Executive Accountability Framework October 2024

- Download the Executive Accountability Framework 325KB

Overview

Executives at the Reserve Bank of Australia (the Bank) are held to high standards of accountability. Clear accountability is the foundation for the Bank to promote good governance and a strong culture

in pursuit of its objectives. In support of this, the Executive Accountability Framework (EAF) outlines where accountability lies within the executive team for the Bank’s functions and operations. These Executives are accountable for the decisions, actions and outcomes in these areas. The Bank’s Executive Structure is outlined on the Bank’s website, and the accountabilities of Executives are summarised in Table 1.

The accountabilities are set out in more detail in the Bank’s broader governance framework, including the following legislation and documents:

- the Reserve Bank Act 1959 (Reserve Bank Act), the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and other relevant legislation

- the key Bank policies that set the framework for decision-making across the areas of governance, risk, work safety, staff conduct and the use of Bank resources

- the charters of the Bank’s boards and committees that are responsible for strategy, management and compliance.

The EAF is part of the Bank’s wider framework for governance and transparency. This includes the publication of statements following meetings of the Reserve Bank Board (Board) and the Payments

System Board (PSB), appearances before Parliamentary committees, the publication of the annual report and corporate plan, and the Bank’s regular communication and community engagement.

The key elements of the Bank’s EAF are:

- the Bank-wide accountabilities of Executives and

- the accountabilities of Executives within their functional area.

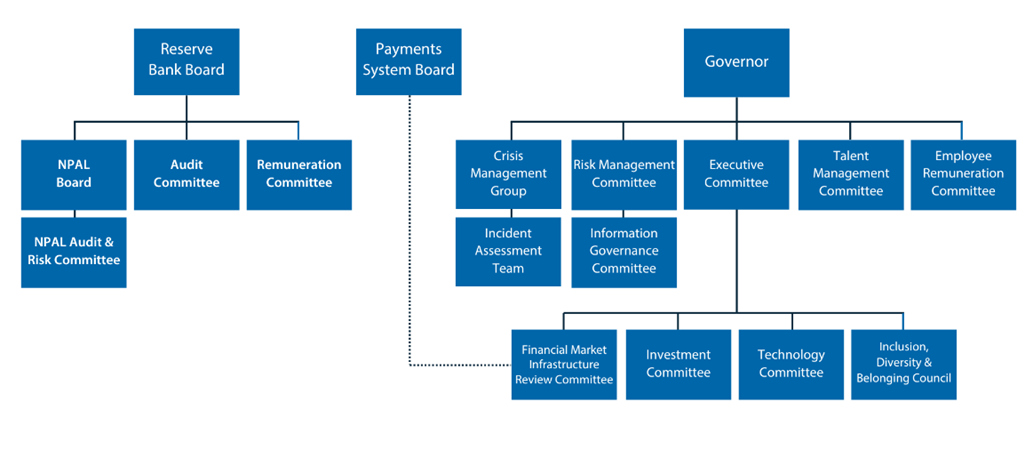

The responsibilities of the Bank’s boards and committees are also set out in this document. The governance structure of these boards and committees is presented in Figure 1.

Bank-wide accountabilities of Executives

Governor

The Governor is appointed by the Treasurer and leads the Bank in pursuing its mission to promote the economic prosperity and welfare of the people of Australia. As Chair of the Board and the PSB, the Governor has the centralrole in coordinating and setting the Bank’s monetary and financial policies. The Governor is also the Bank’s principal spokesperson and ensures the Bank’s policies are well understood both externally and within the Bank.

Management of the Bank: The Governor manages the Bank under the Reserve Bank Act and is the Chair of the Bank’s Executive Committee (Exco).

Governance and reporting: The Governor is the ‘Accountable Authority’ of the Bank under the PGPA Act. The Governor is accountable for fulfilling the Bank’s governance and reporting obligations, including through the publication of the annual report and corporate plan and ensuring arrangements are in place for the disclosure of material personal interests. The Governor is accountable to the Australian Parliament, including through regular appearances before Parliamentary committees.

Strategy: The Governor, together with the Deputy Governor and Chief Operating Officer, is accountable for setting the Bank’s strategic direction. The Governor approves the Bank’s Corporate Plan.

Communications: The Governor is the Bank’s chief spokesperson. The Reserve Bank Board and Payments System Board have agreed that the Governor (and where appropriate the Deputy Governor) is the spokesperson for the Board on monetary, financial system stability and payments policy matters respectively. Arrangements for media engagement by Bank staff more broadly are set out in the Media and Social Media Policy.

Fraud and Corruption control: The Governor is accountable for taking all reasonable measures to prevent, detect and deal with fraud and corruption, in accordance with the PGPA Act.

The Bank’s culture: The Governor, together with the Deputy Governor and Chief Operating Officer, is accountable for setting a clear ‘tone from the top’ as a strong foundation for the Bank’s culture.

Monetary and financial policies: The Governor is accountable for implementing the governance and monetary policy framework set out in the Statement on the Conduct of Monetary Policy. The Governor is accountable for discharging the obligation of the Board to inform the Government of its monetary policy from time to time, including through regular discussions with the Treasurer.

Investigate reports of wrongdoing: The Governor is accountable for ensuring the integrity, independence and effectiveness of the Bank’s policies and procedures on whistleblowing and that staff who raise concerns are protected from detrimental treatment as set out in the Reporting Wrongdoing Policy. The Governor is the ‘Principal Officer’ and an ‘Authorised Officer’ for the purposes of the Public Interest Disclosure Act 2013.

Freedom of Information: The Governor is accountable for fulfilling the Bank’s obligations under the Freedom of Information Act 1982 as the ‘Principal Officer’ of the Bank.

Regulatory cooperation: As Chair of the Council of Financial Regulators (CFR), the Governor is accountable for the Bank cooperating with APRA, ASIC and the Australian Treasury, as set out in the CFR’s Charter.

Crisis management: The Governor is accountable for crisis management at the Bank as Chair of the Crisis Management Group under the Incident Management Framework.

Inclusion, diversity and belonging: The Governor, together with the Deputy Governor and COO, is accountable for creating a workplace which enables inclusion, diversity and belonging, consistent with the Inclusion, Diversity and Belonging Statement of Commitment.

Deputy Governor

The Deputy Governor (DG) is appointed by the Treasurer and is the Deputy Chair of the Board. The DG assists the Governor in the day-to-day management of the Bank and works with the Chief Operating Officer to ensure coordination between policy, operations and organisational decision-making. The DG provides strategic leadership of the Bank’s policy functions, including assisting the Governor to oversee the Economic Group, Financial Markets Group, Financial Systems Group and Business Services Group. The DG also oversees the integrity and independence of the Bank’s internal legal, audit, and risk and compliance functions.

Management of the Bank: The DG shall perform such duties (including those mentioned below) as are directed or delegated by the Governor and would, in the event of a vacancy in the office of Governor, perform the duties of Governor.

The Bank’s culture: The DG, together with the Governor and Chief Operating Officer, is accountable for setting a clear ‘tone from the top’ as a strong foundation for the Bank’s culture.

Monetary and financial policies: The DG assists the Governor to implement the governance and monetary policy framework set out in the Statement on the Conduct of Monetary Policy.

Risk management: The DG is accountable for risk management at the Bank as Chair of the Risk Management Committee (RMC), including oversight of the Bank’s three lines of accountability model, consistent with the Risk Management Policy and the Risk Appetite Statement.

Investigate reports of wrongdoing: The DG is accountable for ensuring the integrity, independence and effectiveness of the Bank’s policies and procedures on whistleblowing and that staff that raise concerns are protected from detrimental treatment as set out in the Reporting Wrongdoing Policy. Each of the Governor, DG and Chief Risk Officer is an ‘Authorised Officer’ for the purposes of the Public Interest Disclosure Act.

Strategy: The DG shares accountability for setting the Bank’s strategic direction with the Governor and Chief Operating Officer.

Inclusion, diversity and belonging: The DG, together with the Governor and Chief Operating Officer, is accountable for creating a workplace which enables inclusion, diversity and belonging, consistent with the Inclusion, Diversity and Belonging Statement of Commitment.

Chief Operating Officer

The Chief Operating Officer (COO) reports to the Governor. The COO assists the Governor in the day-to-day management of the Bank and works with the DG to ensure co-ordination between policy, operations and organisational decision-making. The COO is responsible for the Enterprise Services & Strategy Group (ESSG), comprised of the Bank’s Finance, People, Knowledge Management, Workplace, Information Technology, Enterprise Strategy & Change and CoreMod Program Departments.

Management of the Bank: The COO shall perform such duties (including those mentioned below) as are directed or delegated by the Governor.

The Bank’s culture: The COO, together with the Governor and DG, is accountable for setting a clear ‘tone from the top’ as a strong foundation for the Bank’s culture.

Investment expenditure: The COO is accountable for the Bank’s investment expenditure decisions as Chair of the Investment Committee, by ensuring that investments are aligned to the Bank’s strategic plan, deliver value for money and that the associated benefits are realised, including by holding project steering committees accountable for delivery.

Technology services: The COO is accountable for ensuring the Bank’s technology services meet the needs of the Bank, including as Chair of the Technology Committee.

Crisis management: The COO is accountable for incident response and recovery at the Bank as Chair of the Incident Assessment Team and Facilitator of the Crisis Management Group under the Incident Management Framework.

Business continuity: The COO is accountable for executive oversight of the effective and consistent adherence to the Incident Management Framework and coordination of Bank-wide operational resilience testing, in line with Risk Appetite.

Strategy: The COO shares accountability for setting the Bank’s strategic direction with the Governor and Deputy Governor. In addition, the COO is accountable for coordinating the activities that support the formulation of those strategic priorities and reporting progress against them; and for overseeing the Bank’s Enterprise Strategy & Change Department.

Inclusion, diversity and belonging: The COO, together with the Governor and DG, is accountable for creating a workplace which enables inclusion, diversity and belonging, consistent with the Inclusion, Diversity and Belonging Statement of Commitment.

Assistant Governor (Business Services)

The Assistant Governor (Business Services) (AG(BS)) reports to the Governor and manages Business Services Group (BSG).BSG provides transactions-based services to the Bank’s customers, including the Australian Government, distributes Australia’s banknotes, and provides payments settlement services to financial institutions.

Banking services: The AG(BS) is accountable for providing banking services to Australian Government departments and agencies, including the management of the Government’s core accounts and transactional banking.

Australian banknotes: The AG(BS) is accountable for the design, issue, reissue and cancellation of Australian banknotes to maintain the capacity of Australian banknotes to provide a safe, secure and reliable means of payment and store of value.

Payments settlements: The AG(BS) is accountable for the operation of the Reserve Bank Information and Transfer System, to support the settlement of payments and interbank obligations arising from the conduct of Exchange Settlement Accounts and the Bank’s own trading activities.

Anti-money laundering/counter-terrorism financing (AML/CTF): The AG(BS) is accountable for the Bank’s compliance with its AML/CTF obligations, consistent with the AML/CTF Policy.

Assistant Governor (Economic)

The Assistant Governor (Economic) (AG(EC)) reports to the Governor and manages Economic Group (EC). EC analyses economic trends, both domestic and overseas, produces forecasts and undertakes research relevant to the framing of policy in a number of areas of the Bank’s responsibility.

Advice on the economy and monetary policies: The AG(EC) is accountable as principal adviser to the Governor, Deputy Governor and the Board on monetary policies and the working of the Australian macro-economy.

Assistant Governor (Financial Markets)

The Assistant Governor (Financial Markets) (AG(FM)) reports to the Governor and manages Financial Markets Group (FMG), which implements the Bank’s operations in domestic and foreign exchange markets, monitors developments in financial markets and coordinates the Bank’s relationships with international institutions.

Advice on financial markets: The AG(FM) is accountable as a principal adviser to the Governor, Deputy Governor and the Board on monetary policies and on financial market developments and markets-related policy.

Management of the financial portfolios: The AG(FM) is accountable for the management of the Bank’s financial portfolios, including foreign currency and gold reserves, central bank foreign exchange swaps, domestic market operations, and the Bank’s domestic portfolio, under a delegation from the Governor in the Financial Risk Management Governance Policy.

Financial risk management: The AG(FM) is accountable for the effective application of the Bank’s financial risk management, consistent with the Financial Risk Management Governance Policy. The AG(FM) is to ensure that the Bank’s financial risk exposure guidelines remain appropriate, and to monitor compliance with those guidelines.

Assistant Governor (Financial System)

The Assistant Governor (Financial System) (AG(FI)) reports to the Governor and manages Financial System Group (FSG), which supports the Bank’s responsibilities for financial system stability and its role in payments system oversight and regulation.

Advice on financial stability: The AG(FI) is accountable for advising the Governor, Deputy Governor and the Board on financial stability.

Regulatory cooperation: The AG(FI) is accountable for the Bank cooperating with APRA, ASIC and the Australian Treasury, as a Bank representative on the CFR, as set out in the CFR’s Charter.

Chief Risk Officer

The Chief Risk Officer (CRO) reports to the Deputy Governor and the Board Audit Committee, and manages Risk Management Department (RM). RM supports a consistent and effective framework for managing risk, both at the enterprise level and for individual business units and co-ordinates second-line activities across the Bank. RM also assists departments to identify, understand and manage their compliance obligations. RM monitors and reports on financial portfolio risks and compliance and provides second-line assurance and challenge with respect to the Bank’s operations in financial markets.

Risk Management Strategy: The CRO is accountable for the design and successful execution of the Bank’s risk and compliance management strategy, ensuring effective oversight and challenge. The CRO ensures that risk tolerances and metrics are set and monitored to evaluate risk relative to the risk appetite.

Risk Management Frameworks and Policies: The CRO is accountable for the development, oversight and compliance monitoring of all risk and compliance management frameworks in respect of financial and non-financial risk, including in relation to operational risk, business continuity and third party risk, cyber risk, fraud and corruption control, AML/CTF, sanctions and privacy risk. In relation to financial risk management, the CRO ensures that the Bank’s financial risk exposure guidelines remain appropriate and independently monitors compliance with those guidelines. The CRO also reviews and challenges the risk management capability and capacity of the Bank’s staff.

Risk Appetite Statement: The CRO is accountable for the development of the Risk Appetite Statement and supporting tolerances, for implementing effective frameworks and processes to evaluate risk in the Bank relative to the Risk Appetite Statement and for supporting the Bank in developing appropriate risk mitigations.

Risk culture: The CRO is accountable for defining, embedding and measuring the Bank’s risk culture, including how staff identify, understand, discuss and act on risks (jointly with the Chief People Officer).

Conflicts of interest: The CRO is accountable for maintaining, on behalf of the Governor, instructions to staff for the disclosure of material personal interests, consistent with the Code of Conduct for Reserve Bank Staff and PGPA Act and as set out in the Disclosure of Material Personal Interests Instructions.

Investigate reports of wrongdoing: The CRO is accountable for the proper handling of disclosures as an ‘Authorised Officer’ for the purposes of the Public Interest Disclosure Act for the Reporting Wrongdoing Policy.

Business continuity: The CRO is accountable for providing oversight of the Bank’s arrangements for business continuity management and business resilience, consistent with the Risk Appetite Statement, the Incident Management Framework and Operational Resilience Guideline.

Head of Audit Department

The Head of Audit Department (AD) reports to the Deputy Governor and the Board Audit Committee and manages AD. AD conducts risk-based and objective assurance and advisory services to the Bank to ensure that the system of risk management and internal control has been established and is operating effectively. AD also reviews the efficiency, effectiveness and economy of the Bank’s operations and identifies opportunities to improve performance.

Internal audit and reporting: The Head of AD is accountable for undertaking a risk-based audit program and implementing the Audit Department Charter. The Head of AD is accountable for providing independent and objective assurance to the Board Audit Committee and senior management on the Bank’s activities.

Chief Financial Officer

The Chief Financial Officer (CFO) reports to the COO and manages Finance Department (FA). FA is responsible for the Bank’s financial statements and taxation reporting obligations, preparing the Bank’s budget and related reporting, overseeing the Bank’s procurement activities and providing a range of support services, including corporate payments, payroll and travel.

Financial reporting: The CFO is accountable for the production and integrity of the Bank’s financial information and its regulatory reporting, including in support of the Bank’s Corporate Plan.

Expenditure and payment approval: The CFO is accountable for expenditure and payment approval at the Bank, consistent with the Expenditure and Payment Approval Policy.

Procurement: The CFO is accountable for the framework supporting procurement and disposal of tangible assets, consistent with the Procurement and Disposal Policy.

Third party risk: The CFO is accountable for the framework supporting effective contract and performance management of external suppliers, in line with the Procurement and Disposal Policy.

Chief Communications Officer

The Chief Communications Officer (CCO) reports to the Governor and manages Communications Department (CD). CD is responsible for communicating the Bank’s decisions and activities to the Australian community and for keeping staff informed of relevant developments across the Bank.

Communications: The CCO is accountable for providing strategic advice to the Governor and the Bank on external and internal Bank-wide communications programs and executing on those programs, in order to build and maintain public trust in the Bank. The CCO is also accountable for directing the Bank’s efforts to promote economics education in Australia.

Chief People Officer

The Chief People Officer (CPO) reports to the COO and manages the provision of people-related services to support the Bank in maintaining a productive and engaged workforce. This includes recruiting high-quality employees as well as implementing policies and programs that cover employment conditions, performance, reward, development, diversity and workplace health and safety.

People management: The CPO is accountable for talent acquisition, remuneration, and employment terms and conditions, consistent with the Position Management Policy, the Leave Management Policy and the RBA Enterprise Agreement 2023.

The Bank’s culture: The CPO is accountable for frameworks to define, measure and embed a culture in line with the Bank’s values, as set out in the Code of Conduct (and shared with CRO in relation to risk culture).

Work health and safety: The CPO is accountable for managing work health and safety at the Bank, consistent with the Work Health and Safety Policy.

Protective security of people: The CPO is accountable for personnel security, including employee screening and conduct, consistent with the Protective Security Framework.

Workplace behaviour: The CPO is accountable for managing workplace behaviour at the Bank, consistent with the Code of Conduct for Reserve Bank Staff and the Workplace Behaviour Policy.

Head of Knowledge Management Department

The Head of Knowledge Management Department (KM) reports to the COO and manages KM. KM is responsible for the Bank’s knowledge, information and data management frameworks, governance and systems. The KM Department is also responsible for the Bank’s archives and public access to information that is required to be in the public domain.

Information management: The Head of KM is accountable for information management at the Bank, the Information Management Policy, Information Classification Policy and associated Information Governance Framework.

Data management: The Head of KM is accountable for data management at the Bank, the associated Data Management Policy and associated Data Management Framework.

Protective security of information assets: The Head of KM is accountable for the framework in support of the protective security of information assets stored in the Bank’s knowledge, information and data management systems, and selected shared output from business systems, consistent with the Protective Security Framework.

Head of Workplace Department

The Head of Workplace Department (WP) reports to the COO and is responsible for the management of the Bank’s physical assets, the maintenance of its properties and building infrastructure, and the delivery of workplace services.

Maintaining Bank facilities: The Head of WP is accountable for property management, building works, infrastructure maintenance and repairs, fire and emergency control, and various facility services, consistent with the Work Health and Safety Policy.

Crisis management testing and emergency control: The Head of WP is accountable for crisis preparations, testing and emergency control at the Bank, and ensuring that the Bank’s physical assets are secure and resilient, and appropriately maintained consistent with the Incident Management Framework and the Operational Resilience Guideline.

Protective security of physical premises: The Head of WP is accountable for the security of the Bank’s physical premises, consistent with the Protective Security Framework and the Physical Security Policy for RBA Premises.

Chief Information Officer

The Chief Information Officer (CIO) reports to the COO and manages Information Technology Department (IT). IT is responsible for the efficient, effective, compliant and secure use of information technology to support the Bank’s policy, operational and corporate functions.

Technology services: The CIO is accountable for providing technology services to support the Bank’s current policy, operations and corporate functions and its future strategic direction and ensuring that the Bank’s technology assets are secure and resilient, and appropriately maintained consistent with the Bank’s Incident Management Framework and the Operational Resilience Guideline.

Protective security of technology assets: The CIO is accountable for the security of information stored in the Bank’s technology systems, including risks arising from cyber-threats, consistent with the Protective Security Framework and the Information Systems Security and Acceptable Use Policy.

Accountabilities of Executives within their functional area

Strategy: All executives are accountable for supporting implementation of the Bank’s strategic priorities within their functional areas.

Investment expenditure: All Executives are accountable the delivery of material projects, including that benefits are realised and costs are managed, including through their role as business sponsors and members of relevant Steering Committees under the oversight of the Investment Committee.

Expenditure and payment approval: All Executives are accountable for expenditure and payment approval in their functional area, consistent with the Expenditure and Payment Approval Policy.

People management: All Executives are accountable for overseeing the selection, appointment and performance management of staff within their functional area, and for engaging in succession planning for critical roles at the Bank.

The Bank’s culture: All Executives are accountable for creating a culture in their functional area aligned with the Bank’s values and consistent with the Code of Conduct for Reserve Bank Staff, including a culture around risk-taking aligned with the Bank’s Risk Appetite Statement. Executives are to ensure that staffing, training and morale are maintained at a level that allows their functional area to efficiently achieve its objectives.

Work health and safety: All Executives must exhibit safety leadership and demonstrate a commitment to health and safety matters at the Bank, and apply the Bank’s work health and safety procedures effectively in their functional area, consistent with the Work Health and Safety Policy.

Workplace behaviour: All Executives are accountable for managing workplace behaviour in their functional area, consistent with the Code of Conduct for Reserve Bank Staff and the Workplace Behaviour Policy.

Conflicts of interest: All Department Heads are accountable for supporting compliance with the Bank’s instructions for the disclosure of material personal interests in their functional area, consistent with the Code of Conduct for Reserve Bank Staff and the Disclosure of Material Personal Interests Instructions.

Inclusion, diversity and belonging: All Executives are accountable for ensuring that equity, diversity and inclusion principals are adhered to in their functional area, consistent with the Inclusion, Diversity and Belonging Statement of Commitment.

Risk management and compliance: All executives are accountable for managing risks in their functional area, consistent with the Risk Management Policy and the Risk Appetite Statement. All executives are accountable for ensuring they identify, monitor and operate in accordance with legal obligations relevant to their functional area, including seeking advice as necessary.

Operational resilience: All Executives are accountable for managing business continuity and the operational resilience of their functional area, in collaboration with key support departments, consistent with the Risk Appetite Statement, the Incident Management Framework and Operational Resilience Guideline.

Third party risk and procurement: All Executives are accountable for ensuring that their functional area complies with the Bank’s procurement processes and for entering into contracts that adequately protect the interests of the Bank and contain appropriate risk allocation. Executives are accountable for the effective management of those contracts, including procurement contracts, in accordance with Bank policies and guidelines and managing the performance of external suppliers, consistent with the Procurement and Disposal Policy, in their functional area.

Fraud and corruption control: All Executives are accountable for fraud and corruption control in their functional area, consistent with the Fraud and Corruption Control Policy.

Anti-money laundering/counter-terrorism financing (AML/CTF): All Executives are accountable for the implementation of the Bank’s AML/CTF Policy in their functional area. This applies in particular for departments that provide ‘designated services’, which include Banking Department, Payments Settlements Department and International Department.

Sanctions: All Executives are accountable for the implementation of the Bank’s Sanctions Policy in their functional area. This applies in particular for departments involved in supplier screening, payments and other transactions, which include Banking Department, Payments Settlements Department and Finance Department.

Privacy: All Executives are accountable for compliance with the Bank’s privacy obligations in their functional area, consistent with the Privacy Guidelines.

Data governance: All Executives must ensure that they and their functional areas support data management best practices in accordance with the Data Management Framework.

The Bank’s Boards and Committees

Reserve Bank Board

| Status | The Board is established under the Reserve Bank Act. The Governor and the members of the Board are appointed by the Treasurer. |

|---|---|

| Membership | Governor (Chair); DG (Deputy Chair); Secretary to the Australian Treasury; six non-executive members. |

| Responsibilities | Under the Reserve Bank Act, the Board is responsible for ‘monetary and banking’ policy. The Board is also responsible for the Bank’s policies on all matters other than monetary and banking policy, except for its payments system policy. |

| Duties of Board members | The obligations of members of the Board under the Reserve Bank Act and the PGPA Act include exercising their powers and discharging their duties with care and diligence, honestly, in good faith and for a proper purpose. Members must not use their position, or any information obtained by virtue of their position, to benefit themselves or any other person, or to cause detriment to the Bank or any other person. |

| Code of conduct | The Code of Conduct for Board Members imposes obligations on members that are designed to ensure that members observe the highest possible standards of ethical conduct. |

Payments System Board

| Status | The PSB is established under the Reserve Bank Act. |

|---|---|

| Membership | Governor (Chair); a representative of the Bank appointed by the Governor (Deputy Chair); APRA Chair; up to five other non-executive members. Apart from the members appointed by the Governor and APRA, the Governor and other members of the PSB are appointed by the Treasurer. |

| Responsibilities | Under the Reserve Bank Act, the PSB has a duty to ensure, within the limits of its powers, that the Bank’s powers are exercised in such a way that, in the PSB’s opinion, will best contribute to: controlling risk in the financial system; promoting the efficiency of the payments system; and promoting competition in the market for payment services, consistent with the overall stability of the financial system. Additionally, the Reserve Bank Act states that the PSB has a duty to ensure, within the limits of its powers, that the powers and functions of the Bank under the Corporations Act 2001 are exercised in a way that, in the PSB’s opinion, will best contribute to the overall stability of the financial system. The PSB is required to adhere to the Government’s expectations for regulator performance and reporting. |

| Duties of Board members | PSB members also have obligations to exercise their powers and discharge their duties with care and diligence, honestly, in good faith and for a proper purpose. Members must not use their position, or any information obtained by virtue of their position, to benefit themselves or any other person, or to cause detriment to the Bank or any other person. |

| Code of Conduct | The Code of Conduct for PSB Members imposes obligations on members that are designed to ensure that members observe the highest possible standards of ethical conduct. |

Reserve Bank Board Audit Committee

| Status | The Audit Committee is established in accordance with the PGPA Act. |

|---|---|

| Membership | Three or more members, who are either non-executive members of the Board or external appointments; the Chair is a non-executive member of the Board. The DG represents the Bank’s management at meetings, but is not a member of the Committee. |

| Charter | The Reserve Bank Board Audit Committee Charter is determined by the Governor and approved by the Board. |

| Responsibilities | The Audit Committee is to review the appropriateness of the Bank’s financial and performance reporting, system of risk oversight and management and system of internal control and assist the Board in relation to its responsibility to approve the Bank’s financial statements. |

Reserve Bank Board Remuneration Committee

| Status | The Remuneration Committee is a subcommittee of the Board. |

|---|---|

| Membership | Three non-executive members of the Board, including the Chair. |

| Charter | The Reserve Bank Board Remuneration Committee Charter is approved by the Board. |

| Responsibilities | The Remuneration Committee is responsible for assisting the Board to discharge its statutory responsibilities to review the remuneration of the Governor and Deputy Governor annually and, within the discretion allowed under the Principal Executive Office framework of the Remuneration Tribunal, determine adjustments for recommendation to the Board for approval. |

Note Printing Australia Limited Board

| Status | The Note Printing Australia Limited (NPAL) Board is a corporate board reporting to the Reserve Bank Board. |

|---|---|

| Membership | Between three and ten directors appointed by the Bank, including a minimum of three Bank executives (one as Chair). |

| Charter | The Note Printing Australia Limited Charter is approved by the Reserve Bank Board. |

| Responsibilities | The NPAL Board is responsible for the strategy and operations of Note Printing Australia (NPA), including in relation to risk management and NPA’s security and control environment, and for the overall conduct of NPA on a sound commercial basis. |

NPAL Board Audit and Risk Committee

| Status | The Audit and Risk Committee is established by the NPAL Board. |

|---|---|

| Membership | Three or more members, who are either members of the NPAL Board or external appointments. |

| Responsibilities | The role of the Audit and Risk Committee is to assist the NPA Board in fulfilling its oversight obligations by providing assurance and advice on: NPAL’s financial statements and the adequacy of the internal control and risk management environment; the effectiveness and independence of internal and external audit; and NPAL’s processes for monitoring compliance with relevant laws and regulations. |

Executive Committee

| Status | The Executive Committee (Exco) assists and supports the Governor in fulfilling their responsibility to manage the Bank. Exco is the key management committee of the Bank for matters of strategic or Bank-wide significance. |

|---|---|

| Membership | Governor (Chair); DG; COO; all Assistant Governors. The Secretary attends all meetings. |

| Charter | The Reserve Bank of Australia Executive Committee Charter is approved by the Governor. |

| Responsibilities |

Exco’s agenda includes:

Members are expected to bring to Exco for discussion important issues affecting their area or the Bank as a whole. Members are also expected to bring proposals for significant changes to their operations to Exco. |

Investment Committee

| Status | The Investment Committee reports to Exco. |

|---|---|

| Membership | COO (Chair); AG(BS); AG(FM). |

| Advisors | The CFO, CPO, CIO and CRO. |

| Charter | The Investment Committee Terms of Reference are approved by Exco. |

| Responsibilities | The Investment Committee is responsible for monitoring and making recommendations to Exco on the Bank’s Project Portfolio. The Investment Committee evaluates and prioritises the Bank’s spending on projects to maximise the benefits, and optimise the use of financial and non-financial resources. |

Technology Committee

| Status | The Technology Committee (TC) reports to Exco. |

|---|---|

| Membership | COO (Chair); CIO; Head of Banking Department; Head of Domestic Markets Department; CPO; Head of Payments Settlements Department, and one other Head of Department selected by the Chair. |

| Charter | The Technology Committee Charter is approved by Exco. |

| Responsibilities |

The TC provides oversight and governance of the role of technology in executing the Bank’s strategy, on behalf of Exco including:

|

Inclusion, Diversity and Belonging Council

| Status | The Inclusion, Diversity and Belonging Council reports to Exco. |

|---|---|

| Membership | Governor (Chair); CPO; Executive Sponsors and Chairs of the Employee Resource Groups. |

| Responsibilities | The Inclusion, Diversity and Belonging Council assists the Bank to achieve its aims relating to diversity and inclusion in the workplace, as set out in the Inclusion, Diversity and Belonging Statement of Commitment. |

Financial Market Infrastructure Review Committee

| Status | The Financial Market Infrastructure (FMI) Review Committee supports the FMI oversight and supervision activities of the Bank’s Payments Policy Department. The committee ensures that these activities are carried out in a manner that is consistent with policies established by the PSB. |

|---|---|

| Membership | AG(FI) (Chair); Head of Payments Policy Department (Deputy Chair); Head of Payments Settlements Department; Head of Domestic Markets Department; at least 2 other members who are senior members of Bank staff with relevant experience, selected by the Chair. |

| Charter | The FMI Review Committee Charter is approved by Exco. |

| Responsibilities |

The responsibilities of the FMI Review Committee include:

|

Risk Management Committee (and Information Governance Committee)

| Status | The Risk Management Committee (RMC) assists and supports the Governor in fulfilling their responsibility to manage the Bank, including by having an appropriate system of risk oversight and management and an appropriate system of internal control. |

|---|---|

| Membership | DG (Chair); COO; AG(BS); AG(FM); CFO; CIO; Chief Risk Officer; Head of AD; CPO; Head of KM; General Counsel. |

| Charter | The Risk Management Committee Charter is approved by the Governor. |

| Responsibilities |

The RMC is responsible for overseeing:

|

Incident Assessment Team (IAT)

| Status | The IAT manages those incidents which have disrupted, or have the potential to disrupt, the Bank’s core activities, critical systems, or threatens its reputation and reports to the Governor either directly or through the Crisis Management Group where required. |

|---|---|

| Membership | COO (Chair); AG(BS) (alternate Chair) and AG(FMG) (alternate Chair); CRO; CIO; Head of WP; CPO; Senior Manager, Security and Risk, Workplace Department; other staff as needed. |

| Responsibilities | The IAT assesses the nature and potential impact of an incident (business continuity event, crisis or emergency) and determines whether it can be managed through business-as-usual processes and resources, or requires management by the IAT which includes taking decisions on priorities, actions and communications, and convening the Crisis Management Group when required, as set out in the Incident Management Framework. |

Crisis Management Group (CMG)

| Status | CMG assists the Governor in responding to incidents designated as an emergency or crisis that if left unmanaged could have a ‘major’ or ‘significant’ consequences for the Bank’s people, operations, assets or reputation. |

|---|---|

| Membership | Governor (Chair); Deputy Governor (alternate Chair); COO (alternate Chair and CMG Facilitator); other members of the Executive Committee; Chief Risk Officer; CIO; Head of WP; CPO; CCO. The Chair may determine the CMG will constitute a smaller group or include other members in response to a given crisis. |

| Responsibilities | The CMG takes decisions on priorities, actions and communications in response to an emergency or crisis, advises the Reserve Bank Board if necessary, and members coordinate and implement the Bank’s response for their respective areas of responsibility, as set out in the Incident Management Framework. |

Talent Management Committee (TMC)

| Status | The TMC reviews the leadership potential of senior staff across the Bank to manage succession planning and support the development of leaders, and reports to the Governor. |

|---|---|

| Membership | Deputy Governor (Chair), COO, Assistant Governors, CPO, and senior managers in Human Resources Department for Business Engagement and Leadership. |

| Responsibilities | The TMC oversees succession plans and the senior talent pool at the Bank by reviewing senior Bank employees’ skills, experience and capabilities and assessing their likelihood of progressing to more senior roles. |

Employee Remuneration Committee (REMCO)

| Status | The REMCO reviews and makes recommendation to the Governor in relation to the Bank’s remuneration and benefits policy, structure and practices, and the annual remuneration process for Bank employees. |

|---|---|

| Membership | COO (Chair), Deputy Governor, Assistant Governors and CPO. |

| Charter | The Employee Remuneration Committee Charter is approved by the Governor. |

| Responsibilities | The REMCO oversees, and considers changes to, the Bank’s remuneration and benefits policy, structure and practices, and monitors the annual remuneration process for Bank employees to ensure fair and consistent outcomes. The Committee makes recommendations to the Governor in relation to these matters. |

Accountabilities of Executives at the Bank

| Accountabilities | Executives with Bank-wide accountabilities | Executives accountable within their functional area | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gov | DG | COO | AG (BS) | AG (EC) | AG (FM) | AG (FS) | CRO | AD Head | CFO | CCO | CPO | KM Head | WP Head | CIO | ||

| Management of the Bank | ||||||||||||||||

| Governance and reporting | ||||||||||||||||

| Leadership of the Bank’s policy functions and Business Services Group | ||||||||||||||||

| Oversee integrity and independence of the Audit, Legal, and Risk and Compliance functions | ||||||||||||||||

| Leadership of the Bank’s Enterprise Services and Strategy Group | ||||||||||||||||

| Strategy | ||||||||||||||||

| Management of the Bank’s financial portfolios | ||||||||||||||||

| Investment expenditure | ||||||||||||||||

| Financial reporting | ||||||||||||||||

| Expenditure & payment approval | ||||||||||||||||

| Communications | ||||||||||||||||

| Knowledge management | ||||||||||||||||

| Freedom of information | ||||||||||||||||

| Monetary and financial policies | ||||||||||||||||

| Advice on the economy | ||||||||||||||||

| Advice on financial markets | ||||||||||||||||

| Advice on financial stability | ||||||||||||||||

| Regulatory cooperation | ||||||||||||||||

| Internal audit and reporting | ||||||||||||||||

| People and culture | ||||||||||||||||

| People management | ||||||||||||||||

| The Bank’s culture | ||||||||||||||||

| Work health and safety | ||||||||||||||||

| Workplace behaviour | ||||||||||||||||

| Conflicts of Interest | ||||||||||||||||

| Inclusion, diversity and belonging | ||||||||||||||||

| Investigate reports of wrongdoing | ||||||||||||||||

| Risk management & compliance | ||||||||||||||||

| Risk Management Strategy | ||||||||||||||||

| Risk Appetite Statement | ||||||||||||||||

| Risk Management Frameworks & Policies | ||||||||||||||||

| Financial risk management | ||||||||||||||||

| Fraud and corruption Control | ||||||||||||||||

| AML/CTF | ||||||||||||||||

| Sanctions | ||||||||||||||||

| Privacy | ||||||||||||||||

| Operational resilience | ||||||||||||||||

| Business continuity | ||||||||||||||||

| Crisis management | ||||||||||||||||

| Incident response & recovery | ||||||||||||||||

| Third party risk | ||||||||||||||||

| Business services | ||||||||||||||||

| Banking services | ||||||||||||||||

| Australian banknotes | ||||||||||||||||

| Payments settlements | ||||||||||||||||

| Enabling services | ||||||||||||||||

| Technology services | ||||||||||||||||

| Knowledge Management | ||||||||||||||||

| Protective security | ||||||||||||||||

| of people | ||||||||||||||||

| of information assets | ||||||||||||||||

| of physical premises | ||||||||||||||||

| of technology assets | ||||||||||||||||

| Maintaining Bank facilities | ||||||||||||||||

| Procurement | ||||||||||||||||