The Non-Accelerating Inflation Rate of Unemployment (NAIRU)

Download the complete Explainer 169KBHistorically, a key challenge for policymakers is to achieve a low rate of unemployment without fuelling excessive increases in wages growth and inflation. Economists call the lowest rate of unemployment that achieves this the ‘non-accelerating inflation rate of unemployment’, or NAIRU.

This Explainer outlines the concept of the NAIRU, the importance of the NAIRU, and the factors that determine its level.

What is the NAIRU?

The NAIRU is the lowest unemployment rate that can be sustained without causing wages growth and inflation to rise. It is a concept that helps us gauge how much ‘spare capacity’ there is in the economy. The NAIRU cannot be observed directly. However, we can infer things about the NAIRU from other variables that can be observed, and which give clues about the level of spare capacity in the economy.

Box: Refresher

Unemployment rate

The unemployment rate is the percentage of people in the labour force who are willing and able to work, but do not currently have jobs. ‘Full employment’ is where there are enough jobs for people who are available and want to work. It should be noted that full employment does not mean zero unemployment because some people might be unemployed as a result of skill mismatches or as they move between jobs (see Explainer: Unemployment: Its Measurement and Types).

Inflation

Inflation is the rate at which prices of goods and services that households buy increase. The Reserve Bank has the objective to achieve price stability – that is, low and stable inflation – which preserves the value, or purchasing power, of money over time (see Explainer: Inflation and its Measurement).

What is ‘spare capacity’? There will be spare capacity in an economy when aggregate demand for goods and services is less than the economy's capacity to produce them. As spare capacity decreases, businesses have difficulty finding enough suitable workers. As a result, businesses may offer higher wages to attract and retain workers, and they may increase the prices of their products to cover their higher labour costs. More jobs and higher wages result in greater spending, further increasing aggregate demand and the scope for businesses to increase the prices of their products, ultimately leading to an increase in inflation. When spare capacity increases, the reverse is true (demand for workers falls; there is downward pressure on wages growth and prices; and inflation falls).

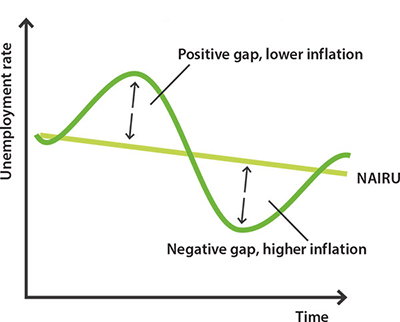

A key indicator of spare capacity in the economy is the difference between the NAIRU and the unemployment rate – sometimes known as the ‘unemployment rate gap’ (and also referred to as the ‘unemployment gap’). Even though we cannot directly observe the NAIRU, if wages growth and inflation are decreasing, there is likely to be spare capacity in the economy; we can conclude that the unemployment rate is above the NAIRU. On the other hand, if wages growth and inflation are increasing, there is likely to be insufficient capacity in the economy; we can conclude that the unemployment rate is below the NAIRU. When there is no unemployment rate gap, the NAIRU is equal to the unemployment rate consistent with the economy operating at its full capacity.

Why is the NAIRU important?

Measures of the NAIRU are one of several tools policymakers use to assess how far the economy is from full capacity and what this means for labour market outcomes, wages growth and inflation.[1] For example, the NAIRU is considered by the Reserve Bank when setting monetary policy in order to achieve its objectives of full employment and low and stable inflation. In particular, the Reserve Bank uses the estimated unemployment rate gap as a tool for forecasting wages and inflation, which helps to assess how far it is from its objectives and what it can do to achieve those objectives:

- If the unemployment rate is higher than the NAIRU, the economy would not be at full employment and there would be downward pressure on inflation. If inflation is likely to be below the inflation target, the Reserve Bank might want to stimulate the economy by lowering the cash rate and/or implementing unconventional policies (see Explainer: Unconventional Monetary Policy). This encourages spending, thereby stimulating aggregate demand and reducing spare capacity (see Explainer: Transmission of Monetary Policy).

- If the unemployment rate is lower than the NAIRU, the economy is operating above its full capacity, and there is upward pressure on inflation. If inflation is likely to be above the inflation target, the Reserve Bank might want to cool the economy by raising the cash rate and/or withdrawing other policy support. This would help to reduce aggregate demand and inflationary pressures.

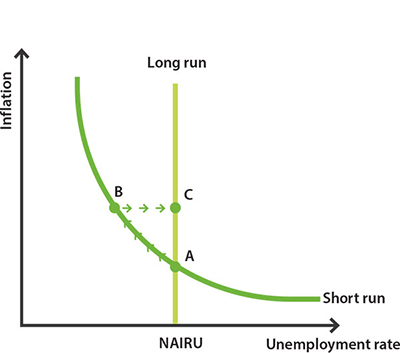

In the short run, there is a trade-off between the Reserve Bank's monetary policy objectives because unemployment and inflation move in opposite directions in response to changes in interest rates. By reducing interest rates, the Reserve Bank could lower unemployment if it is willing to accept higher inflation – or, by increasing interest rates, it could reduce inflation at the cost of higher unemployment. However, it cannot sustainably achieve both unemployment that is below the NAIRU and low and stable inflation at the same time.

The trade-off between unemployment and inflation is summarised by the short-run Phillips Curve. Say the economy is at point A: the unemployment rate is equal to the NAIRU and inflation is low and stable. The Reserve Bank could use monetary policy to stimulate the economy and reduce the unemployment rate below the NAIRU. As a result, the economy moves from point A to point B in the short run, where the unemployment rate is lower and inflation is higher. The further the unemployment is below the NAIRU, the faster inflation will accelerate.

In the long run, however, there is no trade-off between unemployment and inflation because households and businesses expect that a lower unemployment rate will cause higher inflation – that is, they have factored this into their ‘inflation expectations’. Workers now demand increases in wages in anticipation of higher future inflation and as the cost of their labour increases, some businesses will reduce the number of people they employ. This continues until the unemployment rate equals the NAIRU again, and inflation stabilises at a higher level, as shown by point C. The unemployment rate will always return to the NAIRU in the long run, and any attempt to lower the unemployment rate to below the NAIRU will increase inflation. Therefore, the long-run Phillips Curve can be thought of as a straight, vertical line.

The implication of the short- and long-run Phillips Curves is that monetary policy can influence fluctuations in the unemployment rate around the NAIRU in the short run, but it cannot easily change the long-run level of the unemployment rate. To do this, policymakers must look beyond monetary policy to the government policies that more directly influence the NAIRU.

What determines the level of the NAIRU?

Many factors can potentially influence the level of the NAIRU. In recent decades, estimates of the level of the NAIRU both in Australia and internationally have been declining. Some possible factors contributing to this include:

- Globalisation: As economies have become more integrated, the supply of goods and services from overseas has increased, thereby increasing competition for domestic businesses. Competition discourages businesses from raising prices even if unemployment falls because consumers can switch to international suppliers. This lowers the unemployment rate at which inflation begins to accelerate (i.e. the NAIRU).

- Government training and skills programs: Training and reskilling programs can help ensure that workers have the necessary skills to get a job. This increases the pool of workers available to fill a job opening, meaning that the unemployment rate can go lower before businesses have to resort to offering higher wages to attract and retain suitable employees.

- Ease of finding suitable work: Technological developments, such as the internet, have made it easier for businesses to find suitable workers and for the unemployed to find suitable jobs. The quicker ‘matching’ process means that less time is spent searching, thereby increasing the number of workers in the economy that can be productively employed at any time, which means a lower NAIRU.

- Employee bargaining power: Workers' bargaining power during pay negotiations affects wages growth. Lower bargaining power – for example, due to lower union membership – reduces the ability of workers to demand higher wages. In this case, a lower level of the unemployment rate might be needed to cause wages growth and inflation to pick up.

- Underemployment: The underemployment rate is the share of workers who want, and are available to work, more hours. If underemployment is elevated, businesses may be able to increase the hours of existing employees in response to higher demand, rather than compete with other businesses to hire new workers by increasing wages.

- Long-term unemployment or labour scarcity: Long periods of unemployment can decrease a person's job prospects; for example, if they lose skills. Periods of high unemployment can therefore contribute to a higher NAIRU by reducing the pool of suitable workers available to businesses – an effect known as ‘hysteresis’. However, it is also possible that when workers are hard to find, employers will be willing to hire people with lower skills, which could contribute to a lower NAIRU over time.

There are different ways to estimate the NAIRU, using various statistical models. While the true value of the NAIRU cannot be known, and any estimate has a range of uncertainty around it, research by the Bank pointed to the NAIRU for Australia being below 5 per cent prior to the COVID-19 pandemic.[2]

Endnotes

The RBA looks at a broad set of information to assess how close the labour market is to full employment, including a range of labour market indicators and model-based estimates. For more information, see Chapter 4 of the February 2024 Statement on Monetary Policy. [1]

See, for example, Graph 4 in Assistant Governor Luci Ellis's speech Watching the Invisibles. [2]