Reserve Bank of Australia Annual Report – 2021 Banking and Payment Services

The Reserve Bank provides banking and payment services to meet the needs of the Australian Government and to support an efficient and stable Australian financial system. These services supported the government's measures to support Australian households and businesses during the COVID-19 pandemic by ensuring financial assistance payments were processed quickly and reliably. In addition to operating Australia's real-time gross settlement (RTGS) system, the Bank operates national infrastructure to support the settlement of real-time payments by households and businesses on a 24/7 basis. These services provide the Australian Government with access to 24/7 payment capabilities, and are consistent with the Bank's strategic goal of providing innovative, high-quality banking and payment services to the Australian Government, its agencies and, in turn, the Australian public.

Transactional banking services

The Reserve Bank aims to deliver secure, reliable, cost-effective banking and payment services to the Australian Government and its agencies. These services enable the government, through its agencies, to make payments and collect revenue. The provision of transactional banking services for the government is consistent with the Reserve Bank's responsibilities under the Reserve Bank Act 1959, which requires the Bank, insofar as the government requires, to act as the Commonwealth's banker and financial agent.

The Bank currently provides transactional banking services to more than 90 Australian Government agencies. This supports the many Australians who depend on the reliable delivery of these services. While the Bank provides a broad range of payment and collection services, the bulk of the Australian Government's payments are made via local low-value direct entry systems both domestically and overseas. The majority of these payments are welfare and pension payments made on behalf of Services Australia. The Australian Government also makes payments using a number of other methods, including the New Payments Platform (NPP), RTGS, cheque, BPAY and prepaid cards.

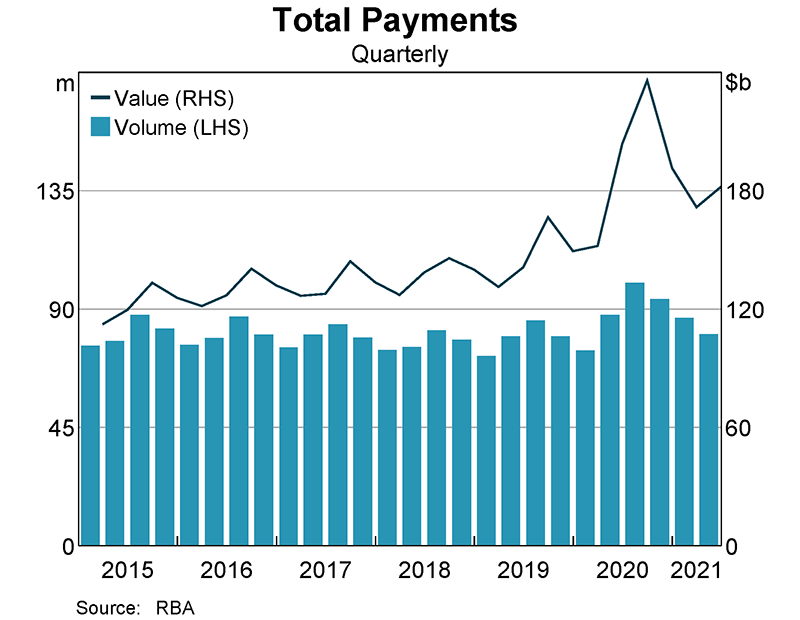

In 2020/21, the Reserve Bank distributed historically high volumes of payments, comprised of around 359.7 million domestic and 1.1 million international payments, totalling $765.7 billion and $15.2 billion, respectively. A significant proportion of these payments related to the timely and efficient delivery of government support payments to households and businesses affected by the COVID-19 pandemic. The Bank disbursed close to 20 million transactions on behalf of Services Australia for Economic Support Payments and the Australian Taxation Office (ATO) for JobKeeper payments during the pandemic.

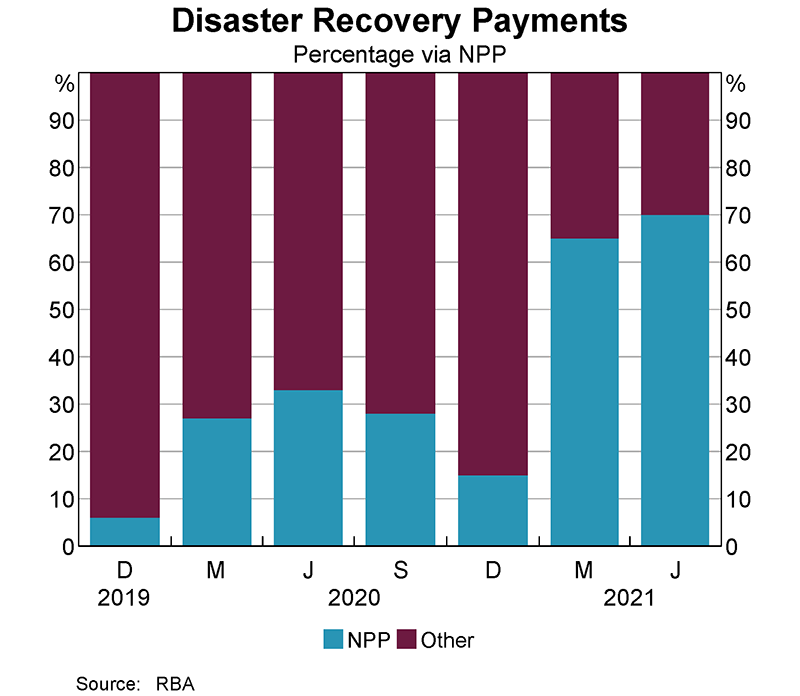

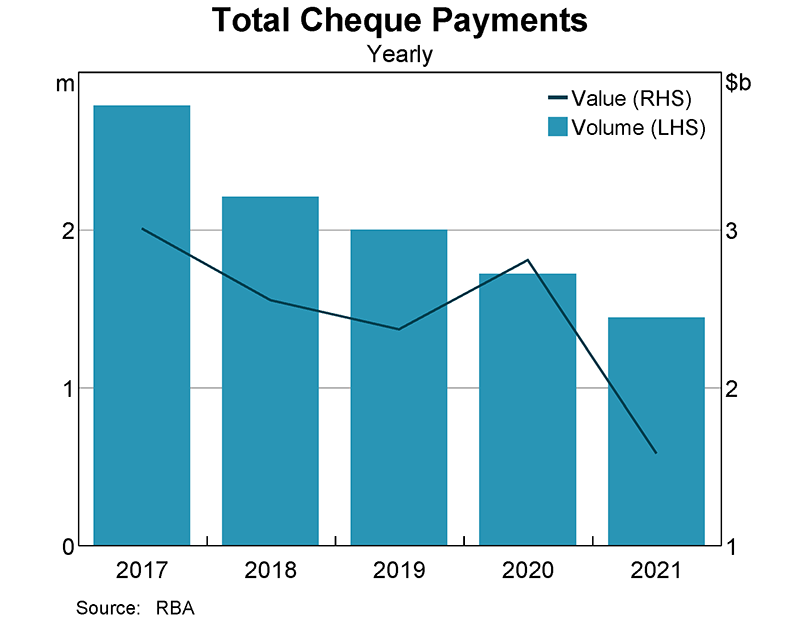

The nature of transactional banking services offered by the Reserve Bank is continually evolving with changes in payments technology and business processes. The Bank works with industry to deliver solutions to its government customers as this occurs. Bank staff contribute to industry initiatives, representing the interests of the government as a significant user of payment services. The Bank supports its government agency customers to adapt to new technologies and processes so they can offer convenient, reliable and cost-effective payment options that continue to meet the needs of their customers. The Bank is also working closely with Services Australia to harness the technological advantages of the NPP. This capability was used to deliver around 70 per cent of the Australian Government Disaster Recovery Payments in near real-time, including more than 259,000 transactions following the floods in New South Wales. This was more than five times the volume processed following the Australian bushfires in the summer of 2019/20. Approximately 15 per cent of the Disaster Recovery Payments were able to be made outside of normal business hours (either after-hours or on weekends), allowing affected households to receive payments when needed, irrespective of the time or day. Conversely, and in line with broader industry trends, the government's cheque payment volumes continue to decline, falling by a further 16 per cent in 2020/21.

In addition to processing government payments, the Reserve Bank provides Australian Government agencies such as the ATO with access to a number of services through which they can collect monies owed from both domestic and international payers. These services include direct entry, RTGS, BPAY, cheque, eftpos, cash, NPP and card-based services via phone and internet. In addition, the Bank worked with the ATO and international money remitters to introduce improvements in the collection of monies from overseas.

The COVID-19 pandemic saw an overall reduction in government collections over the second half of 2020 as economic activity was significantly affected by virus containment measures and some government agencies slowed or ceased active debt recovery activities. Resumption of these activities combined with the economic recovery resulted in a rebound of collections that exceeded pre-COVID-19 levels in the last few months of 2020/21. Overall, the Bank processed 40.4 million collections-related transactions for the Australian Government in 2020/21, amounting to $658.1 billion.

Pro forma business accounts

The Reserve Bank's transactional banking services are subject to the Australian Government's competitive neutrality guidelines. The Bank delivers its services in competition with commercial financial institutions – in many instances, bidding for business at tenders. The Bank must cost and price the services separately from its other activities and meet a prescribed minimum rate of return. For 2020/21, the Bank achieved its competitive neutrality target rate of return.

The following sets of pro forma business accounts for the Reserve Bank's contestable businesses have been prepared in accordance with competitive neutrality guidelines. These accounts do not form part of the audited financial statements.

After-tax earnings from the Reserve Bank's transactional banking services were $3.6 million in 2020/21, $1.1 million lower than in the previous year.

| 2020/21 | 2019/20 | |

|---|---|---|

| Revenue | ||

| – Service fees | 95.0 | 114.4 |

| – Other revenue | 0.5 | 2.9 |

| Total | 95.5 | 117.3 |

| Expenditure | ||

| – Direct costs | 90.7 | 110.7 |

| – Indirect costs | 0.0 | 0.0 |

| Total | 90.7 | 110.7 |

| Net profit/(loss) | 4.8 | 6.6 |

| Net profit/(loss) after taxes(a) | 3.6 | 4.7 |

| Assets(b) | ||

| – Domestic markets investments | 4,205.1 | 2,674.0 |

| – Other assets | 25.2 | 26.9 |

| Total | 4,230.3 | 2,700.9 |

| Liabilities(b) | ||

| – Capital & reserves | 25.0 | 25.0 |

| – Deposits | 4,188.3 | 2,663.5 |

| – Other liabilities | 17.0 | 12.4 |

| Total | 4,230.3 | 2,700.9 |

|

(a) In accordance with competitive neutrality guidelines, income tax expense has been

calculated and transferred to the Commonwealth as a notional part of the Reserve

Bank's annual profit distribution Source: RBA |

||

Central banking services

As part of the central banking services the Reserve Bank provides to the Australian Government, the Bank manages the overnight consolidation of Australian Government agency account balances. The consolidation of balances requires the movement of agency account balances, held with commercial financial institutions and with the Reserve Bank, into the Official Public Account (OPA). Daily payment instructions from the Department of Finance are processed to move funds from the OPA to agency bank accounts to meet their payment obligations. Work by the Bank, the Department of Finance and the Australian Office of Financial Management (AOFM) to modernise the Australian Government's cash management activities was concluded in 2020/21. This work resulted in a move away from term deposits and the introduction of a new cash management account, thereby creating operational efficiencies at the Bank and the AOFM.

While the Reserve Bank manages the consolidation of the government's accounts, the AOFM has responsibility for ensuring that there are sufficient cash balances to meet the government's day-to-day spending commitments and for investing excess funds in approved investments. In November 2020, the AOFM's use of term deposits at the Bank was replaced with a cash management account. The Bank provides a very limited short-term overdraft facility to cater for occasions when there is unexpected demand for government cash balances. This overdraft facility is used infrequently and was not used during the reporting period.

The Reserve Bank also provides banking services to overseas central banks and registry services to supranational organisations issuing Australian dollar-denominated securities. Eight organisations currently use registry services, with this number having been relatively steady over recent years.

Settlement services

The Reserve Bank of Australia owns, operates and maintains Australia's interbank settlement system, the Reserve Bank Information and Transfer System (RITS). This system is critical for the settlement of interbank obligations arising from the wide range of non-cash payments made in the Australian economy, including card-related transactions, direct entry (‘pay anyone’) payments, cheques and high-value payments. These obligations are finally and irrevocably settled in RITS through the simultaneous crediting and debiting of Exchange Settlement Accounts (ESAs), which are at-call accounts held at the Reserve Bank on behalf of RITS member institutions. As a result of the Bank's policy response to the COVID-19 pandemic, the supply of Exchange Settlement balances has increased significantly, ensuring the Australian financial system has sufficient liquidity to support economic activity.

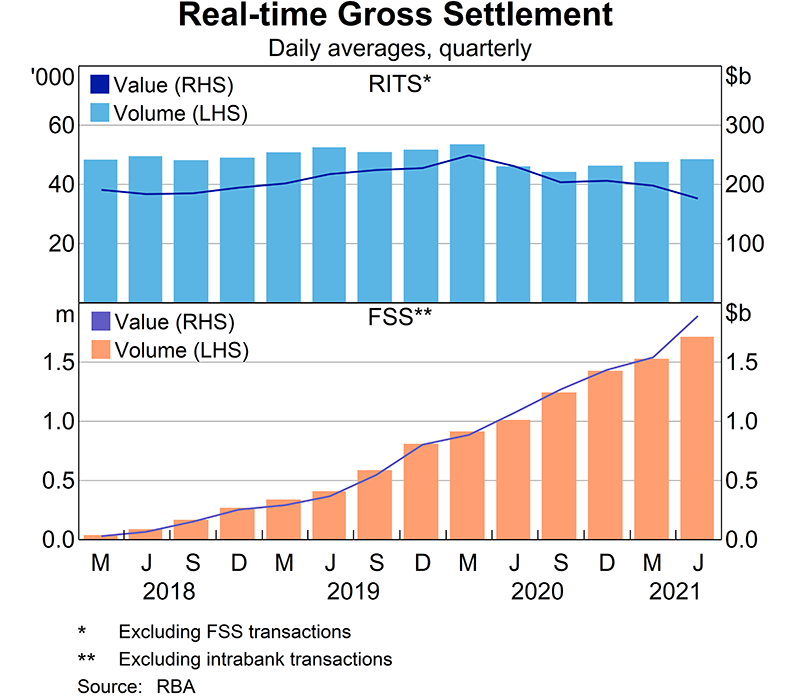

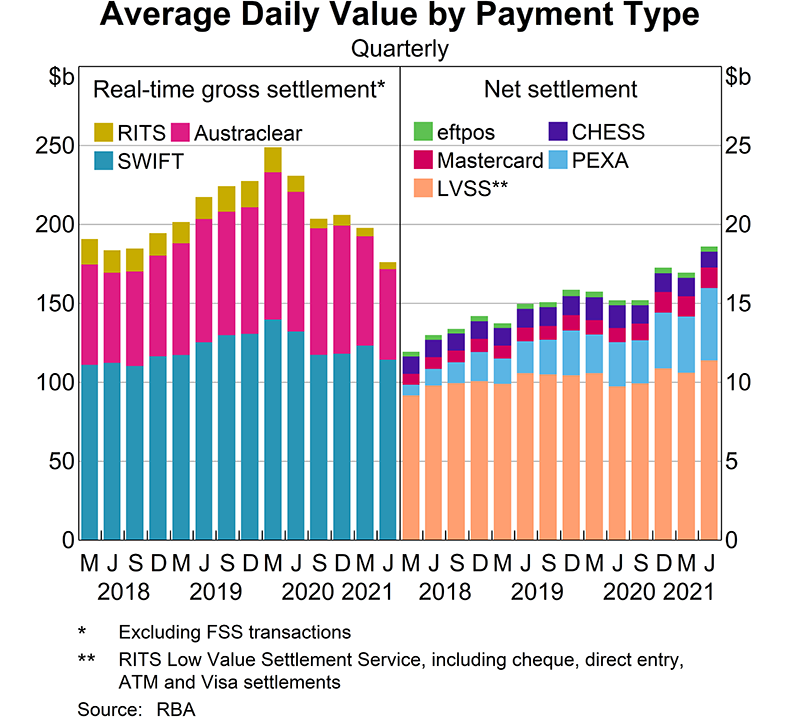

Since 1998, high-value ‘wholesale’ transactions have been settled individually in RITS on a real-time basis through the process of ‘real-time gross settlement’ (RTGS). These transactions include: large customer, corporate and institutional payments; wholesale debt and money market transactions; and the Australian dollar leg of foreign exchange transactions. In 2020/21, RITS settled an average of 46,600 of these transactions each business day, worth $196 billion, which amounts to RITS turning over the equivalent of Australia's annual GDP every 10 business days. Compared with the previous financial year, this marked a decrease of 8 per cent and 16 per cent in settlement volumes and values respectively. This can largely be explained by the impact of the pandemic on economic and financial market activity, and the unprecedented levels of system liquidity that have depressed interbank lending activity (see chapter on ‘Operations in Financial Markets’).

Another service of RITS is the Fast Settlement Service (FSS), which enables the real-time gross settlement of transactions initiated through the NPP. Since its public launch in 2018, the NPP has greatly expanded the availability of fast and low-cost payments to Australian consumers, businesses and government agencies. Payments can be made in real-time, 24 hours a day, each day of the year, using unique identifiers (PayIDs) such as phone numbers and emails in addition to traditional bank account numbers. As of June 2021, NPP functionality is available for around four in five Australian bank accounts, with more than 7.7 million PayIDs registered. While RITS provides members with various transaction and liquidity management tools to ensure the efficient settlement of wholesale transactions, the FSS adopts a more streamlined approach to transaction management, which prioritises the high throughput of generally low-value transactions. FSS growth remained on-trend throughout 2020/21, and average daily volumes reached 1.8 million, worth $2.1 billion in June. This growth can largely be attributed to the ongoing migration of account-to-account (pay-anyone) payments from the direct entry system. Real-time settlement in the FSS means that NPP payments can be made with immediate funds availability to the recipient, which has been beneficial for a range of time-critical payments during the COVID-19 pandemic (such as for emergency payments, as noted above under ‘Transactional banking services’).

While the introduction of NPP and FSS has greatly expanded the availability of real-time payments, the majority of low-value payments are still settled in RITS on a deferred net basis. The RITS Low Value Settlement Service (LVSS) collates interbank obligations. These obligations arise from direct entry payments, cheques, some debit and credit cards, BPAY and ATMs for net settlement at predetermined times throughout the day. In 2020/21, LVSS net settlements totalled around $10.7 billion each day. Another $6.3 billion was settled each day through externally administered batches, whereby an approved entity nets electronic transactions originating from an upstream business operator and submits them to RITS for simultaneous settlement in a ‘batch’. This includes obligations arising from eftpos and Mastercard payments, equities transactions processed by the ASX Clearing House Electronic Sub-register System (CHESS), and electronic property transactions processed by Property Exchange Australia (PEXA) and Sympli Australia. Most batches are settled in RITS once per day, with the exception of property batches which are settled throughout each business day. This enables the near real-time settlement of individual property transactions with electronic title lodgement occurring simultaneously at the relevant land titles office. Property settlements in RITS continued to grow through 2020/21, which, along with direct entry payments, contributed to strong growth in the average daily value of net settlements since the December quarter 2020.

Given its critical role in Australia's financial infrastructure, the Reserve Bank continually works to ensure that RITS remains secure and resilient, with particular attention focused on the risk of cyber-attack. The Bank is nearing completion of a third-site data bunker, which aims to minimise the risk of data loss or corruption in the event of a major disruption to the Bank's core systems, including its critical settlement systems. During 2020/21, the Bank participated in industry working groups concerned with preventing payments fraud, uplifting cyber event coordination, and enhancing the security of external connections to RITS and relevant feeder systems. In collaboration with other members of the Council of Financial Regulators, the Bank commenced a pilot threat intelligence exercise. The purpose of the exercise is to identify systemic risks to the integrity and stability of Australia's financial markets.

The COVID-19 pandemic introduced operational risk challenges for RITS members as changes were made to work arrangements and project timetables. Bank monitoring of RITS member incidents indicates that members have avoided significant operational disruption during the pandemic period, although incident numbers and their duration have remained at historically high pre-pandemic levels. The pandemic also had implications for the Reserve Bank's management of operational risks. At the onset of the pandemic, the Bank introduced additional measures to ensure reliable settlement services, including work-from-home arrangements for the majority of staff and liaison with key RITS feeder systems and members. The Bank was able to return to flexible office-based arrangements for most operational staff in early 2021, although work-from-home arrangements for all but a minimum of critical staff were reintroduced in the middle of the year owing to the re-imposition of restrictions on movement in response to heightened pandemic concerns. In 2020/21, RITS and FSS availability was around 99.96 per cent and 99.999 per cent, meeting the targets of 99.95 per cent and 99.995 per cent, respectively.

The Reserve Bank conducts annual assessments of RITS against the Principles for Financial Market Infrastructures (PFMIs), which are international standards set by the Committee on Payments and Market Infrastructures and the Technical Committee of the International Organization of Securities Commissions. The most recent assessment, completed in May 2021, concluded that RITS ‘observed’ all relevant principles except for operational risk and participant-default risk, which were both ‘broadly observed’. To return operational risk to ‘observed’, the Bank is improving the oversight of maintenance performed by external contractors, and has made a range of improvements to its operational activities through the Bank's Technology Stability Improvement Program. This program, which finished in mid 2021, enhanced the Bank's operational practices through additional resourcing and training, procedural improvements, and better management of patching computer systems. While operational procedures for managing a RITS member default are in place, the Bank will also formally document the relevant decision-making and crisis-management arrangements.

The Reserve Bank is also committed to ensuring RITS continues to meet the functional needs of the payments industry. A multi-year refresh of core network and application infrastructure supporting RITS and related systems was completed during 2020/21, delivering benefits such as increased system resilience and processing throughput. Of particular significance is ongoing work to support the industry-wide migration of AusPayNet's High Value Clearing System to ISO 20022 – a modern and open messaging standard that encourages payments innovation through richer data and better interoperability. For the Bank, this project involves both an upgrade to its back office payments processing systems and also migrating messages currently used by RITS onto the ISO 20022 message standard. The Bank remains on schedule and continues to work closely with the payments industry on message formats and build requirements.

In line with the Financial Stability Board's updated cross-border payments roadmap, the Reserve Bank is participating in various working groups discussing the linkage of domestic fast payment systems. This international initiative aims to address the cost, speed, transparency and access issues that characterise existing cross-border payment arrangements. The potential synergies of an agreed ISO 20022 messaging format in this context are also being considered.

The Bank continues to play a role in promoting competition and innovation in payments systems, including by enabling broad-based access to settlements infrastructure like RITS. Following amendments to the Banking Act 1959 in 2018, there has been an increase in non-traditional, non-authorised deposit-taking institutions, such as fintechs, seeking to operate ESAs, including money remitters, card acquirers and third-party payment providers.

As of 30 June 2021, there were 167 RITS members, of which 102 held ESAs and a further 65 held RITS membership solely for the purpose of participating in the Bank's domestic market operations. Of the 102 ESA holders, and in addition to the Bank itself, 94 were authorised deposit-taking institutions (ADIs) with the remainder consisting of central counterparties, securities settlement facilities and non-ADI payment service providers. During 2020/21, five ‘batch administrators’ submitted external batches to RITS for settlement and 13 RITS ESA members directly settled NPP transactions through the FSS.

The Reserve Bank offers correspondent banking services to other central banks and official institutions overseas to allow for settlement of certain Australian dollar payments and provides safe custody services to these overseas agencies. The face value of securities held in custody by the Bank in this capacity was around $89 billion at the end of June 2021. The Bank also provides settlement services for banknote lodgements and withdrawals by commercial banks.