the increase in NSW has been notable – and comprises females aged 25–64 years and older workers of both sexes (Graph 2.26). Alongside structural longer-run increases in participation, these groups tend to increase their labour supply noticeably when demand for labour is strong.

The unemployment rate remains unchanged

The unemployment rate has been around 5¼ per cent since April (Graph 2.27). Over the past year or so, unemployment rates have increased across most states, with Western Australia a notable exception. The share of underemployed workers – who want and are available to work additional hours – has increased a little recently. As a result, a broader measure of labour market underutilisation, which captures both the hours sought by the unemployed and the additional hours that underemployed people would like to work, has increased over the past six months or so, consistent with the recent increase in the share of part-time workers. Ongoing spare capacity in the labour market has been reflected in modest wages growth.