Speech Australian Fixed Income Markets – Recent Developments and a Look Ahead

It is a pleasure to be at the Australian Government Fixed Income Forum here in Tokyo. Today I will talk about two topics that relate to the government bond market in Australia. They are:

- how conditions fared through the recent failures of several banks in the United States and Europe

- how the wind-down of the Reserve Bank’s balance sheet is affecting markets.

Market conditions through the recent banking shock

The failure of three US banks in early March, one of which was quite large, and the demise of Credit Suisse soon after, was a shock to global markets. Many people were attentive to the possibility of financial strains as interest rates rose around the world, but I think it is fair to say that relatively few believed these strains would lead to major bank failures, given the efforts over recent years in strengthening bank regulation.

The recent events were unexpected and led to pronounced moves in international markets. Government bond yields saw large movements in both directions, credit spreads widened, liquidity in secondary markets fell and issuance in primary markets dried up for a time. Conditions have of course since stabilised.

In Australia we witnessed many of the same developments. But a consistent theme – based on our own observations and on what we heard in market liaison – was that Australian markets fared relatively well throughout this period.

Starting in money markets, these events saw risk premiums widen slightly in Australia but not to unusual levels. The spread of short-term bank paper to overnight indexed swap (OIS) rates widened by around 25 basis points at the three-month tenor, which was well within its recent range. The yields on bank paper did not actually rise, but rather the widening in spreads was driven by falls in OIS rates. In comparison, money market spreads in some other economies rose sharply to be outside recent ranges.[1]

In the government bond market, we saw significant volatility as yields in Australia closely tracked those in the US Treasury market. This volatility reflected the market’s changing assessment of the likelihood that the offshore banking stress would become systemic and lead to a downturn across much of the global economy, to which central banks would respond.

However, this volatility did not reflect market dysfunction. The Australian bond market continued to function through this period, albeit with a modest decline in liquidity and a widening of bid-offer spreads. Our market liaison indicated that there was no forced selling or other Australian bond market-specific factors. Rather, bond dealers reported that trading volumes had declined because clients were taking a ‘wait and see’ approach and reducing their discretionary trading activity due to the heightened uncertainty. Bond dealers did not report wholesale cuts in clients’ risk positions or one-sided selling flows, as had been the case during the dysfunction in March 2020. This allowed them to continue to warehouse and clear risk. Within a week or so, conditions had more or less returned to normal.

Overall, conditions in the Australian Government bond markets compared favourably with some other advanced economy markets over this period. For example, in other markets liquidity fell further and yield anomalies along the curve increased more noticeably.[2]

Turning to the primary market, the Australian Government and semi-government authorities continued to issue bonds during the height of the stress in early March. Semis issuance actually increased that month. We did see a pause in bank and corporate issuance by Australian entities around that time, as was the case in most countries. But issuance resumed after a week or so. In fact, in March, issuance by Australian banks, as a whole, was above average, with most of that issuance occurring after the failure of Silicon Valley Bank, including some large deals in offshore markets – this is notable given the offshore stresses were concentrated in banks. Spreads on longer term Australian bank debt also widened slightly, but again remained well within their recent range. Taking a wider perspective, Australian banks are well ahead of their funding needs and have the flexibility to adapt their issuance to market conditions as needed.

It is difficult to be definitive about the reasons for the robust performance of Australian markets through this period, but there are a few factors that likely contributed.

The most important factor is the strength of the Australian banking system. Australian banks are well regulated, highly liquid and have capital levels that are ‘unquestionably strong’. Indeed, Australia is the only jurisdiction that requires large banks to hold Pillar 1 capital against interest rate risk in the banking book; interest rate risk is of course the risk that was poorly managed by Silicon Valley Bank and led to its collapse. While volatility in global markets was transmitted to Australia, the underlying driver of that volatility – a fear of systemic banking stress – was never an issue domestically.

In addition, several aspects of the bond market itself have contributed to resilient liquidity with a good balance of supply and demand. In particular, the government’s borrowing needs are relatively modest when compared with similar economies, while demand from both domestic and offshore investors is consistently strong, reflecting Australia’s sound financial management. In addition, both the Reserve Bank and the AOFM operate securities lending facilities that allow market makers to borrow bonds, against cash or other collateral, at a modest fee. This gives market makers the confidence to quote prices knowing they will be able to cover any shorts quickly and relatively cheaply.

Effect of the unwinding of the Reserve Bank’s balance sheet on markets

The second topic I’d like to talk about is the evolution of the Reserve Bank’s balance sheet and how this is interacting with markets.

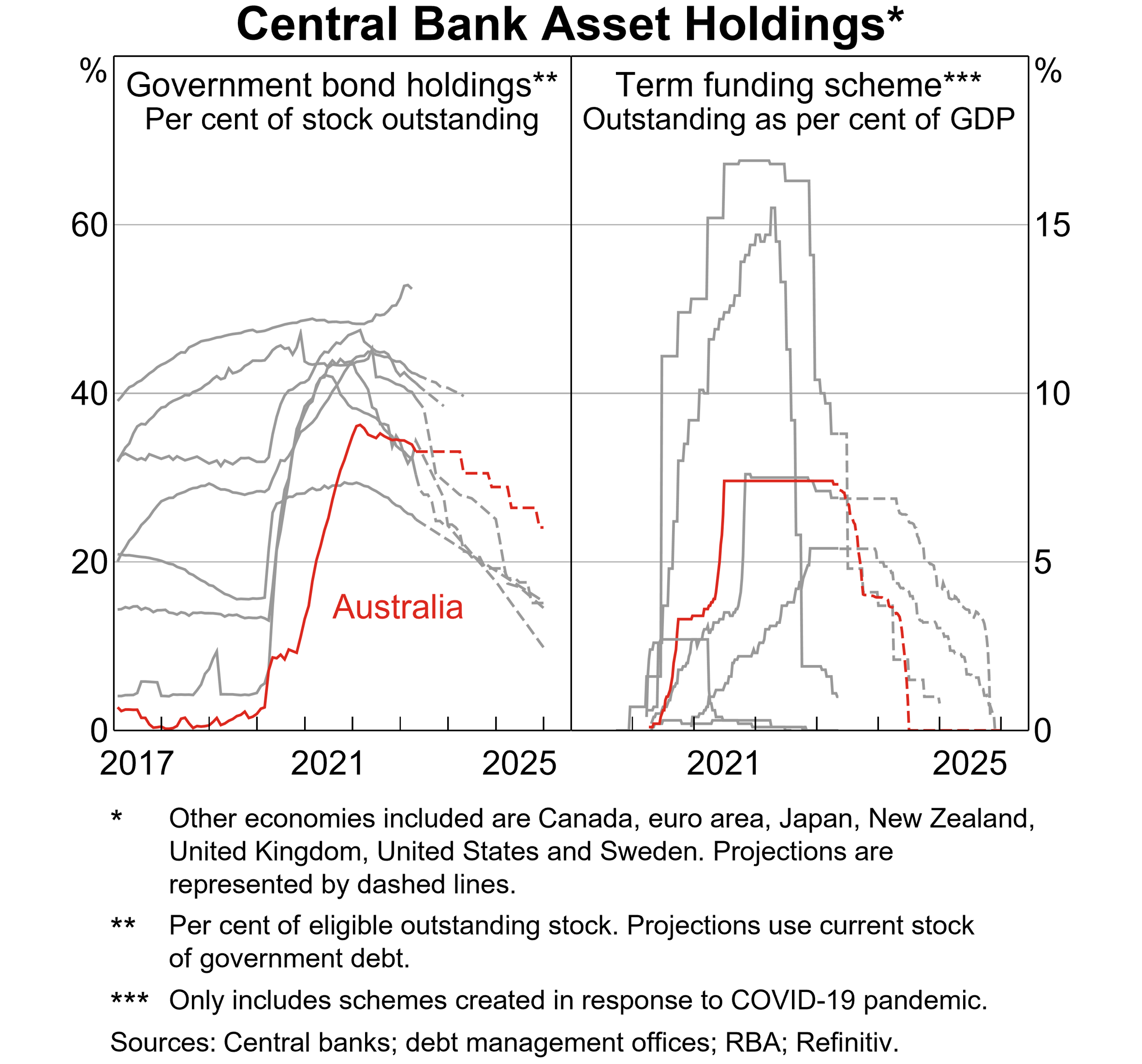

Like most central banks, the Reserve Bank significantly expanded its balance sheet during the pandemic to support markets and the economy. The Bank purchased around $360 billion of government bonds and provided around $190 billion of three-year funding to banks under the Term Funding Facility (TFF). The size of these programs was within the range of peer countries, when scaled for the size of the domestic bond markets and the economy.

The Bank’s bond purchases did lead to dysfunction in some parts of the bond market, for some periods. But, in other ways, they arguably helped market functioning, and we avoided broader impairment of the market; the mid-to-longer end of the yield curve remaining liquid throughout.[3] The adverse effects on market functioning were most obvious for bonds around the three-year mark where we bought a very large share of the bonds outstanding.[4] Our securities lending has helped to alleviate the shortages of these bonds. And conditions are now returning to normal: demand to borrow these shorter maturity bonds from the Bank has been falling recently as private investors have sold short-term bonds to extend their holdings out the curve.[5]

Turning to the future, our balance sheet has now started to unwind. Around $20 billion of purchased bonds have matured, and the pace of these maturities will increase to around $35–45 billion per year. TFF funding also recently started to mature, with around $4 billion having been repaid so far and large maturities due ahead of September this year and June next year.

This unwinding of the balance sheet will have a number of interrelated effects on the Australian financial system, as it works its way across bank funding, the bond market and money markets. We expect this process to run smoothly, though are attentive to the challenges involved.

Starting with the TFF, the banks drawing on this facility were able to lower their funding costs. In addition, they also effectively received a so-called ‘liquidity upgrade’ because the facility allowed funding to be secured by a broad set of collateral. Banks mainly pledged securitised mortgages to the Reserve Bank as collateral and in return received very liquid central bank reserves in the form of Exchange Settlement (ES) balances. This boosted their high-quality liquid asset (HQLA) holdings and so their liquidity coverage ratios (LCRs).[6]

As the TFF matures, this process will go into reverse – liquid assets (and liquidity ratios) in the banking system will fall if banks do not respond. Banks can offset this drain of liquidity in two ways, and they will likely use both to varying extents:

- Banks can acquire other forms of HQLA, which in Australia means Australian Government Securities (AGS) or semi-government bonds (semis). And that has indeed been happening, with banks purchasing large amounts of these bonds over recent months.

- Alternatively, banks can reduce their need to hold liquid assets by shifting their funding from shorter term to longer term debt. This has also been happening lately. Banks have issued large volumes of long-term bonds and have encouraged their depositors to shift from at-call deposits towards term deposits (by offering attractive returns).[7]

So that process of balance sheet adjustment in the banking system is well underway.

Turning to the government bond market, as the Reserve Bank’s holdings of government bonds fall the private sector will need to absorb more issuance, all else equal (including as maturing bonds are refinanced). This process might place some upward pressure on yields, but any effect is likely to be modest for several reasons. First, the unwinding of our holdings should already be largely reflected in market pricing. Second, as I just mentioned, banks are looking to build up their holdings of AGS and semis to maintain their liquid assets, which creates natural demand.[8] Third, the funding needs of the Australian Government remain relatively modest in an international context.

Finally, the decline in our balance sheet will be important for money markets. Both TFF maturities and the fall in the Bank’s government bond holdings will drain ES balances.[9] Lower ES balances may see the traded cash rate increase a little within the corridor and cause a slight increase in money market rates relative to OIS rates.[10]

The decline in ES balances will be particularly rapid as the TFF rolls off; this has the potential to cause some strains, even though ES balances will remain abundant. Reserves will roughly halve between now and June next year. We will monitor this closely and respond if necessary, but our expectation is that the process will run smoothly. ES balances will remain well above pre-pandemic levels for some time, so will be ample for the banking system’s payment needs. In addition, the Reserve Bank’s current framework for implementing monetary policy should support the transition to lower ES balances. In particular, we fill all reasonable approaches to our open market repo operations that meet our preferred term and repo rate requirements, so banks can access the liquidity they need. We can also adapt these operations quickly if needed to ensure the cash rate remains consistent with the target set by the Board and liquidity remains available to those that require it.

Before concluding, it is worth noting that in May the Board reviewed the Bank’s approach to reducing its holdings of government bonds, as was discussed in the Minutes to the Board meeting. The Board agreed that the current approach of holding the bonds until they mature, which was adopted a year ago, remains appropriate for the time being. This approach recognises that the Bank’s balance sheet is already set to decline rapidly given the maturity of funding under the TFF. It also recognises that bond sales by the Bank might complicate the government’s bond issuance and reduce the effectiveness of any future quantitative easing program.

The Board also agreed that it is appropriate to review this approach periodically. The maturity of the initial tranche of TFF funding in coming months will provide information on how financial markets respond as the Bank’s balance sheet declines.

Conclusion

To briefly recap, Australian markets successfully weathered the recent volatility associated with stresses in some offshore banks. More broadly, markets have been resilient despite the sharpest tightening in monetary policy in over 30 years.

As always, the future is uncertain and holds challenges, and the coming run-down of the Bank’s balance sheet will involve an unprecedented draining of liquidity. We have sound institutional settings and our base case is that this process will run smoothly. We also have the tools to respond if any issues arise.

Thank you for your time.

Endnotes

I am grateful to Richard Finlay for his help in preparing these remarks. [*]

The cost of borrowing US dollars increased for a period in some of the major foreign exchange swap markets. That prompted a number of central banks to increase the frequency of their US dollar swap line operations from weekly to daily. By contrast, there was little evidence of increased US dollar demand in the Australian dollar swap market, which continued to function well. [1]

Although in an absolute sense, larger advanced economy government bonds markets such as the US Treasury market are of course more liquid than the Australian Government bond market. [2]

See RBA (2022), ‘Review of the Bond Purchase Program’. [3]

See RBA (2022), ‘Review of the Yield Target’. [4]

These developments are also visible in the bond-futures basis – that is, the discrepancy between futures prices and bond yields (after adjusting for repo costs), which should be zero in a perfectly liquid and frictionless market. The basis spiked in early 2020 for both the three-year and 10-year futures contact, as arbitragers withdrew from the market and pricing anomalies emerged. The 10-year basis narrowed back to normal levels relatively quickly, and stayed there, whereas the three-year basis remained elevated in absolute terms throughout the course of our bond buying. More recently, however, it has narrowed to be closer to pre-pandemic levels. [5]

Note that LCRs rose for a time, but in aggregate are currently back to pre-pandemic levels, with banks’ higher HQLA holdings offset by the phase-out of the Committed Liquidity Facility and higher net cash outflows. [6]

Another implication of the TFF was that banks locked in fixed-rate funding for three years on their TFF liabilities, against a floating-rate exposure on the ES balance assets that they acquired. As touched on above, Australian banks typically carry very little interest rate risk, and so banks largely hedged the fixed-rate/floating-rate mismatch as they drew down TFF funding, either in the swap market or by writing fixed-rate loans to offset their fixed-rate TFF borrowings. This means there will be little additional impact on net interest margins or bank profits as TFF funding matures. [7]

The end of the Committed Liquidity Facility, which was fully phased-out to zero on 1 January 2023, has also supported HQLA demand from banks. See RBA (2022), ‘Committed Liquidity Facility’. [8]

The TFF does so directly, as banks use their ES balances to repay loans. Bond maturities do so indirectly, as banks use ES balances to purchase newly issued government bonds from the AOFM, and as the AOFM in turn uses those ES balances to redeem maturing bonds from the Reserve Bank. [9]

Banks are also likely to continue issuing relatively large volumes of term debt and/or asset-backed securities, both to pay for HQLA and to shift their funding sources away from shorter term instruments. All else equal, this will affect pricing via higher spreads between bank bonds and the swap rate, and higher FX hedging costs for debt issued offshore. Markets are of course forward-looking and understand this dynamic; reflecting this, we’ve seen the spread to swap of bank bonds rise to be a little above pre-pandemic levels. This reversed the steep fall seen over 2020, where low issuance and a portfolio-rebalancing effect related to Bank’s government bond purchases depressed the spread to very low levels. [10]