Reserve Bank of Australia Annual Report – 2020 Communication and Community Engagement

The Reserve Bank is committed to its communication being open, transparent and accountable. The Bank's staff across Australia work to understand community priorities and concerns and, in turn, explain the Bank's policies and decisions. The Bank engages through a regional and industry liaison program, a public education program and consultations. The Bank communicates its policy decisions, and the context in which these are made, through speeches and publications. The Bank participates in parliamentary hearings and responds to public enquiries. It supports academic research, and operates a museum where visitors can discover the history of Australia's banknotes and economic development. The Bank also plays a modest philanthropic role in the community.

Publications and Speeches

The Reserve Bank's communication about its policy decisions, analysis and operations is primarily made through publications and speeches. Announcements about monetary policy decisions are made shortly after each Reserve Bank Board meeting and minutes are released two weeks later. A media release is published following each Payments System Board meeting, outlining issues discussed at the meeting and foreshadowing any forthcoming documents to be released by the Bank.

The Reserve Bank also explains its analysis through a number of regular publications:

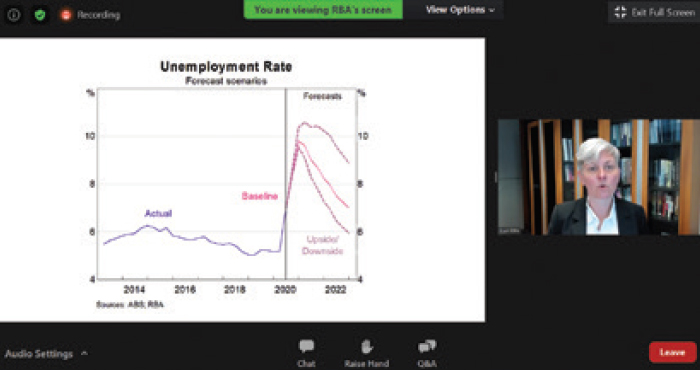

- The quarterly Statement on Monetary Policy provides information about the Reserve Bank's assessment of current economic and financial conditions, along with the outlook for economic activity and inflation in Australia. To aid a broader understanding of the forces shaping the economic outlook and in light of the extreme uncertainty posed by the outbreak of COVID-19, in May 2020 the Bank presented three possible scenarios, instead of a single central profile. These scenarios differed both in terms of the assumed timing of the easing of restrictions imposed to control the virus and the resilience of demand as these restrictions are lifted.

- The Financial Stability Review, published semi-annually, provides a detailed assessment of the condition of Australia's financial system and potential risks to financial stability. In light of the COVID-19 pandemic, in April 2020 the Review assessed the evolution of these risks for the financial system. It noted that, while the pandemic had caused significant strains in the global financial system, the Australian financial system was well placed to manage these strains. It also highlighted that regulatory authorities were working closely to minimise the economic harm caused by the pandemic and that, along with the strong starting position of Australia's banking system, the nation's financial system has the ability to absorb, rather than amplify, the effects of the pandemic.

- The Reserve Bank's quarterly Bulletin contains analysis of a broad range of economic and financial issues as well as aspects of the Bank's operations. During 2019/20, 33 articles were published in the Bulletin.

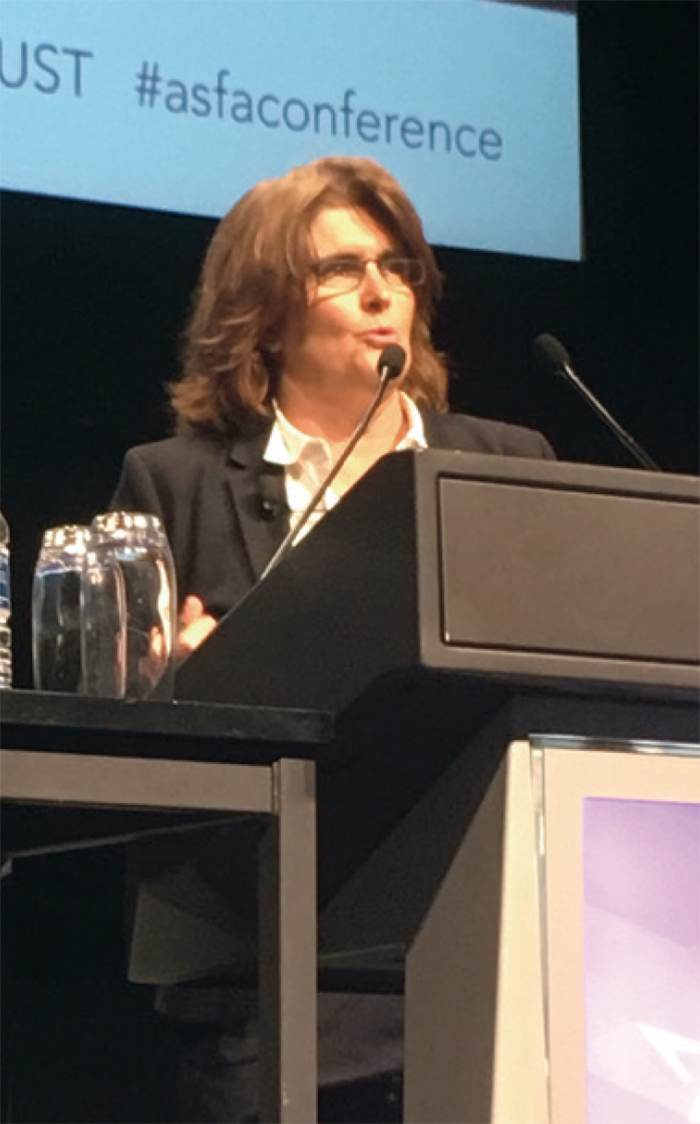

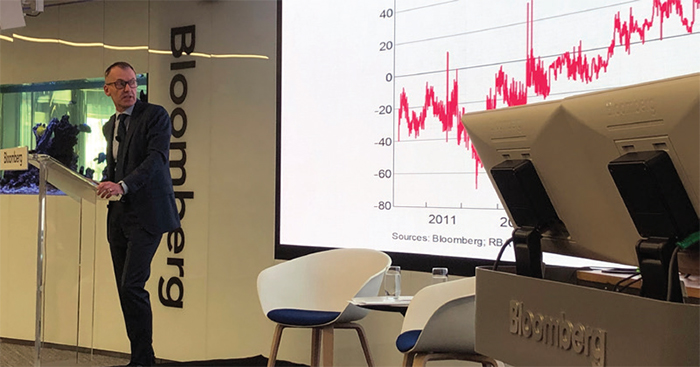

Public appearances provide an opportunity to communicate the Reserve Bank's analysis of economic and financial developments and how they have influenced monetary policy decisions, as well as respond to questions in a public forum. During 2019/20, the Governor, Deputy Governor and other senior officers gave 34 public speeches on various topics. A number of scheduled events were cancelled or postponed by conference organisers amid the pandemic, while nine speeches were delivered ‘virtually’. Senior staff also participated in public panel discussions and parliamentary hearings. More regional centres around Australia were included in the public appearance schedule with questions taken after almost all addresses. In addition to speeches on monetary policy and the Bank's response to COVID-19, there were speeches on the effect of the virus on the economy and financial system. Other speeches by senior officers addressed changes in banking and payments, digital transformation and the future of work. These speeches, the associated question and answer sessions and panel discussions were published on the Bank's website as both audio and text to facilitate transparency and accessibility. In late 2019, the Bank also started providing ‘live’ audio for speeches by the Governor and Deputy Governor.

Photo: Dave Robinson Photography

The Reserve Bank publishes information in both electronic and hard-copy formats, although access to information is mostly online. During the year, the Bank launched an Instagram account to engage with a younger demographic through visual communication. Followers of the Bank's social media accounts on Twitter, LinkedIn, Facebook and Instagram have grown to number over 126,000, while the number of subscribers to the conventional email alert service is around 11,000. Visitors to the Bank's website also made use of the RSS feeds, which allowed them to receive alerts about data updates, media releases, speeches, research papers and other publications, including those related to Freedom of Information requests.

The Reserve Bank's website has continued to evolve with new and refreshed content. The production process for the Financial Stability Review and Chart Pack was made more efficient and the digital version can be accessed in different formats upon publication to facilitate accessibility, as occurs with the Statement on Monetary Policy. The Bank has expanded its digital interactive resources following suggestions from teachers. The Banknotes microsite has continued to be used to communicate information about the new banknote series being issued by the Bank, with the new $20 banknote entering general circulation and the design of the new $100 banknote revealed in 2019/20.

Regional and Industry Liaison

Staff in the Reserve Bank's regional and industry liaison team, which operates from four State Offices around Australia and the Bank's Head Office in Sydney, work together to conduct the Bank's liaison program. The State Offices are located in Adelaide, Brisbane, Melbourne and Perth. Staff in the liaison program meet regularly with businesses, associations, governments and community organisations from across the country, including in regional areas. In 2019/20, nearly 1,000 liaison meetings were conducted and liaison staff visited Bunbury, Darwin, the Gold Coast, Hobart, Mount Gambier, Newcastle, Port Macquarie and Townsville.

Timely information provided by liaison contacts helps the Bank monitor trends in the Australian economy and complements data from official sources. Broad messages from liaison inform the Reserve Bank Board's decision-making and are communicated to the public through the Bank's regular statements and reports as well as speeches by senior staff. Liaison information is also regularly drawn upon for articles in the Reserve Bank Bulletin; in 2019/20, Bulletin article topics included renewable energy investment in Australia and regional variation in economic conditions.

The timeliness of information gathered from liaison was especially valuable in 2019/20 when the Bank needed to assess the effect of the bushfires and the COVID-19 pandemic on the Australian economy. These events had fast-moving effects on economic activity and labour markets, which would not be captured in official data sources for several weeks or months because of publication lags. Liaison information indicated that disruptions to economic activity caused by the bushfires in late 2019 and early 2020 would be temporary in most cases, although regional communities had been disproportionately affected.

Significant disruptions to activity in response to the outbreak of COVID-19 and associated travel restrictions were first reported by contacts in the higher education and tourism sectors in early 2020. As a result of the COVID-19 pandemic and travel restrictions, all liaison meetings were conducted via telephone or videoconference between March and June. The liaison team maintained a high number of meetings over this period, with almost half of all meetings in 2019/20 taking place in the four months to the end of June. With economic conditions changing rapidly, more frequent meetings with liaison contacts ensured that the Reserve Bank Board received the most relevant information to inform its policy decisions. Summary messages from liaison about the impact of the pandemic on businesses and the effectiveness of monetary and fiscal support measures were also regularly shared with the Bank's senior management and other government agencies.

As restrictions on economic activity in Australia were imposed from March to contain the spread of the virus, reports of considerable falls in demand became widespread. Firms responded to weaker demand and increased economic uncertainty with a variety of measures to preserve liquidity, including deferring or cancelling non-essential planned capital expenditure, reducing staff hours worked or the number of employees, and implementing wage freezes.

Staff from the State Offices also have an important role in the Bank's communication with members of the public, holding discussions with a broad cross-section of the community. In 2019/20, staff members in the State Offices gave around 30 presentations to members of the community, including at schools, business roundtables and regional chambers of commerce. In addition, Bank employees presented summaries of the Statement on Monetary Policy during the year to around 300 participants in the liaison program, including virtual presentations following the May 2020 Statement.

As noted in the chapter on ‘Governance and Accountability’, the Reserve Bank Board meets in state capitals other than Sydney on a regular basis. Following these Board meetings, a dinner is held with members of the local community, including representatives and leaders from politics, business, the public sector, and educational and community organisations. The dinners provide an opportunity to strengthen relationships between local communities and the Bank. In 2019/20, community dinners were held in Darwin in July 2019 and in Melbourne in October 2019. A community dinner scheduled to be held in Hobart in April 2020 was cancelled owing to the COVID-19 pandemic and domestic travel restrictions.

The Reserve Bank also convened its annual Small Business Finance Advisory Panel, which was established in 1993. The panel discusses issues relating to the provision of finance and the broader economic environment for small businesses. Membership of the panel is drawn from a range of industries across the country. The panel provides a valuable source of information on financial and economic conditions faced by small businesses.

Consultations and Public Enquiries

The Reserve Bank maintains engagement with a wide variety of groups to inform its policy and operational activities. Senior Bank staff meet regularly with representatives of various domestic and international official agencies, business groups and financial market participants to discuss economic, financial and industry developments.

As the first stage of a comprehensive Review of Retail Payments Regulation, the Bank published an Issues Paper in late 2019 seeking stakeholder views on a range of policy issues that could be covered by the Review. Staff from Payments Policy Department began meeting with stakeholders in early 2020. The Bank announced in March that the Review was being put on hold in light of the extraordinary circumstances associated with the COVID-19 pandemic. The Review is expected to be completed in 2021.

In late 2019, the Council of Financial Regulators (CFR) – comprised of the Reserve Bank, the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission and the Australian Treasury – conducted a consultation on proposals for regulatory reforms in relation to financial market infrastructures, including implementation of a crisis management regime for clearing and settlement facilities. Following consideration of the responses received, the CFR agencies developed policy proposals that were provided to the Government in July 2020.

The Reserve Bank held two meetings of its Payments Consultation Group in 2019/20. This group, which was established in 2014, is a structured mechanism for representatives of various users of the payments system (consumers, merchants, other businesses and government agencies) to convey their views on payments system issues as an input to the payments policy formulation process. More details on the activities of this group are provided in the Payments System Board Annual Report.

Staff from Payments Settlements Department continued to conduct regular liaison meetings with Reserve Bank Information and Transfer System (RITS) members and industry groups, such as the Australian Payments Network (AusPayNet).

Staff also participated in various industry forums, including AusPayNet's High Value Clearing System Management Committee. A senior staff member sits on the board of AusPayNet and another senior staff member sits on the board of New Payments Platform Australia Limited (NPPA), the company established to build and operate the NPP. Staff from Payments Settlements and Banking departments represent the Bank on NPP operating committees. Participation in these groups, and a number of other industry forums, helps the Bank to remain well informed about developments in these areas and contribute to innovations in the banking and payments industry.

The Reserve Bank sponsors and provides the secretariat to the Australian Foreign Exchange Committee (AFXC). Among other things, in 2019/20 the AFXC worked to promote the adoption of the FX Global Code in the Australian wholesale foreign exchange market. The code is maintained by the Global Foreign Exchange Committee, of which the AFXC is a member committee, and the Deputy Governor is the Chair. More details are provided in the chapter on ‘International Financial Cooperation’.

During the year, the Bank received approximately 3,100 public enquiries on a broad range of topics, including monetary policy, the economy, financial markets and regulation of the payments system. Responses were provided to the majority of enquiries received by the Bank. Staff from Note Issue Department also continued their engagement with industry and members of the public in relation to the new banknote series, as discussed in the chapter on ‘Banknotes’.

Research

The Reserve Bank publishes the results of longer-term research conducted by staff in the form of Research Discussion Papers (RDPs), which stimulate discussion and comment on policy-relevant issues. The views expressed in RDPs are those of the authors and do not necessarily represent those of the Bank. During 2019/20, 10 RDPs were published on a range of topics in the Bank's areas of interest, including the Australian housing market, consumer spending, Australian banknotes and monetary policy. Reserve Bank staff also published their research in various external journals, including the Economic Record.

Research undertaken at the Bank is frequently presented at external conferences and seminars. In 2019/20, Bank staff presented at a number of conferences and institutions in Australia and overseas.

The Reserve Bank holds regular conferences, which foster interaction between academics, central bankers and other economic practitioners on topical policy issues. The Bank's annual conference for 2020 was cancelled owing to the COVID-19 pandemic. There are, however, plans to revisit the topic ‘The Long-run Effects of the Short-run’ for the 2021 conference and re-engage the participants who had accepted the Bank's invitation to the 2020 conference.

In 2019/20, the Reserve Bank also hosted visits from a number of policymakers from domestic and overseas institutions as well as academics from a range of institutions. These included staff from the Federal Reserve Board, the International Monetary Fund, the Bank of England, the Bank for International Settlements and the Reserve Bank of New Zealand, as well as academics from Seoul National University, Universidad Torcuato Di Tella, University of Texas, Austin and Chicago Booth. During their visits, these visitors presented seminars, taught short courses and participated in research activities at the Bank.

The Bank sponsors economic research in areas that are closely aligned with its primary responsibilities. This sponsorship includes financial support for conferences, workshops, data gathering, journals and special research projects, and encompasses areas of study such as macroeconomics, econometrics and finance. In addition, the Bank provides sponsorship to the Centre for Independent Studies and the Sydney Institute. It is a corporate member of the Lowy Institute for International Policy and The Ethics Centre and an associate member of The South East Asian Central Banks (SEACEN) Research and Training Centre. The Bank is a member organisation of the Committee for Economic Development of Australia (CEDA); the Bank's membership of CEDA includes an annual research contribution.

In 2019/20, the Reserve Bank continued its longstanding contribution towards the cost of a monthly survey of inflation expectations undertaken by the Melbourne Institute of Applied Economic and Social Research at the University of Melbourne. The Bank also maintained its contribution to a quarterly survey of union inflation and wage expectations undertaken by the Australian Council of Trade Unions.

The Bank continued to contribute to funding the International Journal of Central Banking, the primary objectives of which are to disseminate first-class, policy-relevant and applied research on central banking and to promote communication among researchers both inside and outside central banks. The Bank also provides financial support for the Group of Thirty's program of research into issues of importance to global financial markets.

The Bank provides financial support for research on population ageing being conducted by the Australian Research Council Centre of Excellence in Population Ageing Research (CEPAR), based at the University of New South Wales. A senior official of the Bank sits on the Advisory Board of CEPAR.

The Reserve Bank makes a financial contribution to a number of conferences in economics and closely related fields. In 2019/20, these conferences included: the Economic Society of Australia's Women in Economics Network Retreat; the University of New South Wales Australasian Finance and Banking Conference; the University of Technology Sydney's Investment Management Research Program Conference; the PhD Conference in Economics and Business; the Workshop of the Australasian Macroeconomics Society; the Sydney Banking and Financial Stability Conference; the Melbourne Institute Macroeconomic Policy Meetings; and the Australian and New Zealand Econometric Study Group Meeting. The Bank also supports the discussion of economic issues in the community by providing a venue for the Economic Society of Australia's Lunchtime Seminar and Emerging Economist Series.

The Bank commenced a three-year sponsorship with the Economic Society of Australia's Central Council. The sponsorship helps to build and strengthen the profession and the debate on economic issues.

The Bank contributes to the NSW Premier's Teachers Scholarship, which aims to raise awareness of economics as an important field of study, attract a diverse body of students to the field and support excellence in teaching the subject. In conjunction with APRA, the Reserve Bank has continued to sponsor the Brian Gray Scholarship Program, initiated in 2002 in memory of a former senior officer of the Reserve Bank and APRA. One scholarship was awarded under this program in 2020. The cost to the Bank of this scholarship was $7,500.

In 2019, the Economic Society of Australia (Tasmanian Branch) established a scholarship to honour the memory of the late Professor Mardi Dungey, who was a former employee of the Reserve Bank and had been an active member of the Bank's Educators Advisory Panel. A contribution to funding the scholarship was made by the Bank in January 2020.

The total value of support provided for research and education in 2019/20 was $362,535.

Education

Interacting with educators and students remains a key part of the Reserve Bank's community engagement. The Bank has a Public Access & Education team whose role is to support educators and students and coordinate the efforts of staff across the Bank to deliver a public education program. The main focus of the program is economics education at senior high school. This focus was sharpened during the COVID-19 pandemic, and additional resources were developed for senior high school students and their teachers. However, educational activities are also undertaken for different stages of learning (at both school and university).

The Reserve Bank's commitment to economics education is motivated by the importance of economic literacy in the wider community and its concerns about the falling size and diversity of the economics student population. Nationally, the number of high school students studying economics in Year 12 has fallen by around 70 per cent since the early 1990s. Over the same period, the share of high schools offering economics has also fallen, with this being most pronounced among comprehensive government schools. Furthermore, there have been sharp falls in participation by females and students from schools that are culturally diverse or located in lower-income areas. A similar pattern is evident at university. In response, the Bank is seeking to raise awareness of the relevance of economics and the career opportunities it can provide. It is also providing practical support by creating resources that are aligned with curricula, giving presentations to students and offering professional development opportunities to educators.

Five new Explainers addressing topics of current importance were created in line with needs expressed by educators. They were aimed at both senior high school and undergraduate students. The topics included unconventional monetary policy and recessions, given the major economic contraction associated with the COVID-19 pandemic. The new Explainers also provided foundation knowledge about the role of money, as well as topics described by educators as being particularly difficult for students, such as the balance of payments and how a yield curve is formed.

Prior to March 2020, when the COVID-19 outbreak required suspension of face-to-face engagements, educational talks were delivered in person to nearly 4,500 high school students as well as to around 500 university students. The program was delivered through the Reserve Bank's Ambassador program, through which around 50 Bank staff engage with students and educators. Many talks were given directly in classrooms by the Ambassadors, who also give students the opportunity to meet young economists, learn about their work and be exposed to role models. Economists in the Bank's State Offices participate in the program and help ensure that talks are available to students and educators across the country. Before the suspension of in-person talks, the Bank had made additional effort to visit schools in outer metropolitan areas and delivered talks to schools in Port Macquarie, Wangaratta and Townsville.

With Ambassadors unable to present to students in person since the onset of the pandemic, two new video series were introduced to support remote learning. A short video on current economic conditions was published in May after the Statement on Monetary Policy, and is updated on a regular basis. The second video series brought to life the content in the Explainers, providing a video lesson for use by teachers in class or by students for self-directed learning. The first video in this series explored ‘The Labour Market and Unemployment’.

A new digital interactive tool in support of remote learning was also released. At teachers' request, the Reserve Bank developed the Snapshot Comparison tool, which allows users to compare snapshots of economic conditions in Australia at specific dates, as well as between major episodes in Australia's economic history (such as recessions or terms of trade booms).[1] In addition to comparing snapshots of economic data, there are interactive graphs and an ability to export data and graphs for use in class.

While there was a concentrated effort to support remote learning during the pandemic, the Reserve Bank also advanced initiatives with a long-term aim of increasing the size and diversity of the economics student body. Key among these was developing resources about economics for teachers of Years 7–10 students. These resources are aligned with the mandatory economics component of the new NSW Commerce Syllabus, but are relevant to other subjects that include aspects of economics. They are intended to assist teachers and engage students so that they might later select economics. Also, a new Work Experience Program to expose students to economics was introduced. Twelve high-performing Year 10 students from across the country spent a week at the Bank, learning from economists and receiving training in the presentation of economic data.

The Reserve Bank continued to provide teachers with professional development activities. Bank staff spoke at seven external events for teacher professional development, and the Bank maintained its Topical Talks series for educators.

Of the two Topical Talks given during the year, the first was held in person at the Bank's Head Office, while the second, which occurred after suspension of face-to face engagement, was a webinar. This enabled participation by teachers from across the country, including from regional areas. The Bank's annual Teacher Immersion Event – its principal professional development activity – was cancelled because of the COVID-19 outbreak.

Further research was conducted to guide the strategic direction of the public education program. The Reserve Bank collaborated with Ipsos to undertake the ‘High School Students' Subject Selection Survey’ of Year 10, 11 and 12 students in NSW. The aim of the survey was to investigate why students choose subjects, why they choose to study (or not study) economics and their perceptions of economics. The survey was conducted as an in-class activity, with 51 schools participating and over 4,800 students completing the survey. An analysis of the survey results can be found in the June 2020 issue of the Bulletin.[2] The results will inform actions to be taken to help overcome barriers that some students have in choosing economics and encourage participation by a more diverse group of students.

The Educators Advisory Panel – which comprises external education experts who advise on the strategic direction of the Bank's public education program – met twice during the year to review the program's progress.

Museum

The Reserve Bank's Museum showcases a permanent collection of artefacts and hosts additional periodic exhibitions. It also offers regular talks and tours for a wide cross-section of visitors, including students. In the permanent collection, visitors can view the various types of money used in Australia before Federation through to the innovative new series of ‘next generation’ banknotes. Visitors can trace the evolution of the nation's identity as expressed through its banknotes and learn about the influential women and men depicted on them. They can also see the artwork used in banknote design, learn about how banknotes are made and discover their security features.

The Museum has featured the next generation banknotes in a display called A New Vision for Banknotes. In 2019/20, information about the new $20 banknote was added to that for the $50 banknote (released in 2018), the $10 banknote (released in 2017) and the $5 banknote, which launched the new series in 2016. The display has been designed to capture the innovative properties of the new banknotes; it provides details about their design, production and their tactile accessibility feature for people who are vision-impaired. A large multi-touch screen enables visitors to explore the design elements and security features of the new banknotes, along with the rich historical and social context of the imagery and stories that the banknotes contain.

Around 12,400 people visited the Museum during 2019/20. This was well down on the previous year owing to the closure of the Museum during the pandemic. The school holiday program had been expanded prior to the pandemic, with an increase in the variety of public talks given. The number and diversity of high school students visiting the Museum had increased further, consistent with the Reserve Bank's public education initiatives. Senior high school groups were offered talks about the role of the Bank and the economy, which were aligned with the syllabus for both economics and commerce. In addition to these talks, groups of Indigenous students (at high school and university) received presentations on the history of Indigenous design elements in Australia's banknotes. Talks for students were also available about the Museum exhibits and the new banknotes, with these talks customised for some groups, including those with English as a second language or having accessibility requirements and those undertaking vocational training.

There was active use of the Museum's ‘Collection Spotlights’ cases, which enable the periodic small-scale display of significant artefacts and archival records held by the Bank. For example, there was a display about the historic Reserve Bank visit to China in 1961, led by its Governor, Dr H. C. ‘Nugget’ Coombs, before Australia had diplomatic relations with the People's Republic of China. There was also a display of an alternative banknote series produced by the Indigenous artist, Dr Ryan Presley, who re-imagines Australia's currency from the perspective of the First Nations' histories. The alternative banknotes, which closely mirror features of Australia's actual banknotes, were part of a body of work entitled ‘Blood Money’ that drew on research conducted by Ryan Presley in the Bank's Archives and Museum. The physical Collection Spotlights each had corresponding online exhibitions to provide visitors with more information about the Bank's collections.

In 2019, the Reserve Bank once again participated in Sydney Open – an event designed to give the public access to important or unique buildings. There were around 1,800 visitors to the Bank's public foyer areas and Museum – a record attendance at the Bank – with its Head Office building becoming the fifth most visited building in the Sydney Open program. Visitors attended talks about the architecture and design of the Bank's heritage-listed Head Office building. These talks were complemented by a booklet titled Unreservedly Modern and a digital exhibition in the Museum foyer about the public artwork that can be seen when visiting the Head Office building and its buildings in other cities in Australia. The highlight of the Bank's participation in Sydney Open remained the access by smaller groups to the Board suite, where visitors received presentations about the Bank's art collection, which forms part of the cultural legacy of former Governor Dr H. C. Coombs. In 2019/20, small groups were given access to the top floor of the building, with large archival images of views from this floor aligned with current views, so the Bank's building could be located in the changing built environment of Sydney.

The Reserve Bank's Museum also became part of the Cultural Kilometre, in which nine cultural institutions – within a short walk from one another – share information about their programs so that general visitors and educators can more easily plan visits to multiple institutions with complementary collections and learning opportunities.

The information in the Museum is accessible on the Museum's website, which also contains supplementary online exhibitions. The Museum website was refreshed during the year to improve the display of this additional information and provide a user experience similar to that of cultural institutions. An interactive map of the Cultural Kilometre was also added to the site.[3]

Archives

The Reserve Bank Archives contain records and artefacts that cover over 200 years of Australia's financial, economic and social history, as well as the history of the Bank's operations. During 2019/20, the Bank's Archives team responded to more than 180 requests for information. The majority of requests for archival information were from academics and postgraduate students, from both Australia and overseas. Requests from financial institutions with a historical association with the Bank, along with cultural institutions, authors, architects, numismatists and genealogists were also prominent.

Topics of particular interest to those requesting information from the Archives included: colonial banking records; banking staff who served in the First World War; interwar central bank cooperation; former Reserve Bank branches and buildings; former Bank governors (particularly Dr H.C. Coombs); and correspondence between the Bank and the Hawke Government. In addition, the COVID-19 pandemic and its economic effects generated requests about the influenza pandemic of 1918 (known as the Spanish Flu) and the Great Depression of the 1930s. And the release of the new $20 banknote in October 2019 occasioned enquiries about previous banknote series and note designs, and also activities at the Bank's first printing works.

While the COVID-19 outbreak required the closure of the Reserve Bank's Archives repository and public research room, the Archivists were able to support most requests for information remotely by accessing digital versions of records. Digital content was then shared with researchers using the Bank's secure external collaboration tool, RBA Box. These researchers included the Bank's Historian, Associate Professor Selwyn Cornish of the Australian National University, who continues to make considerable progress in the writing of the next volume of the Bank's official history, which has a focus on the 1975–2000 period.

An article about the Reserve Bank's Archives featured in the December 2019 issue of the Bulletin. Entitled ‘Being Unreserved: About the Reserve Bank Archives’ it detailed the history of the Archives, its scope and significance. It also described plans for a digital platform (called Unreserved) to enable the public to have direct access to archival Bank records and allow researchers to conduct independent research on these records. To facilitate this project, the program to digitise the Bank's most significant, interesting or fragile archival records and collection items continues. To date, around two million frames have been digitised.

Once restrictions imposed in response to the COVID-19 outbreak have been lifted, and Unreserved is launched, public access to the Bank's records through the dedicated research room in the Bank's Head Office will resume for those records yet to be digitised. In many instances, the physical form and medium can be integral to interpretation of an archival record. Furthermore, the Bank's Archivists will continue to provide research and advice as a core feature of the public's access to this significant archival collection.

Charitable Activities

During 2019/20, the Reserve Bank made its 18th annual contribution of $50,000 to the Financial Markets Foundation for Children, which is chaired by the Governor. For many years, the Bank has donated a signed uncut banknote sheet to the ASX Refinitiv Charity Foundation for auction, which usually raises over $20,000. The Foundation includes the Financial Markets Foundation for Children in the distribution of auction proceeds. In July 2020, the Governor delivered his fourth address to the Anika Foundation's annual event to raise funds to support research into adolescent depression and suicide. This was the 15th such event supported by the Bank; in this instance, the address was delivered as a webinar.

In March 2020, the Bank made a donation to the Yothu Yindi Foundation to assist with the transportation of Indigenous youth enrolled in educational programs under the auspices of the Dhupuma Foundational Learning program. The project aims to re-engage high school-aged students who are not enrolled in traditional schooling with learning and education activities that take cultural factors into consideration and emphasise the importance of health in the educational process. The donation followed a visit by Governor Philip Lowe and two fellow Reserve Bank Board members to East Arnhem Land to re-establish links formed between the Reserve Bank under the governorship of Dr H.C. ‘Nugget’ Coombs and the Indigenous community of Nhulunbuy in the late 1960s. The visit, in July 2019, followed a meeting of the Reserve Bank Board and a community dinner hosted by the Governor in Darwin.

The Reserve Bank's modest corporate philanthropy program involves several initiatives, key among which involves dollar-matching staff payroll deductions (totalling $112,500 in 2019/20) organised by the Reserve Bank Benevolent Fund. The Bank also facilitates staff salary sacrificing under a Workplace Giving Program.

Following the devastating bushfires in Australia over December and January, Bank staff raised an amount of $16,339 for the Australian Red Cross Bushfire Appeal in a fundraising initiative organised by the Benevolent Fund. In addition, staff of Note Printing Australia raised $2,393 for the Victorian Bushfire Appeal. The Bank dollar-matched both these donations.

Reserve Bank staff participated in a number of volunteering activities in 2019/20 with The Smith Family, Foodbank Victoria and Foodbank NSW and ACT. A small donation was also made to Orange Sky Australia.

The Reserve Bank's contributions under all these initiatives in 2019/20 totalled $264,642.

Footnotes

See <https://www.rba.gov.au/education/resources/digital-interactives/snapshot-comparison/>. [1]

Livermore T and M Major (2020), ‘Why Study (or Not Study) Economics? A Survey of High School Students’, Bulletin, June. Available at <https://www.rba.gov.au/publications/bulletin/2020/jun/why-study-or-not-study-economics-a-survey-of-high-school-students.html>. [2]