Reserve Bank of Australia Annual Report – 2016 Banknotes

The Reserve Bank is responsible for producing and issuing Australia's banknotes. The Bank seeks to ensure there are sufficient high-quality banknotes in circulation to maintain confidence in banknotes as a payment mechanism and store of wealth. The Bank also conducts research and development to ensure that Australian banknotes remain secure against counterfeiting. To this end, the Bank is issuing an upgraded series of banknotes, with the first denomination, the $5, to be issued from 1 September 2016. At the end of June 2016 there were 1.4 billion banknotes, worth $70.2 billion, in circulation.

The Reserve Bank is responsible for producing and issuing Australia's banknotes. Public demand for banknotes stems from the role of banknotes as both a payment mechanism and a store of wealth. To preserve public confidence in the capacity of banknotes to perform these roles, the Bank:

- works with its wholly owned subsidiary, Note Printing Australia Limited (NPA), to design Australia's banknotes; arranges for their production through NPA; and issues the banknotes to meet public demand

- maintains the quality of banknotes in circulation by withdrawing old, worn banknotes and replacing them with new banknotes

- conducts research and development to ensure that Australian banknotes remain secure against counterfeiting.

Next Generation Banknote Program

The Next Generation Banknote program was established in 2007 to ensure Australia's banknotes would continue to be secure against counterfeiting. This program will culminate in an upgraded series of banknotes with a range of innovative new security features that have not previously been used on Australian banknotes. Issuance of the upgraded series will occur over a number of years, with the first denomination, the $5, entering circulation from 1 September 2016 and the $10 planned for late 2017.

The new banknotes will retain many of the key design elements of the current banknote series, including the people portrayed, size, colour palette and denominational structure. There will, however, be design changes to accommodate the new security features. Each denomination will include a top-to-bottom clear window and feature a different species of Australian wattle and native bird within a number of the elements. On the $5 banknote, these are the Prickly Moses wattle (Acacia verticillata subsp. ovoidea) and the Eastern Spinebill (Acanthorhynchus tenuirostris).

An integral element of this program has been the Reserve Bank's extensive consultation to ensure that the new banknotes continue to meet the needs of the community. Advice was sought through a number of channels during the development process, including an external advisory panel comprising experts across a range of fields covering design, Australian art and history, and banknote development and production; subject-matter experts; and focus groups comprising members of the public. There was also extensive engagement with key users of banknotes, such as retail organisations, financial institutions and the vision-impaired community. This engagement has also included the provision of production banknotes to equipment manufacturers for testing.

Ahead of the issuance of the new banknotes, the Reserve Bank developed a communication strategy to ensure the public would be well informed about the new banknotes. The strategy encompasses an ongoing multi-channel public awareness campaign providing information to many groups in the community, including the vision-impaired community, older generations and people from culturally and linguistically diverse backgrounds.

The time and cost involved in the Next Generation Banknote program is substantial. To date, $23 million of a total planned $37 million has been spent on the process of designing and testing the new banknote series, as well as the extensive community consultation, communication and education that is required.

Banknote Accessibility

The Reserve Bank is committed to ensuring that Australia's banknotes are accessible for people who have impaired vision. From the outset of the current program to upgrade the banknotes, it was decided that the existing accessibility characteristics of Australia's banknotes – their size differentials, vibrant colours and bold, contrasting numerals – would be retained. The Bank will also continue to fund the production of a banknote measurement device. Following consultation with the vision-impaired community, the Bank and NPA examined the possibility of adding a tactile feature to the new banknote series. After examining a range of such features, a new embossed feature was chosen to be incorporated into the design as the most effective method of achieving greater accessibility.

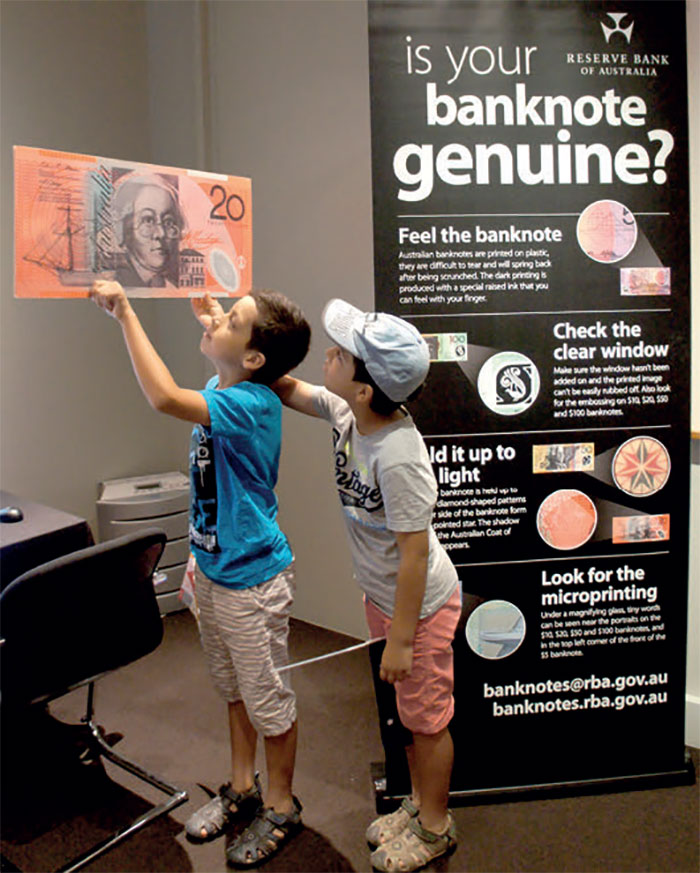

Community Liaison

The Reserve Bank actively engages with a range of stakeholders, including users and manufacturers of banknote equipment, law enforcement agencies, retail organisations, schools and financial institutions, with the aim of increasing community knowledge about banknotes. More than 140 presentations were given during 2015/16, twice as many as in 2014/15. The majority of these presentations were delivered to visitors to the Reserve Bank of Australia Museum.

In June 2016, the Reserve Bank and NPA hosted representatives from organisations that support the vision-impaired community to preview the tactile feature that will be included on the next generation of Australian banknotes. The guests were taken on an accessible tour of NPA's production hall, where they learnt about the multiple layers and processes involved in producing the new $5 banknote.

Banknote Infrastructure Modernisation Program

In preparation for the logistical demands arising from the introduction of the new banknote series, the Reserve Bank has initiated a program to upgrade its existing banknote infrastructure. The main objectives of the upgrade are to increase banknote storage and processing capacity, and to introduce new technologies and systems to improve banknote logistics processes and simplify distribution arrangements with cash-in-transit companies.

The upgrade includes construction of the National Banknote Site (NBS) on the Reserve Bank's existing site in Craigieburn, Victoria. Construction of the new two-storey building began in June 2015 and it is scheduled to be fully operational by the end of 2017.

In addition, the Banknote Infrastructure Modernisation program will improve manual processes in the Reserve Bank's existing sites and introduce automated processes at the NBS. This will allow for more efficient workflows, a reduction in work health and safety risks and further improvements in the security associated with banknote handling. The first phase of the program was implemented in January 2016, with the introduction of new containers for storing and distributing banknotes. The next phase, involving an upgrade of the existing banknote management system, is scheduled to be operational in the second half of 2016. In parallel, the Bank will increase its capacity to process unfit banknotes with the commissioning of additional high-speed banknote processing machines.

Banknote Research and Development

The Reserve Bank's research and development program is designed to ensure that Australian banknotes remain both secure against counterfeiting and functional for a wide variety of users. A core function of this work is the development of innovative technologies that are incorporated into new security features and detection equipment for banknotes. This is achieved in collaboration with experts from various external organisations, including universities, public and private companies, research institutes and other central banks. An integral part of this program is an assessment of the vulnerability of banknotes to different forms of counterfeiting.

In addition to these activities, the Reserve Bank contributes to several international forums associated with banknote security, including the Central Bank Counterfeit Deterrence Group, which examines emerging threats in counterfeiting technologies, and the Reproduction Research Centre, which provides facilities to test new security features. The Bank also works closely with its partners and suppliers to introduce new technologies and features into the banknote production process.

In 2015/16, the research program focused heavily on providing technical expertise for the development of the next generation of Australian banknotes by conducting extensive trials, assessing new technologies and strategies to ensure the durability of the new security features, and developing novel instrumentation for banknote examination. This was done in conjunction with the development of new testing methodologies that will form part of the quality assurance program.

Banknotes on Issue

At the end of June 2016, there were 1.4 billion banknotes, worth $70.2 billion, in circulation. The value of banknotes in circulation increased by 7 per cent in 2015/16, slightly above its long-term growth rate of 6 per cent.

Demand for banknotes continued to increase across all denominations, and was strongest for high-denomination banknotes, with the value of $100 banknotes increasing by 9 per cent and the value of $50 banknotes increasing by 6 per cent in 2015/16. This growth in high-denomination banknotes is well above recent growth in nominal income for the economy and reflects a range of factors, such as overseas demand, which is heavily influenced by movements in the exchange rate, and the fact that high-denomination banknotes are also used as a store of wealth, especially in times of financial uncertainty and low interest rates. Changing payment patterns in the economy, including the increased prevalence of card payments, also continued to influence growth of banknotes in circulation, and are likely to have placed some downward pressure on demand for the lower denomination banknotes.

New Banknote Purchases

The Reserve Bank purchased 129 million Australian banknotes from NPA in 2015/16. These comprised 8 million $5 banknotes, 22 million $10 banknotes and 25 million $50 banknotes of the existing series, and 74 million $5 banknotes of the new series.

Distribution

The Reserve Bank maintains banknote holdings to accommodate growth in the number of banknotes in circulation, for seasonal fluctuations in demand and for contingency purposes in the event of systemic shocks and production disruptions. The Bank has established distribution agreements with a number of commercial banks, which provide them with access to banknotes. The Bank issued banknotes worth $10.4 billion in 2015/16, of which $3.2 billion had previously been in circulation and $7.2 billion were new.

The Reserve Bank aims to maintain a high quality of banknotes in circulation to ensure public confidence in their capacity to perform their role as a payment mechanism and store of wealth. High-quality banknotes are more readily handled by machines and make it more difficult for counterfeits to be passed. For this reason, the Bank has arrangements that encourage the commercial banks and the cash-in-transit companies to continue to use banknotes that remain fit for circulation and return those that are unfit to the National Note Processing and Distribution Centre (NNPDC), operated by NPA. These unfit banknotes are assessed using high-speed processing machines to confirm their authenticity and quality. In 2015/16, the NNPDC received $1.8 billion in banknotes deemed unfit for recirculation.

The Reserve Bank also provides an additional service to members of the public through its Damaged Banknotes Facility. Through this facility, members of the public who have come into possession of damaged banknotes or whose banknotes are accidentally damaged can ask the Bank to examine and verify their damaged or contaminated banknotes. Subject to the claim meeting the requirements set out in the Damaged Banknotes Policy, payment is made based on the assessed value of each claim. The Bank processed 18,281 claims and made $7.5 million in payments in 2015/16.

Counterfeiting in Australia

Australia's level of counterfeiting remains low by international standards. In 2015/16, around 26,000 counterfeits, with a nominal value of nearly $1.5 million, were detected in circulation. This corresponds to around 19 counterfeits detected per million genuine banknotes in circulation. This represents a 37 per cent decline in counterfeiting compared with 2014/15, in part reflecting a number of successful law enforcement investigations. Nevertheless, over the medium term the trend in counterfeiting has been upwards.

To combat counterfeiting in Australia, the Reserve Bank works closely with law enforcement agencies in Australia and overseas to monitor trends and identify emerging threats. As part of this arrangement, the Bank provides analytical and counterfeit examination services and prepares expert witness statements and court testimonies to assist the agencies with their investigations.

Numismatic Banknote Sales

During 2015/16, the Reserve Bank assessed possible commemorative options to coincide with the issuance of the new banknote series.

As a result, two collectors' products will be made available through selected retailers in conjunction with the issuance of the new $5 banknote.

Note Printing Australia Limited (NPA)

NPA is a wholly owned subsidiary of the Reserve Bank that produces banknotes and supplies other related services to the Bank and some other entities. As noted above, in 2015/16 NPA delivered 129 million Australian banknotes to the Bank. NPA also provided banknote distribution and banknote processing services to the Bank. The aggregate amount paid by the Bank to NPA in 2015/16 for the supply of banknotes and related services was $53.9 million.

In addition, NPA delivered 199 million banknotes under contract to Singapore and Brunei in 2015/16, dealing directly with the respective central banks in those countries. NPA also produced 2.3 million P- series passports for Australia's Department of Foreign Affairs and Trade.

| $5 | $10 | $20 | $50 | $100 | Total | |

|---|---|---|---|---|---|---|

| Number | 29 | 51 | 448 | 22,063 | 3,656 | 26,247 |

| Nominal value ($) | 145 | 510 | 8,960 | 1,103,150 | 365,600 | 1,478,365 |

| Parts per million | 0.2 | 0.4 | 2.8 | 34.5 | 11.4 | 18.6 |

|

(a) Figures are preliminary and subject to upward revision due to lags in counterfeit submissions to the Reserve Bank Source: RBA |

||||||