2020 Assessment of the Reserve Bank Information and Transfer System Appendix A: Background Information

- Download the complete Document 1.5MB

This Appendix describes the operational arrangements and key design features of RITS and presents an overview of the operational performance of RITS over the assessment period. Material changes to RITS since the previous assessment are discussed in section 3 of this report.

While the RITS Regulations govern both the core RITS service and FSS, the FSS operates as a separate service from the core RITS service.[19] Except where otherwise noted, this Appendix provides background information on the core RITS service.

A.1 Activity and Participation

RITS is used to settle time-critical wholesale payments for other FMIs: Australian dollar pay-ins to or pay-outs from CLS Bank International (CLS); margin payments to CCPs; and debt and equity settlement obligations arising in securities settlement systems. RITS is also used to make wholesale payments (cash transfers) between members. RITS also settles the interbank obligations arising from non-cash retail payments.

In addition to settling individual wholesale payments, RITS also facilitates the settlement of net interbank obligations arising from the equity market (through CHESS, the equities settlement system operated by ASX Settlement), retail payment systems and the property settlement system (see section A.5 for more information on these systems). Equities, property settlement payments and retail transactions are settled as batch payments. The majority of the value of retail payments settled in RITS is from the direct entry (DE) system.

In late 2019, RITS commenced settling obligations arising from property transactions completed using the electronic conveyancing system managed by Sympli Australia Pty Limited (Sympli). Both Sympli and the existing PEXA electronic conveyancing system can submit linked property transactions for settlement as individual multilateral net batches within RITS.

Agency arrangements for wholesale RTGS payments

Under the Bank's ESA policy, authorised deposit-taking institutions (ADIs) that account for 0.25 per cent or more of the total value of wholesale RTGS transactions, and systemically important CCPs, are required to settle their Australian dollar obligations in RITS using their own ESAs (see section A.9 for further details on access and participation in RITS). An ADI with a share of transactions of less than 0.25 per cent of the total value of wholesale RTGS transactions is permitted to use an agent to settle its transactions. ADIs that elect to use an agent to settle their transactions have the option of holding a dormant ESA for contingency purposes.

Since RITS is an RTGS system, members need access to additional liquidity (relative to a deferred net settlement system) in order to settle payments individually. Liquidity can be sourced from members' opening ESA balances and additional funds made available to members by the Bank via its intraday liquidity facility (see section A.7 for details).

The aggregate of opening ESA balances is primarily determined by the Bank's open market operations (OMOs) and liquidity provided under open repos. Since March 2020 and the announcement of a comprehensive package of measures to support the Australian economy during the COVID-19 pandemic, aggregate ESA balances are also determined by the amount of purchases of Australian government bonds in the secondary market and funding provided to ADIs under the Term Funding Facility (TFF). Open repos facilitate the settlement of same-day DE payments, as evening settlement obligations arising from the DE system are unknown before the close of the interbank cash market. Open repos also provide liquidity for FSS settlements of NPP payments initiated after 4.45 pm Australian Eastern Standard Time (AEST)/Australian Eastern Daylight-saving Time (AEDT) on business days, as well as on weekends and public holidays. Average liquidity in RITS increased sharply following the introduction of open repos in 2013. This increased further in March 2020 following measures undertaken to support the economy and functioning of financial markets in response to COVID-19.[20]

System liquidity plays a role in the timely settlement of RTGS transactions. In general, settling payments earlier in the day is desirable as it limits the potential adverse consequences if a participant or RITS were to experience an operational issue late in the day. The liquidity buffer created by open repos results in higher levels of system liquidity being available earlier in the day and therefore contributes to the earlier settlement of payments in RITS.

A.2 Operational Risk

RITS availability

A key operational target is for RITS to be available to its members at a minimum of 99.95 per cent of the time. Availability is measured relative to the total number of hours that the system is normally open for settlement (see section A.6). In 2019, RITS availability was 99.952 per cent (Table A.1).

| RITS availability(a) | |

|---|---|

| 2019 | 99.95 |

| 2018 | 99.83 |

| 2017 | 99.98 |

| 2016 | 99.99 |

| 2015 | 99.83 |

|

Note: Availability in 2019 represents the average of the five component service availabilities:

|

|

|

(a) In 2018, the methodology for calculating RITS availability changed to a simple average of availabilities calculated for each of the five component services of RITS. Availability for 2017 and earlier years relates to Bank-operated systems. Source: RBA |

|

In addition to its availability target, RITS also has capacity targets. These include a:

- processing throughput target, which aims to ensure that RITS is able to process peak-day transactions in less than two hours (assuming no liquidity constraints)

- projected capacity target, which specifies that RITS should be able to accommodate projected volumes 18 months in advance with 20 per cent headroom.

RITS is regularly tested against these targets and continues to meet them.

External dependencies

The Bank maintains agreements with SWIFT, Austraclear, and other feeder systems that set out operational and support arrangements. RITS also uses a range of utility service providers. To manage dependencies on these providers, both the main and backup sites have an uninterruptable power supply and a backup power generator system. The majority of the external communications links to data centres are via diverse paths.

The efficient operation of RITS is also dependent on the operational reliability and resilience of its members. An operational disruption at a member could prevent it from sending payment instructions to RITS. This could in turn cause liquidity to accumulate in that member's ESA, forming what is known as a ‘liquidity sink’, and preventing liquidity from being recycled through the system efficiently. Recognising this interdependency, the Bank publishes Business Continuity Standards for direct participants in RITS. These standards aim to promote high availability in RITS payments processing operations, requiring both resilience of system components and rapid recovery if failover to alternative systems is required.[21]

The Bank monitors compliance with the Business Continuity Standards on an ongoing basis. Each member that operates an ESA or is a batch administrator is required to submit an annual self-certification statement against the standards. As at the end of 2019, 63 RITS members self-certified, with 14 partly compliant with the standards. Where members are partly or non-compliant, the Bank asks members to provide a timetable to achieve compliance and follows up progress with members.

A.3 Governance and Oversight

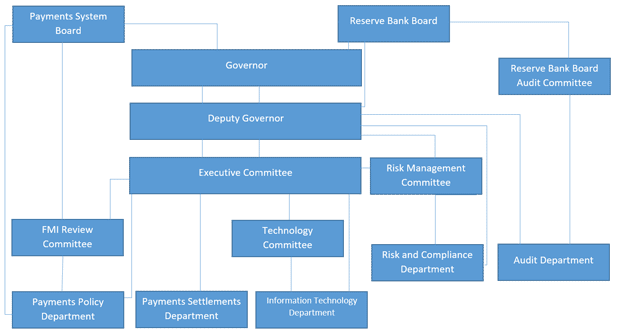

RITS is owned and operated by the Bank. Since it is not operated as a separate legal entity, the management and operation of RITS fall under the governance structure of the Bank and are therefore subject to its normal oversight, decision-making and audit processes. The Bank articulates specific objectives in relation to its operation of RITS on its website.[22] These are consistent with the high-level objectives of the Bank, which emphasise the stability of the broader financial system and the welfare of the Australian people. The Bank accordingly aims to provide infrastructure through which settlement obligations arising from the exchange of high-value payments and debt securities can be completed in a safe and efficient manner.

The governance structure as it applies to RITS is shown in Figure A.1. In accordance with the Reserve Bank Act 1959, the Governor is responsible for the management of the Bank, and is therefore ultimately responsible for the operation of RITS. The Governor is assisted and supported in this responsibility by the Executive Committee, which comprises senior executives. Day-to-day operations, liaison with members, and the ongoing development of RITS are delegated to the Bank's Payments Settlements Department.

RITS is also subject to oversight by the Bank's Payments Policy Department, within the policy framework for which the Payments System Board has ultimate responsibility.[23] The Executive Committee has established an internal FMI Review Committee to govern oversight activities within this framework. This committee is chaired by the Assistant Governor (Financial System) and includes at least a further five senior members of Bank staff with relevant experience.

A.4 Design Features

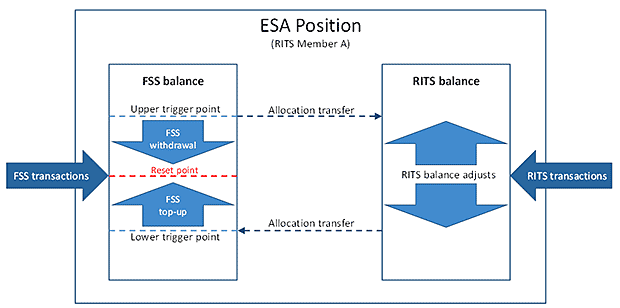

ESA funds are allocated between the core RITS service and the FSS. The RITS balance is used for funding high-value payments and multilaterally netted settlements. The FSS balance is used for funding the real-time settlement of consumer and business NPP payments. Members can control the use of liquidity within the system by setting parameters to automatically allocate ESA funds to or from the FSS. For example, there is functionality allowing members to set criteria (upper, lower and reset point values) that are used by RITS to automatically generate allocation transfers between members' FSS and RITS balances (Figure A.2).[24]

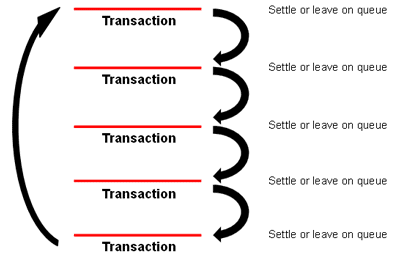

The core RITS system is designed to enhance efficiency in the use of liquidity within the system. Wholesale transactions in RITS are settled on a central queue. The RITS central queue uses a ‘next-down looping’ algorithm to continuously retest unsettled payments in order of submission (Figure A.3). If the transaction being tested for settlement cannot be settled individually using the RITS balance, the auto-offset algorithm searches for up to 10 offsetting transactions (based on the order of submission) between the pair of members and attempts to settle these simultaneously.[25] Members can also nominate specific offsetting payments to be settled simultaneously to assist in managing client credit constraints; this functionality is known as ‘targeted bilateral offset’.

Members have access to a range of real-time information in RITS to enable them to manage their liquidity efficiently and effectively. In particular, members have access to information on their current ESA balances, settled payments and receipts, queued inward and outward transactions, the value of first- and second-leg intraday repos, their projected end-of-day ESA balances, and their FSS balance and RITS/FSS allocation transfer facilities.

RITS also has features that allow members to efficiently manage and conserve liquidity. Members can use ‘sub-limits’, which they can change at any time during the settlement day, to reserve liquidity for priority payments. There are three payment statuses available to members, which determine how wholesale RITS individual transactions draw on liquidity:

- Priority payments are tested against the full RITS balance less funds reserved for property settlement.

- Active payment instructions are settled as long as the paying institution has sufficient funds in their RITS Balance above the sum of the member's specified sub-limit and any property settlement reservations.

- Payments with a deferred status are not tested for settlement until their status is amended.

This functionality can be accessed through either the RITS User Interface or via SWIFT messages. Members can choose to change the payment status of each payment individually, or they can choose to automatically set the status of all payments of a particular type, above and below a member set threshold.[26]

A.5 Systems Linked to RITS

Wholesale RTGS payment instructions can be submitted to RITS directly as RITS cash transfers, or through two feeder systems: SWIFT PDS and Austraclear. The SWIFT PDS is a closed user group administered by AusPayNet, which sets rules and procedures for clearing payments in Australia through its HVCS. The SWIFT PDS is used primarily to make customer and interbank payments, with interbank settlement occurring across ESAs in RITS. Austraclear transactions submitted to RITS for settlement generally represent the cash legs of debt security transactions, which are settled on a delivery-versus-payment model 1 basis.[27] Payment instructions that are not associated with the settlement of securities transactions may also be sent for settlement via the Austraclear system. Other FMIs with ESAs (i.e. CLS, the ASX CCPs and LCH.Clearnet Limited (LCH)) use these feeder systems to settle Australian dollar obligations arising from the systems they operate.

RITS also facilitates the multilateral net settlement of interbank obligations arising from other systems (Table A.2). The settlement of obligations arising in the retail payment systems administered by AusPayNet is facilitated by the Bank's LVSS in RITS. All other multilateral net batches are administered by ‘batch administrators’ and entered into RITS through its batch feeder functionality.[28]

| Linked system | Underlying transaction types | Governance and ownership |

|---|---|---|

| CHESS Batch | Primarily equity security transactions | The CHESS Batch is administered by ASX Settlement, which is owned by ASX Group. ASX Settlement is licensed as a clearing and settlement facility and is subject to the Bank's Financial Stability Standards for Securities Settlement Facilities. |

| Low-Value Settlement Service | Cheque, DE (including the BPAY system), Visa and ATM transactions | Each retail payment system has its own rules and procedures. These rules and procedures are determined by the system administrator (e.g. AusPayNet), in consultation with its members. |

| Mastercard Batch | Mastercard brand credit and debit card payments | The Mastercard Batch is administered by Mastercard International, which is a privately owned company incorporated in the US and listed on the New York Stock Exchange. |

| PEXA Batch | Property transactions | PEXA is owned by a consortium consisting of Commonwealth Bank of Australia, Link Market Services and Morgan Stanley Infrastructure. |

| eftpos Batch | eftpos brand debit card payments | The eftpos Batch is administered by the member-owned eftpos Payments Australia Limited. |

| ASX Financial Settlements Batch | Property transactions | The ASX Financial Settlements Batch is administered by ASX Financial Settlements Pty Limited, which is owned by the ASX Group. |

A.6 Operating Hours

Standard settlement hours in the core RITS service, as established by the RITS Regulations, are 7.30 am to 10.00 pm.[29] Settlement of SWIFT and Austraclear transactions cease at 6.30 pm AEST and 8.30 pm during AEDT (the first Sunday in October to the first Sunday in April).

Prior to 9.15 am, settlement in RITS is limited to the deferred net obligations settled in the 9.00 am settlement process (during the 9.00 am processing session), and, before the 9.00 am settlement process, settlement of RITS cash transfers, interbank Austraclear transactions, obligations for the Mastercard and eftpos batches and DE government clearings. Other payment instructions can be submitted to RITS during this time, but they are not tested for settlement until the daily settlement session commences at 9.15 am. Further details can be found in Table A.3.

| RITS session | Time window | Transactions able to be settled |

|---|---|---|

| Morning settlement session | 7.30am – 8.45am |

eftpos batch transactions

Mastercard batch transactions Cash transfers LVSS |

| 9.00 am processing session | 8.45am – 9.15am |

LVSS

Cash transfers |

| Daily settlement session | 9.15am – 4.30pm | All services(a) |

| Settlement close session | 4.30pm – 5.15pm | Settlement of queued transactions |

| Evening settlement session | 5.15pm – 10.00pm |

Cash transfers

Low value settlement service SWIFT(b) Property settlement batches(b) Austraclear(b) |

|

(a) Includes all batch transactions, LVSS, SWIFT, Austraclear, cash transfers

Source: RBA |

||

There are also restrictions on the types of payments that can settle in the RITS evening settlement session. Only ‘evening agreed’ settlement participants, as defined in the RITS Regulations, can participate fully in the evening settlement session from 5.15 pm onwards.[30] Consequently, to allow the settlement of remaining queued transactions at the end of the day session there is a 45-minute settlement close session. At the end of the settlement close session at 5.15 pm, any remaining queued payments that are not flagged as being ‘evening eligible’ are removed from the queue.

A.7 Liquidity Provision

To facilitate the settlement of payments in RITS, the Bank provides liquidity to members at low cost via its Standing Facilities. Under these facilities, a member can enter into a repo with the Bank; a repo transfers outright title of eligible securities to the Bank (upon purchase of securities) in return for a credit to the member's ESA, with an agreement to reverse the transaction at some point in the future. Standing facilities are available to any RITS member that is ‘approved’ by the Bank's Domestic Markets Department and settles its payments across its own ESA.

There are three types of repos that can be performed under the Bank's Standing Facilities:

- Intraday repos. For these repos, both the sale and repurchase occur on the same day. They are provided free of charge (except for a small settlement transaction fee), but must be reversed before the settlement of Austraclear transactions ceases in RITS.

- Overnight repos. In the exceptional case that a member is unable to reverse an intraday repo by the end of the day, the transaction may, with the approval of the Bank, be converted to an overnight repo. Interest would then be charged at 25 basis points above the cash rate target.

- Open repos. This type of repo does not specify the date on which the transaction will be reversed. The member retains the liquidity for use on future days. Open repos help members meet their settlement obligations without having to actively manage their liquidity, particularly outside of normal banking hours. Open repos were introduced to facilitate the settlement of evening DE payment obligations, the size of which are unknown prior to the close of the interbank cash market and Austraclear. They also support the settlement of NPP obligations arising in the FSS. For members that settle DE or NPP obligations across their own ESA, the Bank determines a minimum position in open repos that the member should maintain.[31] To the extent that these members retain matching funds against their open repo position (subject to an allowance for variations in ESA balances arising from settlement of DE and NPP obligations that occur outside of normal banking hours), those ESA balances are compensated at the cash rate target. However, to preserve the incentive for RITS members to remain active in the interbank cash market while it is open, ESA funds surplus to the ESA holder's open repo position (subject to the DE allowance) earn a rate rate 15 basis points below the cash rate target, while any shortfall in funds incurs a 25 basis point charge.[32]

Members can also source liquidity through term repos and some outright transactions conducted in the Bank's OMOs. The overall amount of ESA funds available via these operations is set by the Bank to support the implementation of monetary policy. These transactions usually involve counterparties selling debt securities to the Bank either under repo or outright. Similarly, as part of the comprehensive package of measures to support the Australian economy during the COVID-19 pandemic, the Bank purchases government bonds in the secondary markets.

A.8 Credit Risk and Collateral

The Bank is not exposed to any credit risk from the settlement of wholesale payments in RITS, or from the settlement of NPP payments in the FSS. Wholesale payments in RITS are settled using funds in members' RITS Allocation and payments settled in the FSS use the member's FSS Allocation. Neither of these allocations can be overdrawn, and the Bank does not guarantee any transaction submitted for settlement in RITS or the FSS.

The Bank does, however, incur credit risk through the provision of liquidity to members through OMOs and Standing Facilities to support the implementation of monetary policy and payments and settlement activity, respectively. It also incurs credit risk through the TFF and the foreign exchange (FX) swap line to support US dollar funding, both established in March 2020.[33] The Bank manages this credit risk by lending funds via purchase of securities under repo. Consequently, it would only face a loss if a RITS member failed to repurchase securities sold under repo and the market value of the securities fell to less than the agreed repurchase amount. To manage this risk, the Bank purchases under repo only highly rated debt securities denominated in Australian dollars and lodged in Austraclear. All securities purchased under repo are conservatively valued, and subject to haircuts and daily margin maintenance.

To enter into a repo with the Bank, an entity must meet eligibility criteria. Counterparties must be: a RITS member and an Austraclear member (and the legal entity holding the Austraclear account must be identical to the legal entity that is a participant in RITS); subject to ‘appropriate regulation’ (for example, an entity regulated by APRA, or a clearing and settlement facility overseen by the Bank); and able to ensure efficient and timely settlement of transactions within Austraclear. To access the Bank's Standing Facilities, an approved counterparty must also settle its payments across its own ESA.[34]

A.9 Access and Participation

Since settlement in RITS occurs using central bank money, only institutions that hold an ESA with the Bank can be settlement participants in RITS. Furthermore, since RITS is the only means of access to ESAs, all ESA holders must be RITS members and meet its operating conditions. The eligibility criteria to hold an ESA with the Bank therefore effectively represent the eligibility criteria for settlement participants in RITS. Policy on ESA eligibility is set by the Bank's Executive Committee, and is available on the Bank's website.[35] The policy has been designed to be fair and open, and to promote competition in the provision of payment services by allowing access to all providers of third-party payment services, irrespective of their institutional status. An updated ESA policy was published in July 2019 (see section 3.3.1).

ADIs are assumed to provide third-party payment services as part of their business so they are eligible by default. Australian-licensed CCPs and SSFs with payment arrangements that require Australian dollar settlement are also eligible to hold an ESA.[36] Only ESA holders that are also full participants or settlement participants as defined in the NPP Regulations are eligible to settle NPP payments in the FSS.

The ESA eligibility policy sets a number of risk-based participation requirements, including around operational capacity and access to liquidity. These are designed to reduce the likelihood that an individual member experiences an operational or financial shock that could disrupt the system more broadly. The application of participation requirements aims to be proportional to a prospective member's expected payments business in RITS.

ADIs with aggregate outgoing RTGS transactions of less than 0.25 per cent of the total value of wholesale RTGS transactions may use an agent to settle their RITS transactions, rather than settling directly across their own ESAs. This reduces the operational burden on smaller RITS members. Payments settled on an RTGS basis through the FSS are not included in the calculation of the 0.25 per cent threshold.

The Bank's ESA policy limits the scope for material risks to arise from tiered participation arrangements. Only ADIs individually accounting for less than 0.25 per cent of the total value of wholesale RTGS transactions may settle through an agent. Consequently no individual indirect member would be expected to pose material risk to either its agent or the system more broadly. Further, to reduce dependence on its agent, a member that participates indirectly has the option to hold a ‘dormant’ ESA for use in an extreme contingency where the availability or effectiveness of the RTGS services provided by its agent are compromised. To ensure that RITS has sufficient information about indirect participation, agents acting for ADIs that participate indirectly are required to report the value and volume of their ADI clients' outgoing RTGS payments to the Bank on a quarterly basis. This information is used to monitor compliance with the 0.25 per cent threshold.

Footnotes

The Bank does not presently assess FSS against the Principles. The Bank will continue to monitor developments in NPP and the FSS, and periodically review whether an assessment against the Principles should be conducted in future. [19]

For more information on these measures, see RBA (2020), ‘Supporting the Economy and Financial System in Response to COVID-19’. Available at <https://www.rba.gov.au/covid-19/>. [20]

For more information on the participant Business Continuity Standards, see RBA (2013), ‘Box E: Participant Business Continuity Standards’, 2013 Self-assessment of the Reserve Bank Information and Transfer System, p 27. [21]

Available at <https://www.rba.gov.au/payments-and-infrastructure/rits/about.html>. [22]

Payments Policy Department and Payments Settlements Department are separate departments in the Bank's organisational structure, with separate reporting lines up to and including the level of Assistant Governor. [23]

For more information on the NPP and FSS, see RBA (2018), ‘Box B: The New Payments Platform and the Fast Settlement Service’, ‘Assessment of the Reserve Bank Information and Transfer System’, pp 7–9. Available at <https://www.rba.gov.au/payments-and-infrastructure/rits/self-assessments/2018/pdf/2018-assess-rits.pdf>. [24]

Payments will only trigger ‘auto-offset testing’ if they have been in the queue for at least one minute. [25]

For example, a member may wish all small SWIFT transactions to be given an ESA Status of priority to allow them to settle quickly out of the priority tranche of ESA funds; transactions above the member-set threshold could be given a status of active to allow manual liquidity management for these transactions. [26]

That is, the cash leg of the transaction is settled on a gross basis simultaneously with the transfer of the security. [27]

To ensure that a batch administrator can administer the batch in a safe and efficient manner, the Bank requires that it meets certain risk-based requirements. For more information, see <https://www.rba.gov.au/payments-and-infrastructure/rits/information-papers/eligibility-criteria-for-batch-administrator/>. [28]

During AEST, the 7.15 pm and 9.15 pm DE settlements occur after the close of the interbank cash market. However, during AEDT, Austraclear and SWIFT transactions continue to be settled until 8.30 pm, so only the last DE settlement occurs outside normal banking hours. [29]

RITS members do not have to be evening agreed if they only participate in DE and property settlements after 5.15 pm. [30]

To limit the need for ESA holders to contract intraday repos on a regular basis, the Bank may agree to contract an amount of open repos (at the cash rate target) over and above the stipulated minimum position. This includes ESA holders that do not participate directly in the settlement of DE obligations in RITS. These maximum permitted positions in open repos are reviewed at least annually. [31]

For further details, see https://www.rba.gov.au/mkt-operations/resources/tech-notes/standing-facilities.html. [32]

For operational notes on the TFF, see <https://www.rba.gov.au/mkt-operations/term-funding-facility/operational-notes.html>. [33]

For more information on the Bank's counterparty eligibility criteria, see <https://www.rba.gov.au/mkt-operations/resources/tech-notes/eligible-counterparties.html>. [34]

The ESA Policy is available at <https://www.rba.gov.au/payments-and-infrastructure/esa/>. [35]

Under the Bank's Financial Stability Standards for Central Counterparties a CCP that the Bank determines to be systemically important in Australia and has Australian dollar obligations is required to settle its Australian dollar obligations across its own ESA or that of a related body corporate acceptable to the Bank. The updated ESA Policy places an equivalent requirement on SSFs that are systemically important in Australia and have Australian dollar obligations. [36]