Assessment of ASX Clearing and Settlement Facilities Appendix B: Background Information

B.1 ASX group structure and governance

The ASX Group operates two types of CS facilities:

- CCPs. A central counterparty (CCP) acts as the buyer to every seller, and the seller to every buyer in a market. It does so by interposing itself as the legal counterparty to all purchases and sales. These arrangements provide substantial benefits to participants in terms of counterparty risk management as well as greater opportunities for netting of obligations. However, they expose the CCPto risk if a participant defaults on its obligations, since the CCP must continue to meet its corresponding obligations to all of the non-defaulting participants. The ASX CCPs manage this risk in a number of ways, including through participation requirements, margin collection, the maintenance of pooled resources and loss allocation arrangements.

- SSFs. A securities settlement facility (SSF) provides for the final settlement of securities transactions. Settlement involves transfer of the title to the security, as well as the transfer of cash. These functions are linked via appropriate Delivery versus Payment (DvP) settlement arrangements that mitigate an SSF's principal risk (i.e. that the securities are delivered but no cash payment received).

The ASX Group operates two CCPs and two SSFs:

- ASX Clear Pty Limited provides CCP services for ASX-quoted cash equities, debt products and warrants traded on the ASX and Cboe markets, equity-related derivatives traded on the ASX market, Cboe-quoted warrants, Transferable Custody Receipts and funds traded on Cboe, and National Stock Exchange of Australia Pty Ltd (NSXA) quoted securities traded on the NSXA market. The provision of CCP services for Cboe and NSXA is provided under the Trade Acceptance Service (TAS), which allows ASX Clear to act as a CCP for trades executed on Approved Market Operator (AMO) platforms in accordance with the ASX Clear Operating Rules and Procedures.

- ASX Clear (Futures) Pty Limited provides CCP services for futures and options on interest rate, equity, energy and commodity products traded on the ASX 24 market, as well as AUD and NZD-denominated OTC interest rate derivatives (IRD).[44]

- ASX Settlement Pty Limited provides SSF services for ASX-listed cash equities, debt products and warrants traded on the ASX and Cboe markets. The provision of SSF services for Cboe is provided under the TAS. Under the Settlement Facilitation Service, ASX Settlement provides DvP settlement services for transactions in non-ASX-listed securities undertaken on trading platforms operated by Approved Listing Market Operators; these include NSXA and the Sydney Stock Exchange Limited. ASX Settlement also provides for subscriptions and redemptions in unlisted managed funds through the mFund Settlement Service.

- Austraclear Limited provides settlement and depository services for debt securities, including government bonds. It also provides settlement services for derivatives traded on the ASX 24 market and for margin payments in ASX Clear and ASX Clear (Futures).

Each of the ASX facilities holds a CS facility licence, and each CCP and SSF is required under the Corporations Act to comply with the relevant FSS determined by the Bank (i.e. the CCP Standards and SSF Standards, respectively) and to do all other things necessary to reduce systemic risk.

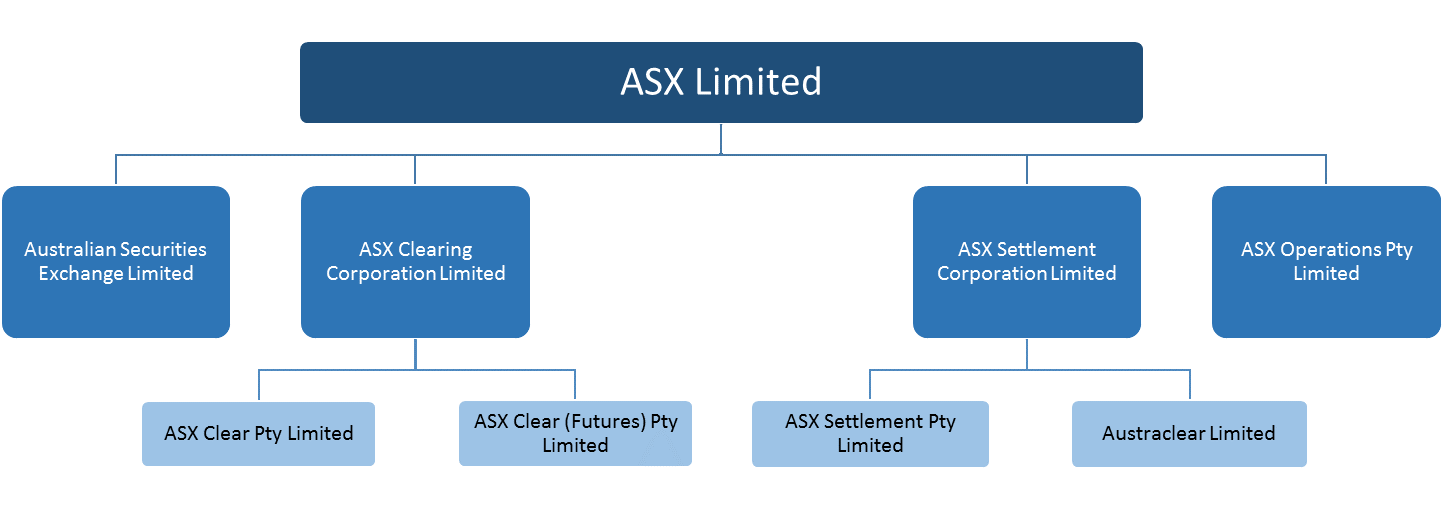

The four CS facilities form part of the ASX group of companies (see Figure 2), and are controlled by ASX Limited through two holding companies – ASX Clearing Corporation Limited (ASXCC) and ASX Settlement Corporation Limited. ASX Clear and ASX Clear (Futures) are subsidiaries of ASXCC, which manages the financial resources according to a treasury investment policy and investment mandate approved by the CS Boards. The two SSFs – ASX Settlement and Austraclear – are subsidiaries of ASX Settlement Corporation Limited. ASX Limited is the licensed operator of the ASX market, which provides a trading platform for ASX-quoted securities and equity derivatives. Another subsidiary, Australian Securities Exchange Limited, is the licensed operator of the ASX 24 market, an exchange for futures products.

ASX Limited is the ultimate parent company of the four CS facilities and is listed on the ASX market. The ASX Limited Board is responsible for overseeing the processes for identifying significant risks to ASX and for ensuring that appropriate policies, as well as adequate control, monitoring and reporting mechanisms are in place.[45] This means that the ASX Group operates on a day-to-day basis as a single group, rather than as a collection of individual entities.

As corporate entities, the CS facilities are required to have their own boards. The CS Boards focus on management of clearing and settlement risk and oversee compliance with the FSS and consistency with the international PFMI standards.[46] A number of directors of the CS facilities' boards (CS Boards) are also directors of ASX Limited. This can give rise to commercial conflicts of interest as ASX Clear and ASX Settlement provide clearing and settlement services to market operators who are competitions of ASX Limited. It can also give rise to more general conflicts of interest in cases where the interests of the CS facilities diverge from those of the broader ASX Group (e.g. in the allocation of resources across the group).

The ASX Limited Board has established four committees to assist in discharging its role and responsibilities: the Audit and Risk Committee (ARC); the Technology Committee; the Nomination Committee; and the Remuneration Committee. [47] These committees also undertake activities on behalf of the CS facilities, although the CS Boards are have the primary role for clearing and settlement risks. The Audit and Risk Committee (ARC) review and oversee systems of risk management, internal control and regulatory compliance. The Technology Committee is responsible for review and oversight of the ASX Group's technology and information strategies and performance. This includes oversight of ASX's technology project implementation and management of cyber resilience, including the CHESS replacement program.

ASX has three executive-level committees that support decisions related to the risk management of the CS facilities:

- The Risk Committee, which ensures the adequacy and appropriateness of the risk management frameworks, policies, process and activities of the ASX Group, including the ERMF.

- The Regulatory Committee, which oversees licence compliance matters.

- The Technology and Cyber Committee, which oversees IT security and systems and incident management.

ASX's Executive Committee operates in parallel to these three executive-level committees.[48] The Executive Committee reports to the ASX Limited Board and CS Boards on strategic and business initiatives, non-risk related frameworks and HR matters.

To assist in managing risk across the organisation, ASX uses the ‘three lines’ model. This is intended to provide a clear organisational structure, clarify responsibilities for managing risks and controls across the business, and promote a culture of risk ownership among frontline managers. The first line is made up of the operational management staff who are accountable for risk management within their business functions. The second line includes the independent risk management and compliance functions which oversee, facilitate and assist Line 1's risk management.

The third line is ASX's Internal Audit function which provides independent reviews on internal control systems and procedures, as well as assurance on the manner in which Lines 1 and 2 achieve the risk objectives.[49] ASX Internal Audit has full access to the Audit and Risk Committee, as well as unrestricted access to all ASX records, property and personnel. The general manager of Internal Audit reports to the Chair of the Audit and Risk Committee, with an administrative reporting line through to the Chief Financial Officer.

ASX also operates external standing forums to gauge the views of participants and other stakeholders. These include:

- Risk Consultative Committees for both ASX Clear and ASX Clear (Futures), comprising participants from each CCP. The committees are consulted on material changes to default management processes, the margining methodology, the default fund, position and liquidity limits, participation criteria, and other changes affecting risk management practices or related rules.

- The ASX Clear (Futures) Default Management Group (DMG), which is comprised of OTC participants and is consulted on aspects of the default management process.

- A Business Committee, which acts as a stakeholder advisory body for ASX's cash market clearing and settlement services. The Committee is comprised of representatives of clearing participants, settlement participants, AMOs, share registries and a number of relevant industry associations.[50]

- Advisory user groups for particular products and services (i.e. ETOs, interest rate derivatives and Austraclear), which are forums for participants to provide feedback on those products and services.

See section 4.3.4 for ASX's external engagement in relation to the CHESS replacement program.

B.2 Regulatory environment

The Corporations Act establishes conditions for the licensing and operation of CS facilities in Australia and gives ASIC and the Bank powers and responsibilities relating to these facilities. These powers are exercised under the governance of ASIC's Commission and the Bank's Payments System Board, respectively. The regulators' roles are defined in the Corporations Act.

- The Bank is responsible for determining standards (the FSS) for the purposes of ensuring that CS facility licensees conduct their affairs in a way that causes or promotes overall stability in the Australian financial system. In addition, the Bank is responsible for assessing how well a licensee is complying with its obligation under the Corporations Act, to the extent that it is reasonably practicable to do so, to comply with these standards and do all other things necessary to reduce systemic risk.

- ASIC is responsible for assessing the extent to which CS facility licensees comply with all other obligations of a CS facility licensee arising under the Corporations Act, including the obligation, to the extent that it is reasonably practicable, to do all things necessary to ensure that the CS facility's services are provided in a fair and effective way.

The Bank has determined two sets of FSS relevant to its oversight of CS facilities: the CCP Standards and SSF Standards.

As licensees, the ASX CS facilities are required to provide the Bank with timely information on any material developments relevant to the services provided under its CS facility licence and its compliance with the FSS (see section 2.4.1). The Bank also gathers information on the facilities through an open and ongoing dialogue with ASX staff, including through scheduled periodic meetings and ad hoc targeted meetings on specific topics.[51] Based on the information gathered, the Bank undertakes regular assessments of the ASX CS facilities.

The ASX CCPs are recognised by the European Securities and Markets Authority (ESMA) as ‘third-country CCPs’. This allows the ASX CCPs to continue to provide clearing services to participants established in the European Union (the CCPs have transitional recognition in the UK following its withdrawal from the EU). ASX Clear (Futures) was also granted an exemption from registration as a Derivatives Clearing Organization in the US. This exemption allows ASX Clear (Futures) to provide clearing services to US banks with respect to ‘proprietary’ swaps. The Bank and ASIC have established a memorandum of understanding (MoU) with each of ESMA and the US Commodity and Futures Trading Commission which, among other things, supports cross-border cooperation and information sharing. The Bank has also issued a supplementary interpretation of CCP Standards to facilitate the ASX CCPs' recognition in the EU (see Appendix C). The Swiss Financial Market Supervisory Authority (FINMA) also recognises ASX Clear (Futures) as a foreign central counterparty, which allows it to grant Swiss market participants supervised by FINMA direct access to its facilities as clearing participants.

The Bank has a MoU with the RBNZ which establishes cooperation arrangements relevant to ASX Clear (Futures)' activities in NZD-denominated products. ASX Clear (Futures) has been designated as a settlement system under the RBNZ Act.

B.3 Risk management in the ASX central counterparties

CCPs are exposed to both credit and liquidity risks, primarily following the default of one or more participants. Credit risk is the risk that one or more counterparties will not fulfil their obligations to the CCP, resulting in a financial loss, while liquidity risk arises where the CCP is unable to meet its payments obligations at the time that they are due, even if it has the ability to do so in the future. ASX Clear and ASX Clear (Futures) manage the risks arising from a potential default in a number of ways, including through participation requirements, margin collection, the maintenance of prefunded pooled financial resources, recovery tools, and risk monitoring and compliance activities.

Participation requirements

Participants in each CCP must meet minimum capital requirements. While capital is only a proxy for the overall financial standing of a participant, minimum capital requirements offer comfort that a participant has adequate resources to withstand an unexpected shock, for example, arising from operational or risk-control failings.

- ASX Clear requires direct participants that clear cash market products or derivatives to maintain at least $5 million in capital. ‘General participants’, which are able to clear on behalf of third-party participants, are subject to capital requirements of between $5 million and $20 million, depending on the number of third parties they clear for. These base capital requirements are supplemented by additional capital requirements that are designed to account for the complexity of each participant's business model, which can increase total core capital requirements to a maximum of $35 million.

- ASX Clear (Futures) requires participants that clear futures only to hold at least $5 million in net tangible assets (NTA) or $25 million in NTA for remote (i.e. offshore) participants. Participants using the OTC derivatives clearing service must meet a higher minimum NTA (or Tier 1 Capital) requirement of $50 million.

The CCPs also impose capital-based position limits (CBPLs) on participants' activity. Specifically, a participant's initial margin requirements cannot be more than three times the level of ASX's measure of ‘liquid capital’, NTA or Tier 1 Capital. Under certain conditions, banks and subsidiaries of banks or bank holding companies that are participants of ASX Clear (Futures) are instead subject to a fixed $1.5 billion aggregate limit for initial margin requirements. If a participant exceeds its CBPL, it will be called for additional margin.

Prefunded financial resources

The CCPs cover their credit and liquidity exposures to their participants by collecting margin and maintaining a fixed quantity of prefunded pooled resources. The CCPs collect several types of margin.

- Variation margin. Variation (or ‘mark-to-market’) margin is collected at least daily from participants with mark-to-market losses and – in the case of futures, OTC derivatives and cash market contracts – paid out to the participants with mark-to-market gains.

- Initial margin. Both CCPs routinely collect initial margin from participants to mitigate credit risk arising from potential changes in the market value of a defaulting participant's open positions between the last settlement of variation margin and the close-out of these positions by the CCP. The CCPs use statistical models to calculate initial margin.

- Additional initial margin (AIM). The CCPs may also make calls for AIM when exceptionally large or concentrated exposures are identified, including through stress tests, or when predefined position limits are exceeded.

In addition to end-of-day margin calls, the CCPs call margin on an intraday basis when exposures exceed predefined limits due to changes in market value and the opening of new positions.

ASX requires that any variation and intraday margin shortfall be posted in cash, while initial margin may be posted in the form of cash or securities that ASX would be able to rapidly and reliably liquidate in the event of the participant's default. Specifically, ASX Clear accepts certain equity securities and exchange-traded funds as collateral, while ASX Clear (Futures) accepts certain Australian Government and semi-government securities, US Treasury Bills, as well as foreign currency denominated in EUR, GBP, JPY, NZD or USD. Participants may meet AIM obligations using AUD cash or non-cash collateral, including Australian Government and semi-government securities. ASX applies haircuts to non-cash and foreign currency collateral to cover market risk on the liquidation of those assets.

The margin and other collateral posted by a participant would be drawn on first in the event of that participant's default.[52] Should this prove insufficient to meet the CCP's obligations, the CCP may draw on a fixed quantity of prefunded pooled financial resources (referred to as the CCP's ‘default fund’; Graph 2).

- ASX Clear's default fund remained at $250 million during the assessment period. This comprised $178.5 million of own equity and $71.5 million paid into a restricted capital reserve from the National Guarantee Fund in 2005.

- The default fund of ASX Clear (Futures) remained at $650 million during the assessment period. This included $450 million of ASX's own equity and $200 million of contributions from participants.

There were no changes to either CCP's default fund over 2021/22.

Credit stress tests

In order to assess the adequacy of its financial resources to cover its current and potential future credit exposures, the CCPs perform daily credit stress tests. These tests compare each CCP's available prefunded resources against the largest potential loss in the event of the joint default of two participants and their affiliates under a range of extreme but plausible scenarios (i.e. the Cover 2 requirement). The requirement for the ASX CCPs to have sufficient prefunded resources to meet Cover 2 reflects the Bank's supplementary interpretation of the FSS, under which both CCPs are deemed to be systemically important in multiple jurisdictions.

Neither ASX Clear (Futures) (Graph 3) or ASX Clear (Graph 4) experienced any days on which their credit stress test Cover 2 requirement exceeded their respective prefunded financial resources in 2021/22.

The ASX CCPs automatically call AIM, to be paid before 11:00 am the next day, when credit stress test results are in excess of a participant's Stress Test Exposure Limits (STEL). The STELs are based on external agencies' credit ratings and ASX's internal creditworthiness model, with all STELs set at less than half of the total default fund of the relevant CCP. Not all of these STEL AIM calls are related to shortfalls in the Cover 2 requirement.

Liquidity risk management

Credit exposures faced by the CCPs from a participant default also create liquidity exposures. The CCPs may also face additional default liquidity exposures in excess of their credit exposures due to the timing of when payment obligations fall due. These additional exposures may be particularly large for ASX Clear, since it clears equity trades with delivery obligations. For example, if a participant with net equity purchase obligations were to default, ASX Clear's initial liquidity exposure would include the cost of settling the payment obligations of the defaulted participant. However, the CCP must wait two days for funds to become available from selling the purchased securities due to the T+2 settlement cycle. By contrast, the CCP's credit exposure would be limited to the change in price in the securities between the defaulting participant's last variation margin payment and the time the CCP executes an offsetting securities trade. ASX Clear also faces liquidity exposures from its acceptance of equity collateral against derivatives positions. Specifically, if ASX Clear were to liquidate its equity collateral, it would likely have to wait two days to receive the proceeds of the sale.

The ASX CCPs perform daily liquidity stress tests to assess the adequacy of their available liquid resources to cover the largest potential liquidity exposure arising from the joint default of two participants and their affiliates under a range of extreme but plausible scenarios (Cover 2 liquidity target). The CCPs' liquidity stress test framework utilises the same market stress scenarios as the corresponding credit stress tests, but also takes into account additional, liquidity-specific risks.

While ASX Clear manages liquidity across both its cash market and derivatives products, it has defined a target minimum cash market liquidity ‘buffer’, which was sized at $130 million during the assessment period. Cover 2 cash market liquidity exposures regularly exceeded the buffer over 2021/22, in which case ASX Clear would have had to rely on offsetting transactions arrangements (OTAs, which are essentially liquidity commitments from its participants) to settle any exposures above the buffer. The buffer also implicitly defines a liquidity threshold for ASX Clear's derivatives-market exposures of $350 million. During the assessment period, liquidity exposures at both ASX Clear and ASX Clear (Futures) remained within their respective thresholds.

A liquidity stress test breach at either CCP could, depending on the number and magnitude of the breaches, result in an increase to the CCPs' prefunded resources, or the establishment or increase in the size of committed liquidity facilities.

Both ASX Clear and ASX Clear (Futures) also face liquidity risk from the reinvestment of pooled prefunded resources and the portion of margin posted by participants in the form of cash. These assets are reinvested and held by ASXCC, the holding company for the two CCPs, according to a defined investment policy and investment mandate. Liquidity risk arises since ASXCC would have to convert its assets into cash to meet any obligations arising from a participant default or for day-to-day liquidity requirements, such as the return of cash margin to participants. To mitigate investment liquidity risk, ASXCC's investment policy requires that a minimum portion of ASXCC's investments must be in liquid assets to meet its minimum liquidity requirements.

Recovery tools

In a highly unlikely scenario that involves more than two large participant defaults or market conditions that are beyond ‘extreme but plausible’, it is possible that prefunded or other liquid financial resources could be insufficient to fully absorb default-related losses or meet payment obligations. In such circumstances, the CCP may be left with an uncovered credit loss or liquidity shortfall. Each CCP's approach for allocating an uncovered credit loss or liquidity shortfall following a participant default relies on a number of tools:

- Recovery Assessments. The power to call for additional cash contributions from participants to meet uncovered losses and fund payment obligations, in proportion to each participant's exposures at the CCP before the default. Recovery Assessments are capped at $300 million in ASX Clear and $600 million in ASX Clear (Futures) (or $200 million for a single default).

- Variation margin gains haircutting. A tool, available to ASX Clear (Futures) only, allowing the CCP to reduce (haircut) outgoing variation margin payments to participants in order to allocate losses or a liquidity shortfall arising from a defaulting participant's portfolio. There is no cap on the use of this tool.

- Settlement payment haircutting. A reserve power that could be used in the context of complete termination to allocate losses or a liquidity shortfall if the above tools were insufficient. Complete termination would involve tearing up all open contracts at the CCP and settling them at their current market value. Any residual losses or liquidity obligations of the CCP could be allocated by haircutting settlement payments to participants. Use of this tool would have a highly disruptive effect on the markets served by the CCP, so would be considered only as a last resort.

In addition, ASX Clear can address a liquidity shortfall relating to the settlement of securities transactions via the use of OTAs with participants due to receive funds in the settlement batch. Both CCPs also have the power to restore a matched book (i.e. no market risk on its net positions) via partial or complete termination of contracts at their current market value if normal close-out processes cannot be carried out.

ASX has established a staged process for replenishment of the CCPs' default funds in the event that these were exhausted or partially drawn down following a participant default. At the end of a 22 business-day ‘cooling-off period’ following the management of a default, ASX Clear's and ASX Clear (Futures)' default funds would be replenished up to $150 million and $400 million, respectively.

Footnotes

Equity index futures and options on these futures are cleared through ASX Clear (Futures), while options over equity securities or indexes are cleared through ASX Clear. [44]

See ASX Constitution and ASX Board Charters. Available at <https://www2.asx.com.au/about/corporate-governance>. [45]

See CS Board Charters. Available at <https://www2.asx.com.au/about/corporate-governance>. [46]

See ASX Board Committee Charters. Available at <https://www2.asx.com.au/about/corporate-governance>. [47]

See ASX Executive Team. Available at <https://www2.asx.com.au/about/our-board-and-management/our-executive-team>. [48]

See ASX Internal Audit Charter. Available at <https://www2.asx.com.au/about/corporate-governance>. [49]

See ASX Business Committee Charter. Available at <https://www.asx.com.au/cs/documents/charter-of-the-business-committee.pdf>. [50]

For more information, see RBA (2021), ‘The Reserve Bank's Approach to Supervising and Assessing Clearing and Settlement Facility Licensees’, 25 February. [51]

For ASX Clear (Futures) the other collateral would include the defaulted participant's contributions to the CCP's prefunded pooled financial resources. [52]