Financial Stability Review – October 2020Box C:

The Use of Banks' Capital Buffers

In addition to their regulatory minimum capital requirements, banks hold regulatory and voluntary buffers that can absorb losses, enabling them to continue lending in times of stress. Over the past decade, these buffers have substantially increased for Australian banks and their global peers. These larger buffers will enable banks to absorb the credit losses expected as a result of the pandemic-induced economic contraction and the rise in the risk weights of banks' assets as credit quality deteriorates. With sufficiently large buffers, Australian and international banks can accommodate these reductions to capital and still continue lending. Bank regulators globally have emphasised that buffers are available to be used, and banks should continue to write new loans even while capital ratios fall into their buffers. If banks were to cease lending in an attempt to conserve their capital buffers, the reduction in credit availability would have a significant contractionary impact on the economy. By amplifying the downturn, this contraction in credit supply would ultimately be detrimental to the banking system.

Capital buffers exist for stressed situations such as the COVID-19 shock

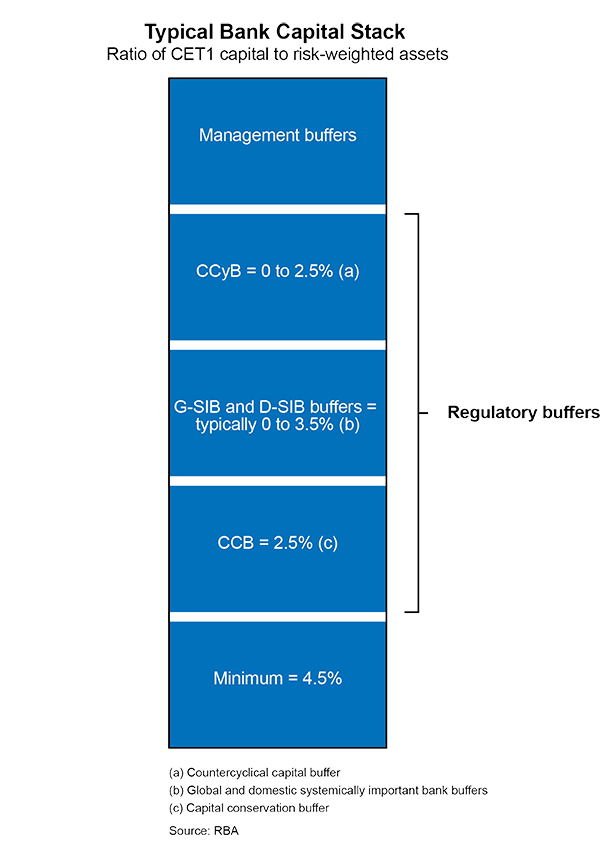

Two regulatory capital buffers are designed specifically to support lending in bad times: the capital conservation buffer (CCB) and the countercyclical capital buffer (CCyB). These regulatory buffers were introduced as part of the Basel III reforms of bank regulation that followed the global financial crisis (GFC). They were designed to ensure that banks have additional layers of capital which can be drawn down when losses occur, enabling them to continue lending and so supporting the economy. Banks are subject to restrictions on earnings distribution if they fall into their regulatory buffers. Banks typically also choose to hold voluntary or ‘management’ buffers, which are discretionary buffers held on top of the CCB and CCyB. Banks hold voluntary buffers to reduce the chance that they fall into their regulatory buffers, and this provides banks with greater capacity to absorb losses during a downturn (Figure C.1).

However, for a number of reasons some banks may be unwilling to draw down their buffers, especially in the current environment.[1] First, banks may want to maintain capital buffers so that they are not constrained in making payments to investors in their Additional Tier 1 capital instruments or distributing profits to shareholders through dividends or buying back shares. Once regulatory buffers are entered, banks face automatic restrictions on the share of earnings that can be distributed. Second, lower capital ratios may cause market participants to question the soundness of individual banks, which could increase their cost of, or limit access to, debt and equity funding. Third, in an uncertain environment such as the current COVID-19 shock, banks may take a conservative approach to capital management by protecting themselves against the risk that credit losses turn out to be larger than the amount they have provisioned. Finally, some banks internationally may be uncertain about, and want to avoid, other regulatory repercussions of accessing their capital buffers, such as heightened supervision. Banks may be concerned that regulators will require a quick restoration of capital buffers after the stress has passed.

Globally, regulators have taken a range of measures to encourage banks to use their capital buffers to continue lending. The Basel Committee on Banking Supervision, the global prudential standard setter for the banking system, has stated several times recently that buffers are there to be used, especially in the current episode. Similarly, prudential authorities in many jurisdictions have released guidance stating that banks are free to draw upon their buffers in the current environment, and that banks will only be required to rebuild these buffers gradually. Guidance has often also stated that buffer drawdowns should not fund discretionary distributions to shareholders (notably dividends), with several jurisdictions placing blanket restrictions on these distributions. As a result, funds which would have otherwise been paid to shareholders are now available to absorb both credit losses and increases in credit risk weights, as well as finance new lending.

Some regulators have been able to emphasise the usability of regulatory capital buffers by ‘releasing’ them. A number of jurisdictions with non-zero CCyBs have lowered them, while others have postponed or cancelled planned increases in their CCyB.[2] Some jurisdictions have also released other buffers such as requirements for domestic systemically important banks. However, many jurisdictions do not have readily adjustable buffers, or their default CCyB rate is set at zero.

The response by the Australian Prudential Regulation Authority (APRA) has been in line with that of its international counterparts. APRA has released guidance that the priority is for banks to maintain lending during the pandemic, and encouraged them to use capital buffers and any additional management buffers to support lending.[3] APRA has also provided firm guidance on distributions to shareholders, stating that it expects Australian banks to retain at least half of their earnings for the remainder of 2020, and actively use capital management initiatives to partially offset any distributions.[4] In addition, APRA informed banks that they will not be expected to meet the ‘unquestionably strong’ capital requirements until this can be achieved without constraining economic activity.[5]

Buffers will decline because of COVID-19 but remain large enough to support lending

Banks' buffers will decline due to expected losses on loans during the downturn, and an increase in risk weights applied to assets. Credit losses on loans to households and businesses are expected to rise, particularly once loan repayment deferrals end, though the extent of the increase is uncertain.

In Australia, the four major banks have raised provisions of around $7½ billion to cover expected losses since the start of the year. This takes their overall provision coverage to 0.8 per cent of gross loans and advances (GLA). Their financial disclosures suggest that provisions would increase to 1.2 per cent of GLA in their most severe (but plausible) scenarios of the current economic contraction. This equates to a further 40–70 basis points of Common Equity Tier 1 (CET1) capital ratios, relative to their current management buffers of 250–350 basis points.

Capital requirements will also rise because risk weights applied to their existing exposures will increase. For example, falls in the prices of property and other collateral, or downgrades of customers' credit rating, can increase the risk weights of mortgage and business lending. The major Australian banks have estimated that these types of increases in risk weights could subtract 70–180 basis points from CET1 capital ratios over the next two years, depending on the scenario used.

These two factors in combination could result in a 110–250 basis point decline in capital ratios over the next couple of years. However, even before taking into account banks' ability to generate new capital over this period, these estimates suggest that, even under the major banks' most severe scenarios, they will still have sufficient buffers available to support further lending.

There is significant uncertainty about the impact that the pandemic will have on banks' credit losses and risk weights, and whether it could affect banks' capital in other ways. Nevertheless, capital buffers at Australian banks should remain at a sufficiently high level to support continued lending. Analysis using the Reserve Bank's stress testing model, suggests that – assuming that banks maintain a moderate pace of lending growth – the combined impact of credit losses and higher risk weights would subtract around 2 percentage points from major and mid-sized banks' capital ratios under the downside scenario for the economy in the Bank's August 2020 Statement on Monetary Policy.[6] As discussed in ‘Chapter 3: The Australian Financial System’, more pronounced falls in GDP, employment or property prices could result in a materially larger fall in capital ratios. However, the economic downturn would need to be much more severe than is currently envisioned for banks' capital ratios to approach regulatory minima.

Internationally, stress tests by regulators indicate that banks in the major advanced economies have enough capital to absorb losses and continue lending. For example, stress tests by the European Central Bank (ECB) and the US Federal Reserve found that most banks have sufficient capital to withstand losses in downside COVID-19 scenarios, though several would experience substantial losses and could approach minimum capital requirements. Similarly, the Bank of England found that UK banks are resilient to a wide range of outcomes.

These conclusions are consistent with Reserve Bank calculations based on a simple stress test model for international banks. The model uses country-level data and draws on past banking crises to simulate the effect of the economic downturn on banks. The scenario presented here is intended to be realistic but more adverse than central projections: credit growth is maintained at its average rate for the past three years, credit loss rates rise by about 3 percentage points on average, risk weights increase by about 14 per cent and other income declines (but remains positive).[7]

Estimates from this model suggest that capital ratios could decline by an average of around 3.6 percentage points for advanced economy banks, after accounting for an average pace of loan growth (Graph C.1). However, outcomes vary considerably across countries depending particularly on GDP forecast revisions and initial loan loss rates. The analysis also suggests that emerging market economy (EME) banks could experience larger declines in capital ratios, of about 5.4 percentage points on average. If this were to occur, some EME banks may need to slow lending growth or raise capital to maintain capital ratios. According to the model, credit losses could be in the range of 1.5–4.25 per cent of loans for advanced economy banks (detracting 2.6 percentage points from capital) and 4–12 per cent for EME banks (detracting 5.3 percentage points). Rising risk weights are estimated to detract about 1.6 percentage points from capital ratios for both advanced economy and EME banks.

Stronger lending may not lower capital ratios if it supports the economy

If banks were to significantly curtail the supply of credit to preserve their capital, it would be likely to materially worsen economic conditions. Lower spending by households and businesses, and so incomes, would in turn lead to higher borrower defaults and larger losses for banks. The capital benefits of reducing lending, while seemingly apparent for an individual bank, are therefore likely to be low for the banking system as a whole if all banks simultaneously pull back on the supply of credit. Internal analysis finds that in a severe macroeconomic scenario, consistent with that discussed in ‘Chapter 3: The Australian Financial System’, moderately faster credit growth need not result in lower capital ratios. This is because faster credit growth results in improved macroeconomic outcomes that contribute to lower credit losses and a smaller increase in average risk weights. Based on the specific calibration, these effects fully offset the increase in risk-weighted assets from additional loans, leaving capital ratios broadly unchanged. This suggests that the long-term cost of using buffers is therefore likely to be small. The ECB found similar results for the euro area.[8]

The risk that negative investor perceptions of buffer use materially affects Australian banks is also low because of their reduced funding needs in the immediate future. Australian banks have strong funding positions following an increase in deposits and their use of the Bank's Term Funding Facility. They are therefore not expected to issue much wholesale debt over the next couple of years, reducing the impact that market perceptions could have on funding costs. APRA's decision to allow capital ratios to remain below the ‘unquestionably strong’ benchmarks until these ratios can be achieved without unnecessarily disrupting the economy gives banks time to rebuild capital buffers organically, which reduces the likelihood that they will need to issue equity at unfavourable pricing. It is therefore unlikely that there will be much of a short-term cost of using buffers, even if it causes capital ratios to be temporarily lower.

Endnotes

Financial Stability Board (2020), ‘COVID-19 Pandemic: Financial Stability Implications and Policy Measures Taken’, Report submitted to the G20 Finance Ministers and Governors, July. Available at <https://www.fsb.org/wp-content/uploads/P150720-2.pdf>. [1]

For more information, see Stojkov K (2020), ‘Different approaches to implementing a Countercyclical Capital Buffer’, RBA Bulletin, September. [2]

APRA (2020), ‘APRA adjusts bank capital expectations’, Media Release, 19 March. Available at <https://www.apra.gov.au/news-and-publications/apra-adjusts-bank-capital-expectations>. [3]

APRA (2020), ‘APRA updates guidance on capital management for banks and insurers’, Media Release, 29 July. Available at <https://www.apra.gov.au/news-and-publications/apra-updates-guidance-on-capital-management-for-banks-and-insurers>. [4]

The ‘unquestionably strong’ benchmarks comprised CET1 ratios of 10.5 per cent for the four major Australian banks; 9.5 per cent for other banks using the internal ratings-based approach for credit risk; and 8.5 per cent for other banks. [5]

While also assuming a 20 per cent fall in property prices. For details on the stress test model, see RBA (2017), ‘Box D: Stress Testing at the Reserve Bank’, Financial Stability Review, October. [6]

The simple stress test model uses data on almost 4,000 banks aggregated to the country level. The scenario covers a two-year period and the parameters vary for advanced and emerging market economies. The scenario draws on information on past banking crises summarised in Hardy DC and C Schmieder (2013), Rules of Thumb for Bank Solvency Stress Testing, International Monetary Fund (IMF) Working Paper No. 13/232, November. Credit loss rates for each country vary based on the size of Consensus GDP growth forecast revisions in 2020. While credit growth typically declines in economic downturns, it is held constant at the country level in the scenario to simulate a situation where banks make extraordinary efforts to continue lending. [7]

ECB (2020), ‘Buffer Use and Lending to the Real Economy’, July. Available at <https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm~de7bd6b109.buffer_use_and_lending_to_the_real_economy_annex2007.pdf>. [8]