Economic Growth

Download the complete Explainer 243KBWhat is Economic Growth?

Economic growth refers to an increase in the size of a country's economy over a period of time. The size of an economy is typically measured by the total production of goods and services in the economy, which is called gross domestic product (GDP).

Economic growth can be measured in ‘nominal’ or ‘real’ terms. Nominal economic growth refers to the increase in the dollar value of production over time. This includes changes in both the volume of production and the prices of goods and services produced. Economists normally talk about real economic growth – that is, increases in the volume produced only, which takes away the effect of prices changing. This is because it better reflects how much a country is producing at a given time, compared with other points in time.

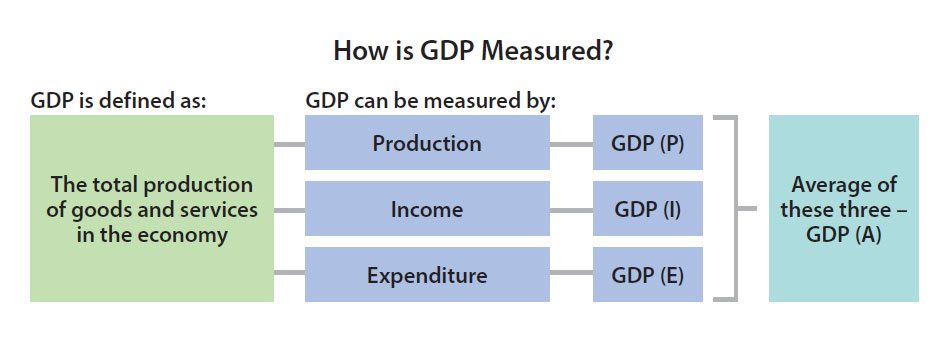

How is GDP Measured?

To measure GDP each quarter, the Australian Bureau of Statistics (ABS) collects data from households, companies and government agencies. The ABS then calculates GDP in three different ways, looking separately at information about production (P), income (I) and expenditure (E). The three definitions of GDP are:

- GDP(P): total value added from goods and services produced

- GDP(I): total income generated by employees and businesses (plus taxes less subsidies)

- GDP(E): total value of expenditure by consumers, businesses and governments on final goods and services.

These are three different ways to estimate the same thing. In practice, different results can be obtained because there are never enough data to build a complete picture of the economy. Many economic activities have to be estimated and measurement errors arise. In Australia, the ABS and economists generally focus on the average of the three measures – GDP(A).

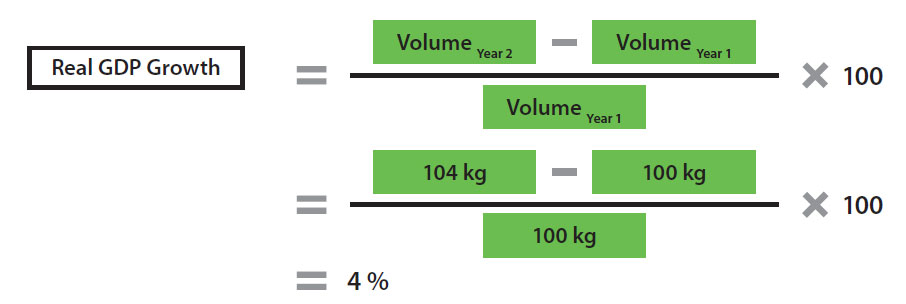

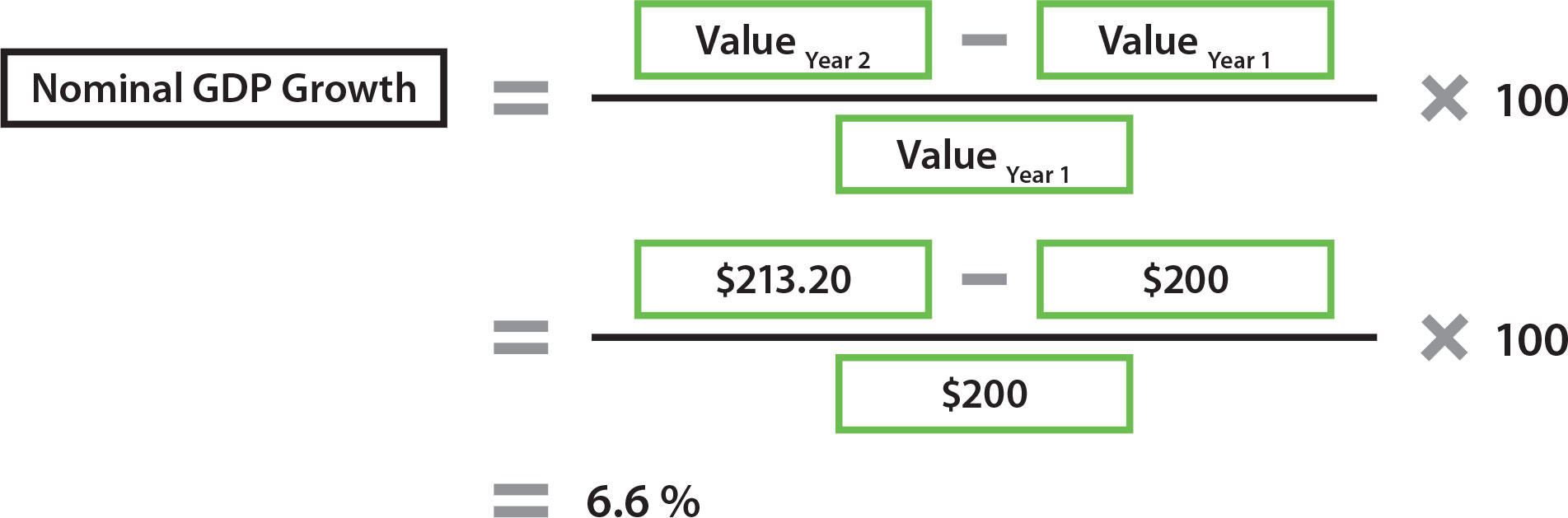

Box: Real versus Nominal GDP – An Example

Nominal GDP is the dollar value of the goods and services produced in a time period, which depends on the volume of what was produced and the prices of what was produced. Real GDP captures only the volume of what was produced.

The calculation of real and nominal economic growth can be shown using an example of an economy that only produces one good - let's say it is apples.

Suppose that in year 1, the volume of apples produced was 100kg and the price of apples was $2 per kg, so the total value of production was $200 (100 x $2). In year 2, 104kg of apples were produced and the price was $2.05 per kg, so the total value of production was $213.20 (104 x $2.05).

In this example, nominal GDP growth (6.6 per cent) is more than real GDP growth (4 per cent) because it includes the increase in prices over the period. (The sum of the growth rates of real GDP and prices is close to, but not exactly equal to, the growth rate of nominal GDP.)

What's not Captured in GDP Statistics?

While GDP is the main measure of economic growth, it doesn't capture everything that adds value to the economy. One example is that caring for children is not included in GDP if carried out by their parents (but is if it is done by a paid childcare worker).

GDP doesn't capture broader aspects of economic welfare of the nation's population. For example, if GDP rose by 2 per cent one year, but the population grew by 4 per cent, then average GDP per person would have decreased. Similarly, GDP doesn't tell us anything about how evenly national income is split across the population. Income may have increased for everyone, or may have been concentrated in certain groups.

Finally, there are things that raise GDP but don't make the country better off. One example is the initial spending to replace buildings and infrastructure after a natural disaster, which boosts measures of economic growth.

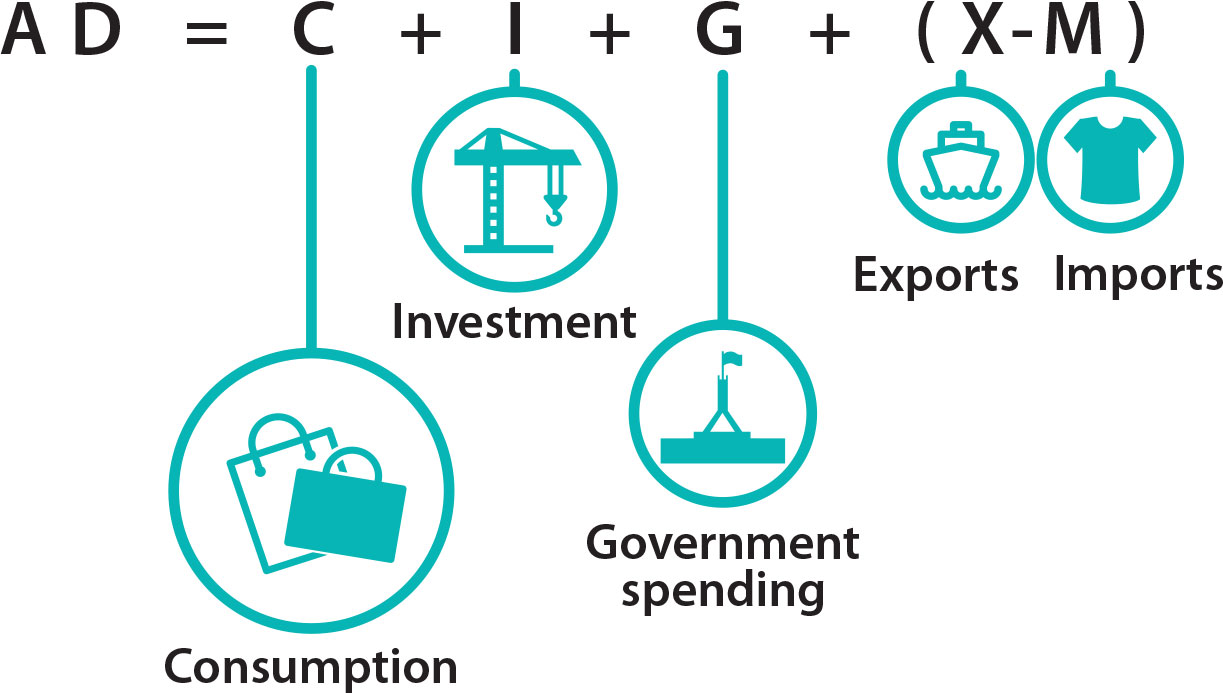

What is Aggregate Demand?

Aggregate demand (AD), like GDP(E), refers to the total level of spending in the economy. Consequently, when aggregate demand is measured it is the same as GDP(E). Aggregate demand includes household spending (also called consumption, C), investment by businesses and households (I), spending by the government (G) and net spending from overseas (X-M).

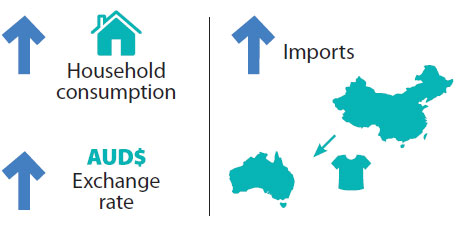

Consumption

Household consumption (C) refers to spending by households on things like rent, groceries and utilities. It makes up the largest share of aggregate demand. The level of consumption by each household is largely dependent on their level of income (Y). Household income that is not spent, is saved (S).

When household income increases, household spending usually increases as well. The amount of extra consumption for an extra dollar of income is called the marginal propensity to consume (MPC).

Box: The Simple Multiplier

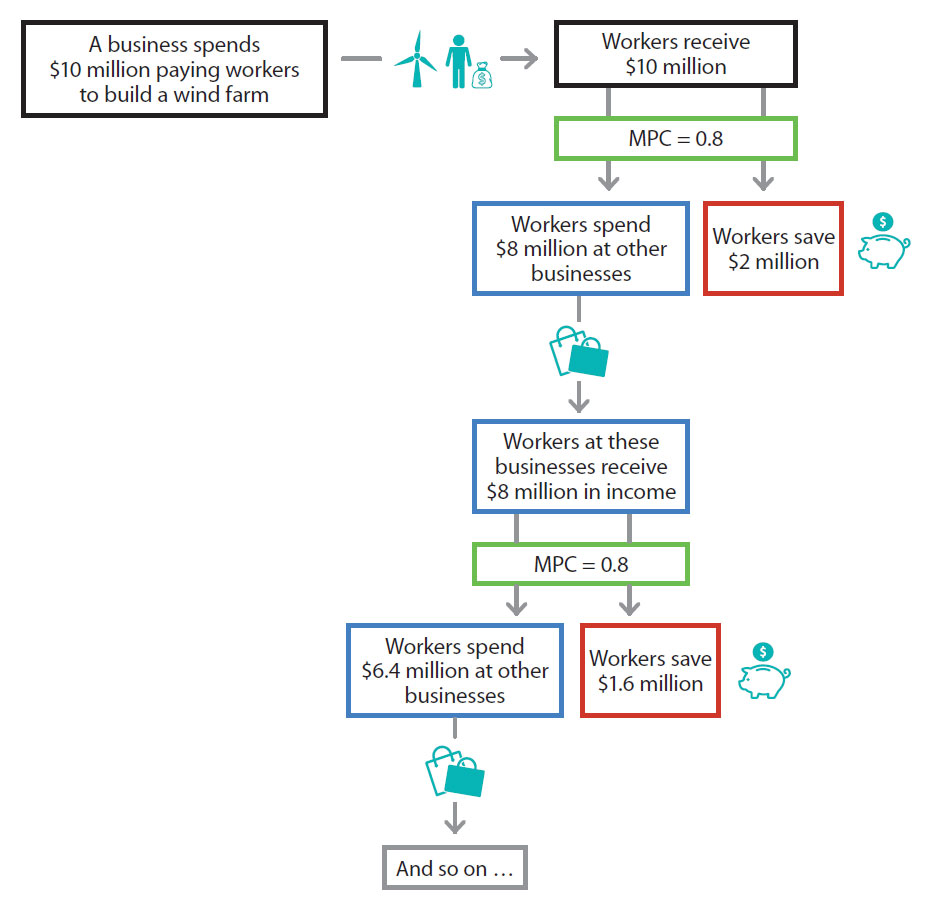

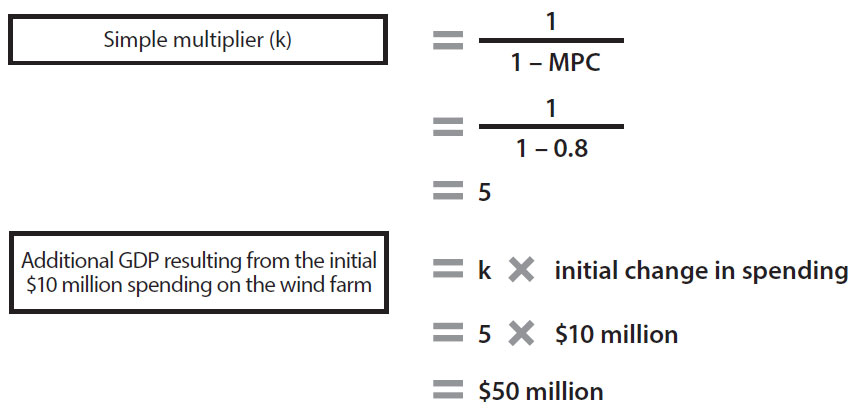

The simple expenditure multiplier refers to how much additional GDP results from an initial change in expenditure. An initial increase in expenditure can lead to a larger increase in economic output because spending by one household, business or the government is income for another household, business or the government. For example, suppose a business decides to build a wind farm in a small town and spends $10 million in the first year. That $10 million would go to engineers and others involved in constructing the wind farm. If their MPC is 0.8, those people will spend $8 million on goods and services and save $2 million. The businesses and individuals receiving that $8 million will in turn spend $6.4 million and so on. So the initial $10 million investment results in a much larger increase in GDP. The total amount of additional GDP can be calculated using the simple multiplier (k). In this example, the multiplier is 5 (that is, 1/(1–0.8)), such that the initial $10 million investment results in $50 million in additional GDP.

A number of factors other than current income are also important for household spending. If households expect to have higher income in the future, household spending will generally increase. Similarly, if household wealth increases, for example, due to rising housing prices, there will likely be an increase in household spending.

Investment

In economic terms, investment refers to spending by businesses and households that increases the economy's capacity to produce goods and services. This includes building new houses and offices, purchasing machinery, constructing roads and other physical infrastructure, as well as purchasing computer software and undertaking research and development. The level of investment in the economy is determined by a range of factors including interest rates, expected profits, government policy and changes in technology.

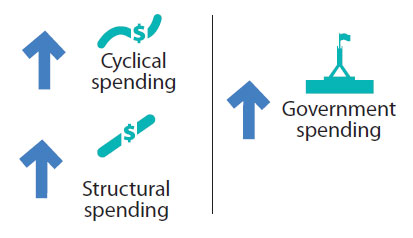

Government spending

Governments spend money on hospitals, schools, defence, roads, transport and more. Government spending can be either structural or cyclical. Structural spending occurs regardless of the state of the economy; it includes, for example, spending on education, health services and defence. Other spending is more cyclical. For example, in an economic downturn when the unemployment rate has increased, there will be more government spending on programs to support the unemployed.

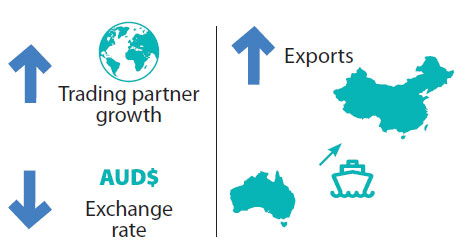

Net Exports

Net exports are made up of the spending on exports minus spending on imports. The spending of imports is subtracted from that on exports because GDP measures production within a country, and imports are produced overseas.

Exports refer to goods and services that Australian businesses sell to other businesses, households and governments overseas. The level of our exports is generally higher when growth in our major trading partners is strong because our exports are used in production in these economies. Australia's exports of iron ore and coal to China have grown rapidly over the past decade, as they are inputs into steel production in China. Steel has been used in the construction of apartment buildings and infrastructure in China, as the economy has grown strongly. Australian exports are also generally higher when the Australian dollar exchange rate is low because it becomes cheaper for other economies to buy Australian goods and services.

Imports are goods and services that Australian businesses, households and the government buy from overseas. The level of imports depends on the strength of the other components of aggregate demand. This is because some household consumption goods and services, investment and government purchases are imported. For example if household consumption is strong, part of this would be imported, so imports would be stronger too. The level of imports also depends on the Australian dollar exchange rate. Imports are generally higher when the Australian dollar exchange rate is stronger, because it becomes cheaper to buy goods and services from overseas.

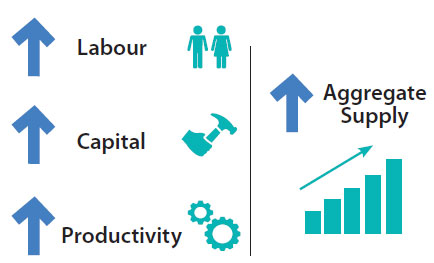

What Factors Affect Aggregate Supply?

Aggregate supply refers to the total output of goods and services in the economy. Aggregate supply is determined by the level of inputs available to produce goods and services, and how efficiently these inputs are used. The main inputs into production are labour and capital. The amount of labour available depends on how many people there are in the economy (population) and how many of them are working or would like to work (the participation rate). Capital refers to things that are used in production. Capital can be tangible, such as buildings, machinery and equipment, or intangible, such as research and development. Productivity refers to how much can be produced with a given set of inputs.

Productivity growth occurs when we find ways to produce more with a given amount of labour and capital. Productivity growth is often associated with increases in efficiency and advances in technology. Increases in aggregate supply increase the productive capacity of the economy (usually called potential output).

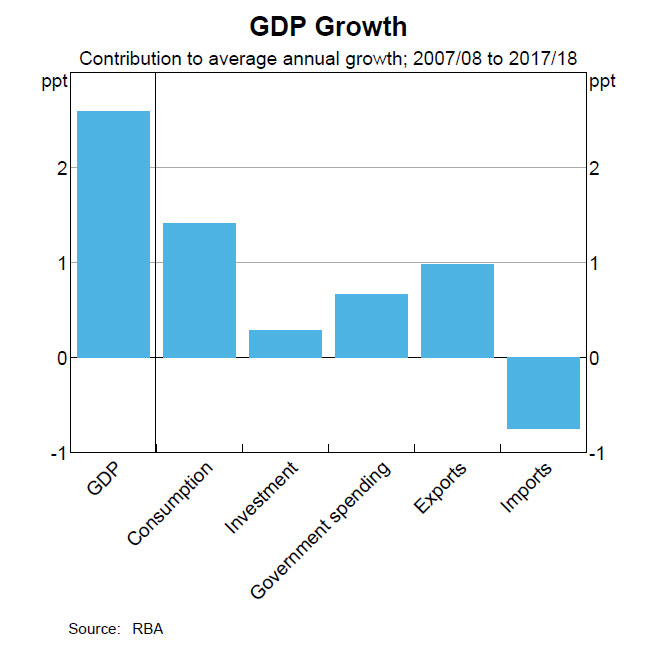

Box: Contributions to GDP growth

Each of the components of aggregate demand contribute to growth in GDP. The size of the contribution to growth is determined by both the size of the component and its growth rate. For example, consumption accounts for more than half of GDP and tends to grow at a steady rate, so it almost always makes a large contribution to GDP growth. Smaller components can have more volatile growth, and have large effects on GDP growth. Mining investment is one example which accounts for a small share of GDP but has recorded large swings over the past decade associated with the resources boom and its slowdown, so it has made large contributions to, and subtractions from, growth at different points in time.

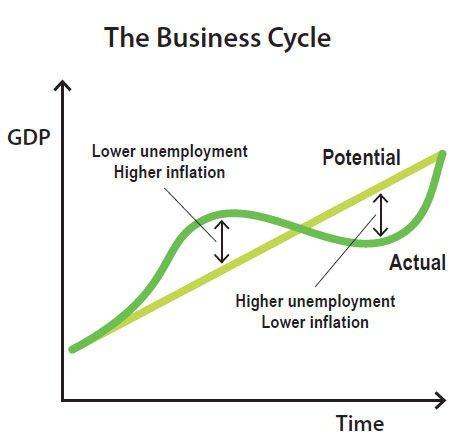

Trends in the Business Cycle

The business cycle refers to fluctuations in economic growth relative to growth in potential output. Monetary policy is one tool used to smooth fluctuations in the business cycle (see Explainer: What is Monetary Policy?).

In the upswing stage of the business cycle, there is usually strong growth in GDP and employment. As a result, the unemployment rate declines and inflation starts to increase. The period of 2005–08 could be characterised as an upswing, as high commodity prices and mining investment contributed to strong economic growth. As the economy began to reach capacity constraints, wages growth and inflation began to increase. Around this time, the Reserve Bank increased the cash rate to put downward pressure on inflation.

In 2008, the global financial crisis put downward pressure on economic activity. Economic growth in Australia slowed, and we experienced other characteristics associated with a downturn. Growth in GDP and employment declined, and the unemployment rate increased. During this period, the cash rate was reduced to stimulate demand and support the economy.