Australia's Inflation Target

Download the complete Explainer 197KBWhat Is the Inflation Target?

Australia's inflation target is to keep annual consumer price inflation between 2 and 3 per cent. The particular measure of consumer price inflation is the percentage change in the Consumer Price Index (CPI). This is a suitable measure of inflation to target because it captures price changes for the goods and services that households buy, is independently produced by the Australian Bureau of Statistics, is publicly available and historical data for this series does not get revised.

An inflation target provides a framework to guide a central bank's policy decisions and to ensure accountability in its management of the economy. The Reserve Bank adopted an inflation target in the early 1990s, as did various central banks around the world, with other central banks following suit over the subsequent decade. In 1996, the Reserve Bank and the Government agreed on the importance of the inflation target and formalised this agreement in the Statement on the Conduct of Monetary Policy (which is typically updated following a change of Government or Reserve Bank Governor). In December 2023, the Statement on the Conduct of Monetary Policy was updated to specify that the Reserve Bank sets monetary policy such that inflation is expected to return to the midpoint of the target.

Why Does the Reserve Bank Target Inflation?

The Reserve Bank uses a flexible inflation target to help achieve its objectives of price stability and full employment, and its overarching goal of promoting the prosperity and welfare of the Australian people. This is because price stability – which means low and stable inflation – contributes to sustainable economic growth. Targeting inflation of 2 to 3 per cent avoids the many costs to the economy from inflation that is too high or too low.

If inflation is too high:

- Consumers' purchasing power – the real value of money – is reduced. If prices are increasing faster than people's nominal incomes, they will be able to afford fewer goods and services over time.

- Workers may then seek larger wage increases to compensate for the effects of higher inflation on their purchasing power. In turn, higher wage growth raises firms' costs, which may lead firms to raise prices further and/or reduce the number of workers they employ.

- Spending and investment decisions may be distorted. This is because high inflation can influence when households make purchases or businesses make investment decisions. For example, if households expect higher inflation, they may make purchases sooner than originally planned to avoid paying more.

- Returns on investment may be lower. Inflation influences investment decisions because a higher inflation rate will reduce the real return on the investment. Inflation can also affect the real interest paid by borrowers to lenders. For example, if inflation turns out to be higher than expected when the loan was agreed, the lender will get less than they had planned because inflation reduces the purchasing power of the interest earnings they receive.

- Businesses need to update their prices more frequently and consumers spend more time comparing prices. This increases their uncertainty about the economy, which may discourage spending and investment and reduce economic growth.

- A country's international competitiveness may be lowered. If inflation is higher in one country, then the goods and services it produces will become more expensive compared with other countries (unless its currency depreciates). For more on exchange rates, see Explainer: Exchange Rates and the Australian Economy.

If inflation is too low:

- Consumers may delay purchases if they expect prices to fall. As a result, falling prices – a situation called ‘deflation’ – can lead to lower spending. Businesses could respond by laying off workers or reducing wages which, in turn, places further downward pressure on demand and prices.

- Businesses facing difficult conditions may find it hard to reduce the real wages of their employees and may resort to laying off workers instead. This is because businesses that need to decrease their real wages usually choose to allow their nominal wages to grow at a rate that is below the general rate of inflation, and if inflation is very low this is more difficult to do.

Box: Real versus Nominal

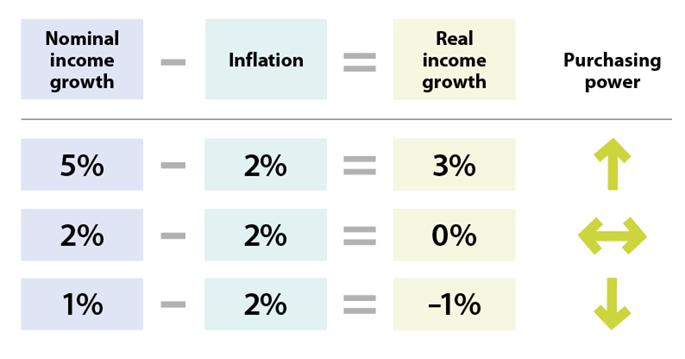

A real value is a dollar value – also known as a nominal value – less the effects of inflation.

The difference between real and nominal values can be shown using income as an example. Suppose that a worker earned $100 last year and $105 this year. The worker has received a 5 per cent increase in nominal income. Also suppose that the inflation rate is 2 per cent over the same period. If we subtract the rate of inflation from the growth in the worker's nominal income, then the worker's real (or inflation-adjusted) income has increased by 3 per cent. This means that the worker can buy 3 per cent more goods and services than before. In other words, their purchasing power has increased by 3 per cent. This and some other examples are shown below.

How Does the Inflation Target Work?

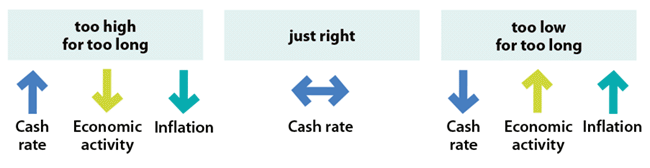

Monetary policy aims to keep inflation between 2 and 3 per cent, in support of the Reserve Bank's goals of price stability and full employment. Assessing the current and expected rate of inflation against the inflation target helps the Reserve Bank in making monetary policy decisions. When inflation is above the target, this can be a sign that the economy is overheating. When inflation is below the target, this can be a sign that there is spare capacity in the economy.

Monetary policy is then used to dampen or stimulate economic activity so that inflation is consistent with the target. If inflation is expected to be higher than the target for a prolonged period, the Reserve Bank would typically tighten monetary policy, such as by increasing the cash rate. If inflation is expected to be lower than the target for a sustained period, the Reserve Bank would typically loosen monetary policy, such as by lowering the cash rate.[1] Monetary policy changes can take time to affect the economy. That is why the Reserve Bank has tended to look to what inflation is forecast to be in the future when deciding on the stance of monetary policy today. In recent years, however, the Reserve Bank has stated that it will focus more on actual inflation outcomes, rather than its forecasts for inflation, when deciding whether to adjust the cash rate. (To learn more about how changes in the cash rate affect the economy, see Explainer: The Transmission of Monetary Policy.)

When deciding if monetary policy should respond to inflation – both current and expected – the Reserve Bank distinguishes between temporary and persistent changes in inflation.

Temporary changes in inflation may be caused by events like supply disruptions or seasonal sales, while persistent changes in inflation arise from things like a sustained increase in wage growth across the community. The Reserve Bank ‘looks through’ temporary changes in inflation when setting monetary policy. However, if households and businesses expect a change in inflation to be longer lasting, it can have a larger effect on their behaviour and consequently become more important to monetary policy decisions. (To learn more about the main drivers of changes in the inflation rate, see Explainer: Causes of Inflation.)

Why target 2 to 3 per cent?

The 2 to 3 per cent target range is sufficiently low that inflation at this level does not significantly influence people's economic decisions. This target range was set in the early 1990s when inflation of around 2 to 3 per cent had already been achieved. It was decided that inflation should be kept at around that rate, given the fact that the lowest average inflation rate experienced by other countries had, over many years, been a little over 2 per cent. At these levels of inflation an economy can achieve sustainable growth in output and employment.

A higher inflation target could increase uncertainty and costs in the economy. A lower inflation target, on the other hand, is costly to achieve.

For example:

- The reduction in growth in spending and investment required to keep inflation at a lower target would lower output growth and increase unemployment.

- Having inflation much lower than 2 to 3 per cent can limit the ability of monetary policy to stimulate demand. For example, in response to a sharp decline in aggregate demand, it may be the case that monetary policy should be set such that real interest rates become negative. Having a very low inflation target (so that actual inflation is close to zero) makes it more difficult to reduce real interest rates to such levels.

- Businesses that need to decrease their real wages and prices in response to negative events usually choose to allow their nominal wages and prices to grow at a rate that is below the general rate of inflation; if inflation is very low, there is less room for a business's wages or prices to grow at a rate below inflation.

In addition, the inflation target must be high enough to account for measurement bias in the CPI. The CPI is upwardly biased because it is calculated with a fixed basket of goods and services which is only updated once a year; until 2017 it was updated only once every few years.

A fixed basket does not take into account that households will adjust their spending patterns to buy less of items with relatively higher inflation rates and buy more of items that are becoming relatively cheaper. Consequently, the price of the basket of goods and services that they actually consume will increase by less than the price of the fixed basket. (For more on this issue see ‘Box D: Updated Weights for the Consumer Price Index’ in the Statement on Monetary Policy, November 2017.)[2]

How Well Have We Met the Inflation Target?

Since the early 1990s, the rate of CPI inflation – also known as ‘headline inflation’ – has, on average, been within the target range and expectations of inflation have been consistent with the target. The Reserve Bank also closely monitors ‘underlying’ inflation, which excludes items that have particularly low or high inflation rates (either frequently or in a given period). This allows the Reserve Bank to look through any temporary factors that are affecting the CPI and to assess broader inflation pressures. Underlying inflation has averaged around the same as headline inflation since the early 1990s. Low and stable inflation reduces uncertainty in the economy and contributes to sustained economic growth.

| Pre inflation target |

Post inflation target** |

||

|---|---|---|---|

| 1976-1984 | 1985-1992 | 1993-2023 | |

| CPI | 9.3% | 6.3% | 2.6% |

| Underlying | 8.6% | 6.3% | 2.6% |

| *Excludes interest charges prior to September quarter 1998 and adjusted for the tax changes of 1999–2000. | |||

| **Although the average for the inflation targeting period is taken from 1993, it is difficult to be precise about the start of the inflation target. | |||

Endnotes

When the cash rate is close to zero, the Reserve Bank may adjust monetary policy by deploying its ‘unconventional’ policy toolkit, see Explainer: Unconventional Monetary Policy. [1]

For a discussion of these issues during the COVID-19 pandemic see ‘Box A: Consumption Patterns and Consumer Price Index Weights’ in the Statement on Monetary Policy, February 2021. [2]